CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

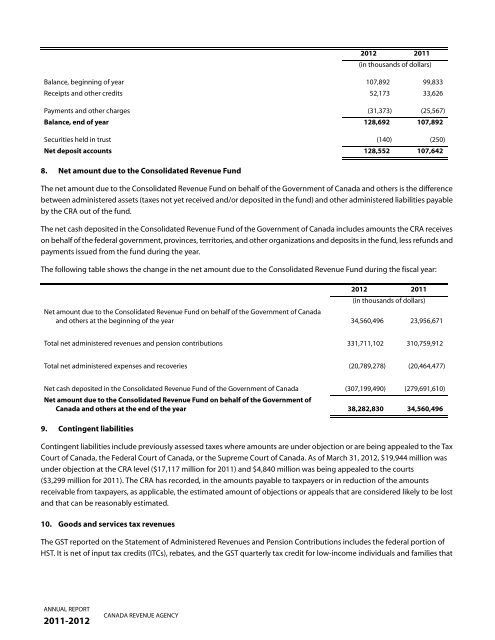

8. Net amount <strong>du</strong>e <strong>to</strong> the Consolidated Revenue Fund<br />

The net amount <strong>du</strong>e <strong>to</strong> the Consolidated Revenue Fund on behalf of the Government of Canada and others is the difference<br />

between administered assets (taxes not yet received and/or deposited in the fund) and other administered liabilities payable<br />

by the <strong>CRA</strong> out of the fund.<br />

The net cash deposited in the Consolidated Revenue Fund of the Government of Canada includes amounts the <strong>CRA</strong> receives<br />

on behalf of the federal government, provinces, terri<strong>to</strong>ries, and other organizations and deposits in the fund, less refunds and<br />

payments issued from the fund <strong>du</strong>ring the year.<br />

The following table shows the change in the net amount <strong>du</strong>e <strong>to</strong> the Consolidated Revenue Fund <strong>du</strong>ring the fiscal year:<br />

9. Contingent liabilities<br />

Contingent liabilities include previously assessed taxes where amounts are under objection or are being appealed <strong>to</strong> the Tax<br />

Court of Canada, the Federal Court of Canada, or the Supreme Court of Canada. As of March 31, <strong>2012</strong>, $19,944 million was<br />

under objection at the <strong>CRA</strong> level ($17,117 million for <strong>2011</strong>) and $4,840 million was being appealed <strong>to</strong> the courts<br />

($3,299 million for <strong>2011</strong>). The <strong>CRA</strong> has recorded, in the amounts payable <strong>to</strong> taxpayers or in re<strong>du</strong>ction of the amounts<br />

receivable from taxpayers, as applicable, the estimated amount of objections or appeals that are considered likely <strong>to</strong> be lost<br />

and that can be reasonably estimated.<br />

10. Goods and services tax revenues<br />

The GST reported on the Statement of Administered Revenues and Pension Contributions includes the federal portion of<br />

HST. It is net of input tax credits (ITCs), rebates, and the GST quarterly tax credit for low-income indivi<strong>du</strong>als and families that<br />

ANNUAL REPORT<br />

<strong>2011</strong>-<strong>2012</strong><br />

CANADA REVENUE AGENCY<br />

<strong>2012</strong> <strong>2011</strong><br />

(in thousands of dollars)<br />

Balance, beginning of year 107,892 99,833<br />

Receipts and other credits 52,173 33,626<br />

Payments and other charges (31,373) (25,567)<br />

Balance, end of year 128,692 107,892<br />

Securities held in trust (140) (250)<br />

Net deposit accounts 128,552 107,642<br />

<strong>2012</strong> <strong>2011</strong><br />

(in thousands of dollars)<br />

Net amount <strong>du</strong>e <strong>to</strong> the Consolidated Revenue Fund on behalf of the Government of Canada<br />

and others at the beginning of the year 34,560,496 23,956,671<br />

Total net administered revenues and pension contributions 331,711,102 310,759,912<br />

Total net administered expenses and recoveries (20,789,278) (20,464,477)<br />

Net cash deposited in the Consolidated Revenue Fund of the Government of Canada<br />

Net amount <strong>du</strong>e <strong>to</strong> the Consolidated Revenue Fund on behalf of the Government of<br />

(307,199,490) (279,691,610)<br />

Canada and others at the end of the year 38,282,830 34,560,496