CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REPORT<br />

<strong>2011</strong>-<strong>2012</strong><br />

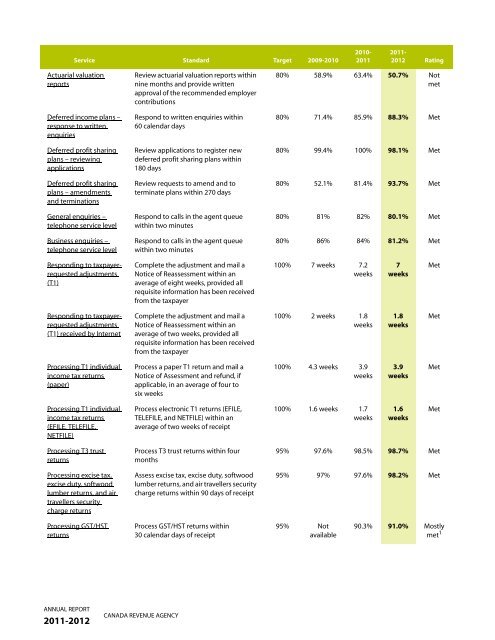

Service Standard Target 2009-2010<br />

Actuarial valuation<br />

reports<br />

Deferred income plans –<br />

response <strong>to</strong> written<br />

enquiries<br />

Deferred profit sharing<br />

plans – reviewing<br />

applications<br />

Deferred profit sharing<br />

plans – amendments<br />

and terminations<br />

General enquiries –<br />

telephone service level<br />

Business enquiries –<br />

telephone service level<br />

Responding <strong>to</strong> taxpayerrequested<br />

adjustments<br />

(T1)<br />

Responding <strong>to</strong> taxpayerrequested<br />

adjustments<br />

(T1) received by Internet<br />

Processing T1 indivi<strong>du</strong>al<br />

income tax returns<br />

(paper)<br />

Processing T1 indivi<strong>du</strong>al<br />

income tax returns<br />

(EFILE, TELEFILE,<br />

NETFILE)<br />

Processing T3 trust<br />

returns<br />

Processing excise tax,<br />

excise <strong>du</strong>ty, softwood<br />

lumber returns, and air<br />

travellers security<br />

charge returns<br />

Processing GST/HST<br />

returns<br />

Review actuarial valuation reports within<br />

nine months and provide written<br />

approval of the recommended employer<br />

contributions<br />

Respond <strong>to</strong> written enquiries within<br />

60 calendar days<br />

Review applications <strong>to</strong> register new<br />

deferred profit sharing plans within<br />

180 days<br />

Review requests <strong>to</strong> amend and <strong>to</strong><br />

terminate plans within 270 days<br />

Respond <strong>to</strong> calls in the agent queue<br />

within two minutes<br />

Respond <strong>to</strong> calls in the agent queue<br />

within two minutes<br />

Complete the adjustment and mail a<br />

Notice of Reassessment within an<br />

average of eight weeks, provided all<br />

requisite information has been received<br />

from the taxpayer<br />

Complete the adjustment and mail a<br />

Notice of Reassessment within an<br />

average of two weeks, provided all<br />

requisite information has been received<br />

from the taxpayer<br />

Process a paper T1 return and mail a<br />

Notice of Assessment and refund, if<br />

applicable, in an average of four <strong>to</strong><br />

six weeks<br />

Process electronic T1 returns (EFILE,<br />

TELEFILE, and NETFILE) within an<br />

average of two weeks of receipt<br />

Process T3 trust returns within four<br />

months<br />

Assess excise tax, excise <strong>du</strong>ty, softwood<br />

lumber returns, and air travellers security<br />

charge returns within 90 days of receipt<br />

Process GST/HST returns within<br />

30 calendar days of receipt<br />

CANADA REVENUE AGENCY<br />

80% 58.9% 63.4% 50.7% Not<br />

met<br />

80% 71.4% 85.9% 88.3% Met<br />

80% 99.4% 100% 98.1% Met<br />

80% 52.1% 81.4% 93.7% Met<br />

80% 81% 82% 80.1% Met<br />

80% 86% 84% 81.2% Met<br />

100% 7 weeks 7.2<br />

weeks<br />

100% 2 weeks 1.8<br />

weeks<br />

100% 4.3 weeks 3.9<br />

weeks<br />

100% 1.6 weeks 1.7<br />

weeks<br />

7<br />

weeks<br />

1.8<br />

weeks<br />

3.9<br />

weeks<br />

1.6<br />

weeks<br />

Met<br />

Met<br />

Met<br />

Met<br />

95% 97.6% 98.5% 98.7% Met<br />

95% 97% 97.6% 98.2% Met<br />

95% Not<br />

available<br />

2010-<br />

<strong>2011</strong><br />

<strong>2011</strong>-<br />

<strong>2012</strong> Rating<br />

90.3% 91.0% Mostly<br />

met 1