CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

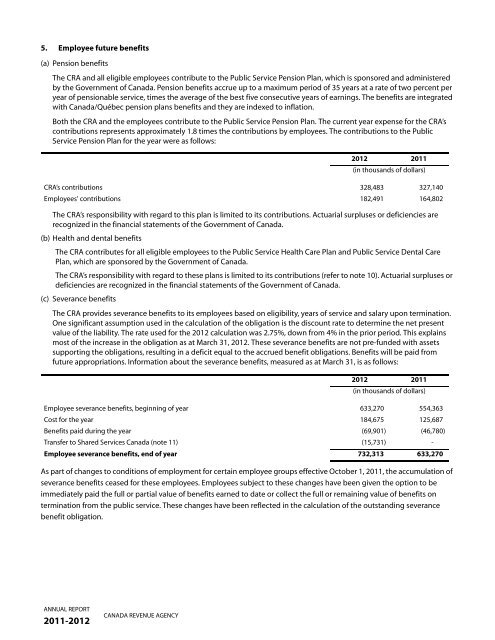

5. Employee future benefits<br />

(a) Pension benefits<br />

The <strong>CRA</strong> and all eligible employees contribute <strong>to</strong> the Public Service Pension Plan, which is sponsored and administered<br />

by the Government of Canada. Pension benefits accrue up <strong>to</strong> a maximum period of 35 years at a rate of two percent per<br />

year of pensionable service, times the average of the best five consecutive years of earnings. The benefits are integrated<br />

with Canada/Québec pension plans benefits and they are indexed <strong>to</strong> inflation.<br />

Both the <strong>CRA</strong> and the employees contribute <strong>to</strong> the Public Service Pension Plan. The current year expense for the <strong>CRA</strong>’s<br />

contributions represents approximately 1.8 times the contributions by employees. The contributions <strong>to</strong> the Public<br />

Service Pension Plan for the year were as follows:<br />

The <strong>CRA</strong>’s responsibility with regard <strong>to</strong> this plan is limited <strong>to</strong> its contributions. Actuarial surpluses or deficiencies are<br />

recognized in the financial statements of the Government of Canada.<br />

(b) Health and dental benefits<br />

The <strong>CRA</strong> contributes for all eligible employees <strong>to</strong> the Public Service Health Care Plan and Public Service Dental Care<br />

Plan, which are sponsored by the Government of Canada.<br />

The <strong>CRA</strong>’s responsibility with regard <strong>to</strong> these plans is limited <strong>to</strong> its contributions (refer <strong>to</strong> note 10). Actuarial surpluses or<br />

deficiencies are recognized in the financial statements of the Government of Canada.<br />

(c) Severance benefits<br />

The <strong>CRA</strong> provides severance benefits <strong>to</strong> its employees based on eligibility, years of service and salary upon termination.<br />

One significant assumption used in the calculation of the obligation is the discount rate <strong>to</strong> determine the net present<br />

value of the liability. The rate used for the <strong>2012</strong> calculation was 2.75%, down from 4% in the prior period. This explains<br />

most of the increase in the obligation as at March 31, <strong>2012</strong>. These severance benefits are not pre-funded with assets<br />

supporting the obligations, resulting in a deficit equal <strong>to</strong> the accrued benefit obligations. Benefits will be paid from<br />

future appropriations. Information about the severance benefits, measured as at March 31, is as follows:<br />

As part of changes <strong>to</strong> conditions of employment for certain employee groups effective Oc<strong>to</strong>ber 1, <strong>2011</strong>, the accumulation of<br />

severance benefits ceased for these employees. Employees subject <strong>to</strong> these changes have been given the option <strong>to</strong> be<br />

immediately paid the full or partial value of benefits earned <strong>to</strong> date or collect the full or remaining value of benefits on<br />

termination from the public service. These changes have been reflected in the calculation of the outstanding severance<br />

benefit obligation.<br />

ANNUAL REPORT<br />

<strong>2011</strong>-<strong>2012</strong><br />

CANADA REVENUE AGENCY<br />

<strong>2012</strong> <strong>2011</strong><br />

(in thousands of dollars)<br />

<strong>CRA</strong>’s contributions 328,483 327,140<br />

Employees’ contributions 182,491 164,802<br />

<strong>2012</strong> <strong>2011</strong><br />

(in thousands of dollars)<br />

Employee severance benefits, beginning of year 633,270 554,363<br />

Cost for the year 184,675 125,687<br />

Benefits paid <strong>du</strong>ring the year (69,901) (46,780)<br />

Transfer <strong>to</strong> Shared Services Canada (note 11) (15,731) -<br />

Employee severance benefits, end of year 732,313 633,270