CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

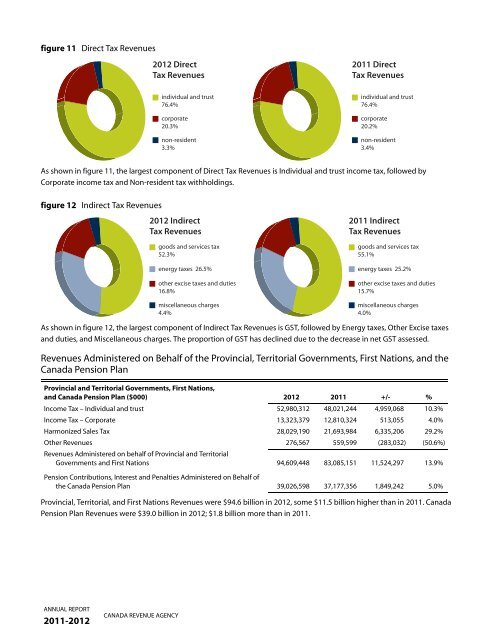

figure 11 Direct Tax Revenues<br />

As shown in figure 11, the largest component of Direct Tax Revenues is Indivi<strong>du</strong>al and trust income tax, followed by<br />

Corporate income tax and Non-resident tax withholdings.<br />

figure 12 Indirect Tax Revenues<br />

As shown in figure 12, the largest component of Indirect Tax Revenues is GST, followed by Energy taxes, Other Excise taxes<br />

and <strong>du</strong>ties, and Miscellaneous charges. The proportion of GST has declined <strong>du</strong>e <strong>to</strong> the decrease in net GST assessed.<br />

Revenues Administered on Behalf of the Provincial, Terri<strong>to</strong>rial Governments, First Nations, and the<br />

Canada Pension Plan<br />

Provincial and Terri<strong>to</strong>rial Governments, First Nations,<br />

and Canada Pension Plan ($000) <strong>2012</strong> <strong>2011</strong> +/- %<br />

Income Tax – Indivi<strong>du</strong>al and trust 52,980,312 48,021,244 4,959,068 10.3%<br />

Income Tax – Corporate 13,323,379 12,810,324 513,055 4.0%<br />

Harmonized Sales Tax 28,029,190 21,693,984 6,335,206 29.2%<br />

Other Revenues<br />

Revenues Administered on behalf of Provincial and Terri<strong>to</strong>rial<br />

276,567 559,599 (283,032) (50.6%)<br />

Governments and First Nations 94,609,448 83,085,151 11,524,297 13.9%<br />

Pension Contributions, Interest and Penalties Administered on Behalf of<br />

the Canada Pension Plan 39,026,598 37,177,356 1,849,242 5.0%<br />

Provincial, Terri<strong>to</strong>rial, and First Nations Revenues were $94.6 billion in <strong>2012</strong>, some $11.5 billion higher than in <strong>2011</strong>. Canada<br />

Pension Plan Revenues were $39.0 billion in <strong>2012</strong>; $1.8 billion more than in <strong>2011</strong>.<br />

ANNUAL REPORT<br />

<strong>2011</strong>-<strong>2012</strong><br />

CANADA REVENUE AGENCY<br />

<strong>2012</strong> Direct<br />

Tax Revenues<br />

indivi<strong>du</strong>al and trust<br />

76.4%<br />

corporate<br />

20.3%<br />

non-resident<br />

3.3%<br />

<strong>2012</strong> Indirect<br />

Tax Revenues<br />

goods and services tax<br />

52.3%<br />

energy taxes 26.5%<br />

other excise taxes and <strong>du</strong>ties<br />

16.8%<br />

miscellaneous charges<br />

4.4%<br />

<strong>2011</strong> Direct<br />

Tax Revenues<br />

indivi<strong>du</strong>al and trust<br />

76.4%<br />

corporate<br />

20.2%<br />

non-resident<br />

3.4%<br />

<strong>2011</strong> Indirect<br />

Tax Revenues<br />

goods and services tax<br />

55.1%<br />

energy taxes 25.2%<br />

other excise taxes and <strong>du</strong>ties<br />

15.7%<br />

miscellaneous charges<br />

4.0%