CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

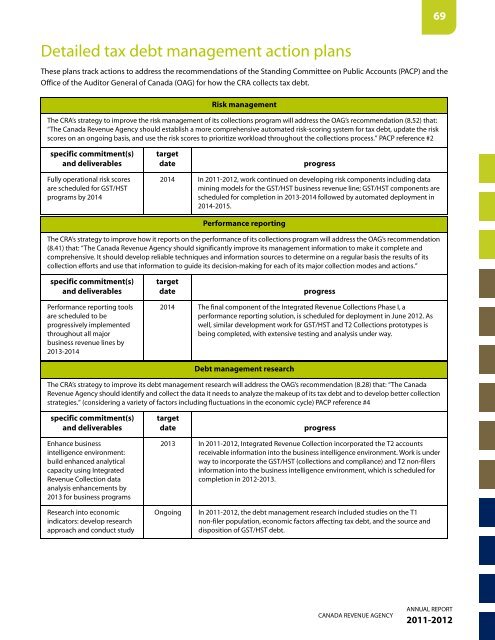

Detailed tax debt management action plans<br />

These plans track actions <strong>to</strong> address the recommendations of the Standing Committee on Public Accounts (PACP) and the<br />

Office of the Audi<strong>to</strong>r General of Canada (OAG) for how the <strong>CRA</strong> collects tax debt.<br />

Risk management<br />

The <strong>CRA</strong>’s strategy <strong>to</strong> improve the risk management of its collections program will address the OAG’s recommendation (8.52) that:<br />

“The Canada Revenue Agency should establish a more comprehensive au<strong>to</strong>mated risk-scoring system for tax debt, update the risk<br />

scores on an ongoing basis, and use the risk scores <strong>to</strong> prioritize workload throughout the collections process.” PACP reference #2<br />

specific commitment(s)<br />

and deliverables<br />

Fully operational risk scores<br />

are sche<strong>du</strong>led for GST/HST<br />

programs by 2014<br />

target<br />

date progress<br />

2014 In <strong>2011</strong>-<strong>2012</strong>, work continued on developing risk components including data<br />

mining models for the GST/HST business revenue line; GST/HST components are<br />

sche<strong>du</strong>led for completion in 2013-2014 followed by au<strong>to</strong>mated deployment in<br />

2014-2015.<br />

Performance reporting<br />

The <strong>CRA</strong>’s strategy <strong>to</strong> improve how it reports on the performance of its collections program will address the OAG’s recommendation<br />

(8.41) that: “The Canada Revenue Agency should significantly improve its management information <strong>to</strong> make it complete and<br />

comprehensive. It should develop reliable techniques and information sources <strong>to</strong> determine on a regular basis the results of its<br />

collection efforts and use that information <strong>to</strong> guide its decision-making for each of its major collection modes and actions.”<br />

specific commitment(s)<br />

and deliverables<br />

Performance reporting <strong>to</strong>ols<br />

are sche<strong>du</strong>led <strong>to</strong> be<br />

progressively implemented<br />

throughout all major<br />

business revenue lines by<br />

2013-2014<br />

target<br />

date progress<br />

2014 The final component of the Integrated Revenue Collections Phase I, a<br />

performance reporting solution, is sche<strong>du</strong>led for deployment in June <strong>2012</strong>. As<br />

well, similar development work for GST/HST and T2 Collections pro<strong>to</strong>types is<br />

being completed, with extensive testing and analysis under way.<br />

Debt management research<br />

The <strong>CRA</strong>’s strategy <strong>to</strong> improve its debt management research will address the OAG’s recommendation (8.28) that: “The Canada<br />

Revenue Agency should identify and collect the data it needs <strong>to</strong> analyze the makeup of its tax debt and <strong>to</strong> develop better collection<br />

strategies.” (considering a variety of fac<strong>to</strong>rs including fluctuations in the economic cycle) PACP reference #4<br />

specific commitment(s)<br />

and deliverables<br />

Enhance business<br />

intelligence environment:<br />

build enhanced analytical<br />

capacity using Integrated<br />

Revenue Collection data<br />

analysis enhancements by<br />

2013 for business programs<br />

Research in<strong>to</strong> economic<br />

indica<strong>to</strong>rs: develop research<br />

approach and con<strong>du</strong>ct study<br />

target<br />

date progress<br />

2013 In <strong>2011</strong>-<strong>2012</strong>, Integrated Revenue Collection incorporated the T2 accounts<br />

receivable information in<strong>to</strong> the business intelligence environment. Work is under<br />

way <strong>to</strong> incorporate the GST/HST (collections and compliance) and T2 non-filers<br />

information in<strong>to</strong> the business intelligence environment, which is sche<strong>du</strong>led for<br />

completion in <strong>2012</strong>-2013.<br />

Ongoing In <strong>2011</strong>-<strong>2012</strong>, the debt management research included studies on the T1<br />

non-filer population, economic fac<strong>to</strong>rs affecting tax debt, and the source and<br />

disposition of GST/HST debt.<br />

CANADA REVENUE AGENCY<br />

69<br />

ANNUAL REPORT<br />

<strong>2011</strong>-<strong>2012</strong>