Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

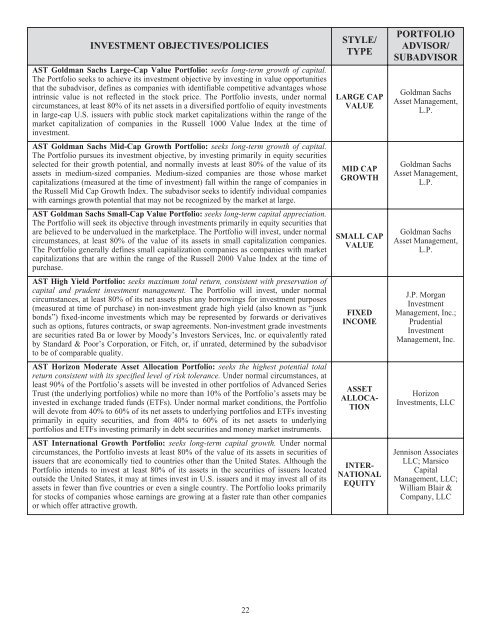

INVESTMENT OBJECTIVES/POLICIES<br />

AST Goldman Sachs Large-Cap Value Portfolio: seeks long-term growth of capital.<br />

The Portfolio seeks to achieve its investment objective by investing in value opportunities<br />

that the subadvisor, defines as companies with identifiable competitive advantages whose<br />

intrinsic value is not reflected in the stock price. The Portfolio invests, under normal<br />

circumstances, at least 80% of its net assets in a diversified portfolio of equity investments<br />

in large-cap U.S. issuers with public stock market capitalizations within the range of the<br />

market capitalization of companies in the Russell 1000 Value Index at the time of<br />

investment.<br />

AST Goldman Sachs Mid-Cap Growth Portfolio: seeks long-term growth of capital.<br />

The Portfolio pursues its investment objective, by investing primarily in equity securities<br />

selected for their growth potential, and normally invests at least 80% of the value of its<br />

assets in medium-sized companies. Medium-sized companies are those whose market<br />

capitalizations (measured at the time of investment) fall within the range of companies in<br />

the Russell Mid Cap Growth Index. The subadvisor seeks to identify individual companies<br />

with earnings growth potential that may not be recognized by the market at large.<br />

AST Goldman Sachs Small-Cap Value Portfolio: seeks long-term capital appreciation.<br />

The Portfolio will seek its objective through investments primarily in equity securities that<br />

are believed to be undervalued in the marketplace. The Portfolio will invest, under normal<br />

circumstances, at least 80% of the value of its assets in small capitalization companies.<br />

The Portfolio generally defines small capitalization companies as companies with market<br />

capitalizations that are within the range of the Russell 2000 Value Index at the time of<br />

purchase.<br />

AST High Yield Portfolio: seeks maximum total return, consistent with preservation of<br />

capital and prudent investment management. The Portfolio will invest, under normal<br />

circumstances, at least 80% of its net assets plus any borrowings for investment purposes<br />

(measured at time of purchase) in non-investment grade high yield (also known as “junk<br />

bonds”) fixed-income investments which may be represented by forwards or derivatives<br />

such as options, futures contracts, or swap agreements. Non-investment grade investments<br />

are securities rated Ba or lower by Moody’s Investors Services, Inc. or equivalently rated<br />

by Standard & Poor’s Corporation, or Fitch, or, if unrated, determined by the subadvisor<br />

to be of comparable quality.<br />

AST Horizon Moderate Asset Allocation Portfolio: seeks the highest potential total<br />

return consistent with its specified level of risk tolerance. Under normal circumstances, at<br />

least 90% of the Portfolio’s assets will be invested in other portfolios of Advanced Series<br />

Trust (the underlying portfolios) while no more than 10% of the Portfolio’s assets may be<br />

invested in exchange traded funds (ETFs). Under normal market conditions, the Portfolio<br />

will devote from 40% to 60% of its net assets to underlying portfolios and ETFs investing<br />

primarily in equity securities, and from 40% to 60% of its net assets to underlying<br />

portfolios and ETFs investing primarily in debt securities and money market instruments.<br />

AST International Growth Portfolio: seeks long-term capital growth. Under normal<br />

circumstances, the Portfolio invests at least 80% of the value of its assets in securities of<br />

issuers that are economically tied to countries other than the United States. Although the<br />

Portfolio intends to invest at least 80% of its assets in the securities of issuers located<br />

outside the United States, it may at times invest in U.S. issuers and it may invest all of its<br />

assets in fewer than five countries or even a single country. The Portfolio looks primarily<br />

for stocks of companies whose earnings are growing at a faster rate than other companies<br />

or which offer attractive growth.<br />

22<br />

STYLE/<br />

TYPE<br />

LARGE CAP<br />

VALUE<br />

MID CAP<br />

GROWTH<br />

SMALL CAP<br />

VALUE<br />

FIXED<br />

INCOME<br />

ASSET<br />

ALLOCA-<br />

TION<br />

INTER-<br />

NATIONAL<br />

EQUITY<br />

PORTFOLIO<br />

ADVISOR/<br />

SUBADVISOR<br />

Goldman Sachs<br />

Asset Management,<br />

L.P.<br />

Goldman Sachs<br />

Asset Management,<br />

L.P.<br />

Goldman Sachs<br />

Asset Management,<br />

L.P.<br />

J.P. Morgan<br />

Investment<br />

Management, Inc.;<br />

<strong>Prudential</strong><br />

Investment<br />

Management, Inc.<br />

Horizon<br />

Investments, LLC<br />

Jennison Associates<br />

LLC; Marsico<br />

Capital<br />

Management, LLC;<br />

William Blair &<br />

Company, LLC