CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

(g) Employee future benefits<br />

(i) Pension benefits<br />

All eligible employees participate in the Public Service Pension Plan administered by the Government of Canada.<br />

The <strong>CRA</strong>’s contributions reflect the full cost as employer. These amounts are currently based on a multiple of an<br />

employee’s required contributions and may change over time depending on the experience of the Plan. The <strong>CRA</strong>’s<br />

contributions are expensed <strong>du</strong>ring the year in which the services are rendered and represent the <strong>to</strong>tal pension<br />

obligation of the <strong>CRA</strong>. Current legislation does not require the <strong>CRA</strong> <strong>to</strong> make contributions with respect <strong>to</strong> any<br />

actuarial deficiencies of the Public Service Pension Plan.<br />

(ii) Health and dental benefits<br />

The Government of Canada sponsors an employee benefit plan (health and dental) in which the <strong>CRA</strong> participates.<br />

Employees are entitled <strong>to</strong> health and dental benefits, as provided for under labour contracts and conditions of<br />

employment. The <strong>CRA</strong>’s contributions <strong>to</strong> the plan, which are provided without charge by the Treasury Board<br />

Secretariat, are recorded at cost based on a percentage of the salary expenses and charged <strong>to</strong> personnel expenses<br />

in the year incurred. They represent the <strong>CRA</strong>’s <strong>to</strong>tal obligation <strong>to</strong> the plan. Current legislation does not require the<br />

<strong>CRA</strong> <strong>to</strong> make contributions for any future unfunded liabilities of the plan.<br />

(iii) Severance benefits<br />

Some employees are entitled <strong>to</strong> severance benefits, as provided for under labour contracts and conditions of<br />

employment. The cost of these benefits is accrued as employees render the services necessary <strong>to</strong> earn them. These<br />

benefits represent an obligation of the <strong>CRA</strong> that entails settlement by future payments. The obligation resulting<br />

from the benefits earned by employees is calculated using information derived from the results of the actuarially<br />

determined liability for employee severance benefits for the <strong>CRA</strong>.<br />

(h) Due from the Consolidated Revenue Fund (CRF)<br />

Amounts <strong>du</strong>e from the CRF are the result of timing differences between when a transaction affects authorities and when<br />

it is processed through the CRF. Amounts <strong>du</strong>e from the CRF represent the net amount of cash that the <strong>CRA</strong> is entitled <strong>to</strong><br />

draw from the CRF without further authorities <strong>to</strong> discharge its liabilities.<br />

(i) Accounts receivable and advances<br />

Accounts receivable and advances are stated at the lower of cost and net recoverable value. An allowance for doubtful<br />

accounts is recorded where recovery is considered uncertain.<br />

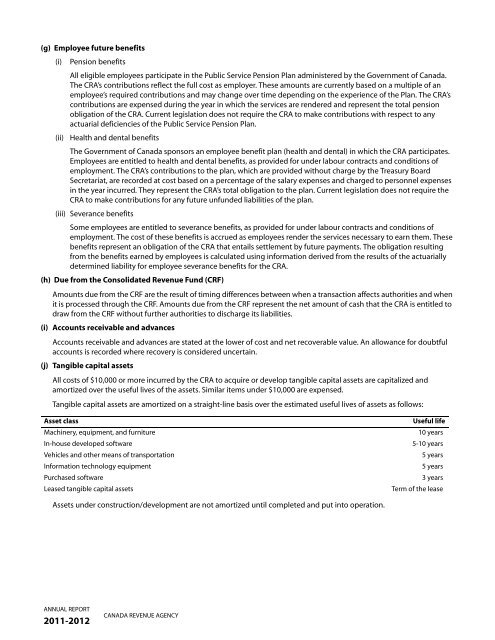

(j) Tangible capital assets<br />

All costs of $10,000 or more incurred by the <strong>CRA</strong> <strong>to</strong> acquire or develop tangible capital assets are capitalized and<br />

amortized over the useful lives of the assets. Similar items under $10,000 are expensed.<br />

Tangible capital assets are amortized on a straight-line basis over the estimated useful lives of assets as follows:<br />

Asset class Useful life<br />

Machinery, equipment, and furniture 10 years<br />

In-house developed software 5-10 years<br />

Vehicles and other means of transportation 5 years<br />

Information technology equipment 5 years<br />

Purchased software 3 years<br />

Leased tangible capital assets Term of the lease<br />

Assets under construction/development are not amortized until completed and put in<strong>to</strong> operation.<br />

ANNUAL REPORT<br />

<strong>2011</strong>-<strong>2012</strong><br />

CANADA REVENUE AGENCY