CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

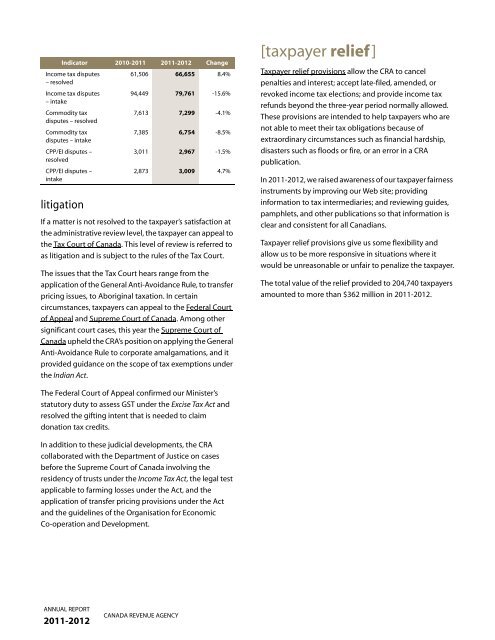

Indica<strong>to</strong>r 2010-<strong>2011</strong> <strong>2011</strong>-<strong>2012</strong> Change<br />

Income tax disputes<br />

– resolved<br />

61,506 66,655 8.4%<br />

Income tax disputes<br />

– intake<br />

Commodity tax<br />

disputes – resolved<br />

Commodity tax<br />

disputes – intake<br />

CPP/EI disputes –<br />

resolved<br />

CPP/EI disputes –<br />

intake<br />

litigation<br />

If a matter is not resolved <strong>to</strong> the taxpayer’s satisfaction at<br />

the administrative review level, the taxpayer can appeal <strong>to</strong><br />

the Tax Court of Canada. This level of review is referred <strong>to</strong><br />

as litigation and is subject <strong>to</strong> the rules of the Tax Court.<br />

The issues that the Tax Court hears range from the<br />

application of the General Anti-Avoidance Rule, <strong>to</strong> transfer<br />

pricing issues, <strong>to</strong> Aboriginal taxation. In certain<br />

circumstances, taxpayers can appeal <strong>to</strong> the Federal Court<br />

of Appeal and Supreme Court of Canada. Among other<br />

significant court cases, this year the Supreme Court of<br />

Canada upheld the <strong>CRA</strong>’s position on applying the General<br />

Anti-Avoidance Rule <strong>to</strong> corporate amalgamations, and it<br />

provided guidance on the scope of tax exemptions under<br />

the Indian Act.<br />

The Federal Court of Appeal confirmed our Minister’s<br />

statu<strong>to</strong>ry <strong>du</strong>ty <strong>to</strong> assess GST under the Excise Tax Act and<br />

resolved the gifting intent that is needed <strong>to</strong> claim<br />

donation tax credits.<br />

In addition <strong>to</strong> these judicial developments, the <strong>CRA</strong><br />

collaborated with the Department of Justice on cases<br />

before the Supreme Court of Canada involving the<br />

residency of trusts under the Income Tax Act, the legal test<br />

applicable <strong>to</strong> farming losses under the Act, and the<br />

application of transfer pricing provisions under the Act<br />

and the guidelines of the Organisation for Economic<br />

Co-operation and Development.<br />

ANNUAL REPORT<br />

<strong>2011</strong>-<strong>2012</strong><br />

94,449 79,761 -15.6%<br />

7,613 7,299 -4.1%<br />

7,385 6,754 -8.5%<br />

3,011 2,967 -1.5%<br />

2,873 3,009 4.7%<br />

CANADA REVENUE AGENCY<br />

[taxpayer relief ]<br />

Taxpayer relief provisions allow the <strong>CRA</strong> <strong>to</strong> cancel<br />

penalties and interest; accept late-filed, amended, or<br />

revoked income tax elections; and provide income tax<br />

refunds beyond the three-year period normally allowed.<br />

These provisions are intended <strong>to</strong> help taxpayers who are<br />

not able <strong>to</strong> meet their tax obligations because of<br />

extraordinary circumstances such as financial hardship,<br />

disasters such as floods or fire, or an error in a <strong>CRA</strong><br />

publication.<br />

In <strong>2011</strong>-<strong>2012</strong>, we raised awareness of our taxpayer fairness<br />

instruments by improving our Web site; providing<br />

information <strong>to</strong> tax intermediaries; and reviewing guides,<br />

pamphlets, and other publications so that information is<br />

clear and consistent for all Canadians.<br />

Taxpayer relief provisions give us some flexibility and<br />

allow us <strong>to</strong> be more responsive in situations where it<br />

would be unreasonable or unfair <strong>to</strong> penalize the taxpayer.<br />

The <strong>to</strong>tal value of the relief provided <strong>to</strong> 204,740 taxpayers<br />

amounted <strong>to</strong> more than $362 million in <strong>2011</strong>-<strong>2012</strong>.