CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

We did not meet our target of responding within<br />

45 business days for written requests for GST/HST rulings<br />

and interpretations. The volume of requests was higher in<br />

the last two years than previously <strong>du</strong>e <strong>to</strong> the intro<strong>du</strong>ction<br />

of HST in Ontario and British Columbia. We expect <strong>to</strong><br />

improve our response time now that the volume of<br />

requests has begun <strong>to</strong> re<strong>du</strong>ce <strong>to</strong> normal levels.<br />

first contact letter for disputes<br />

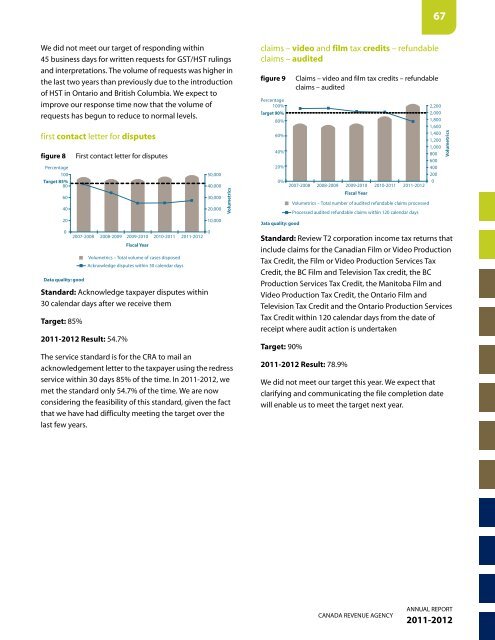

figure 8 First contact letter for disputes<br />

Percentage<br />

100<br />

Target 85%<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Data quality: good<br />

Standard: Acknowledge taxpayer disputes within<br />

30 calendar days after we receive them<br />

Target: 85%<br />

2007-2008 2008-2009 2009-2010 2010-<strong>2011</strong> <strong>2011</strong>-<strong>2012</strong><br />

<strong>2011</strong>-<strong>2012</strong> Result: 54.7%<br />

Fiscal Year<br />

Volumetrics – Total volume of cases disposed<br />

Acknowledge disputes within 30 calendar days<br />

50,000<br />

40,000<br />

30,000<br />

20,000<br />

10,000<br />

The service standard is for the <strong>CRA</strong> <strong>to</strong> mail an<br />

acknowledgement letter <strong>to</strong> the taxpayer using the redress<br />

service within 30 days 85% of the time. In <strong>2011</strong>-<strong>2012</strong>, we<br />

met the standard only 54.7% of the time. We are now<br />

considering the feasibility of this standard, given the fact<br />

that we have had difficulty meeting the target over the<br />

last few years.<br />

0<br />

Volumetrics<br />

claims – video and film tax credits – refundable<br />

claims – audited<br />

figure 9 Claims – video and film tax credits – refundable<br />

claims – audited<br />

Percentage<br />

100%<br />

Target 90%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

2007-2008 2008-2009 2009-2010<br />

Fiscal Year<br />

2010-<strong>2011</strong> <strong>2011</strong>-<strong>2012</strong><br />

Data quality: good<br />

CANADA REVENUE AGENCY<br />

67<br />

Standard: Review T2 corporation income tax returns that<br />

include claims for the Canadian Film or Video Pro<strong>du</strong>ction<br />

Tax Credit, the Film or Video Pro<strong>du</strong>ction Services Tax<br />

Credit, the BC Film and Television Tax credit, the BC<br />

Pro<strong>du</strong>ction Services Tax Credit, the Mani<strong>to</strong>ba Film and<br />

Video Pro<strong>du</strong>ction Tax Credit, the Ontario Film and<br />

Television Tax Credit and the Ontario Pro<strong>du</strong>ction Services<br />

Tax Credit within 120 calendar days from the date of<br />

receipt where audit action is undertaken<br />

Target: 90%<br />

Volumetrics – Total number of audited refundable claims processed<br />

Processed audited refundable claims within 120 calendar days<br />

<strong>2011</strong>-<strong>2012</strong> Result: 78.9%<br />

2,200<br />

2,000<br />

1,800<br />

1,600<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

We did not meet our target this year. We expect that<br />

clarifying and communicating the file completion date<br />

will enable us <strong>to</strong> meet the target next year.<br />

Volumetrics<br />

ANNUAL REPORT<br />

<strong>2011</strong>-<strong>2012</strong>