Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

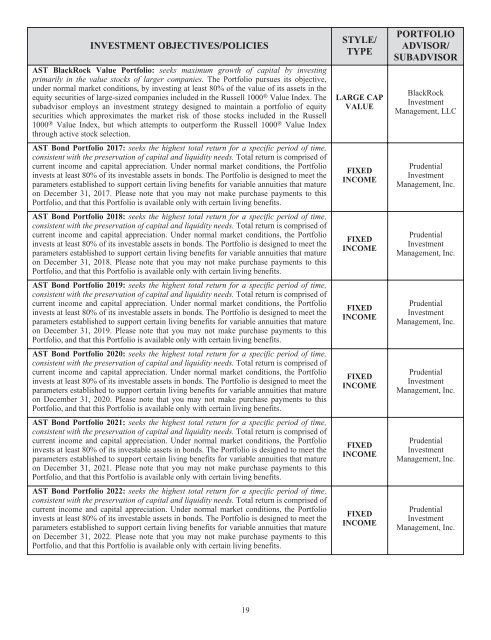

INVESTMENT OBJECTIVES/POLICIES<br />

AST BlackRock Value Portfolio: seeks maximum growth of capital by investing<br />

primarily in the value stocks of larger companies. The Portfolio pursues its objective,<br />

under normal market conditions, by investing at least 80% of the value of its assets in the<br />

equity securities of large-sized companies included in the Russell 1000 ® Value Index. The<br />

subadvisor employs an investment strategy designed to maintain a portfolio of equity<br />

securities which approximates the market risk of those stocks included in the Russell<br />

1000 ® Value Index, but which attempts to outperform the Russell 1000 ® Value Index<br />

through active stock selection.<br />

AST Bond Portfolio 2017: seeks the highest total return for a specific period of time,<br />

consistent with the preservation of capital and liquidity needs. Total return is comprised of<br />

current income and capital appreciation. Under normal market conditions, the Portfolio<br />

invests at least 80% of its investable assets in bonds. The Portfolio is designed to meet the<br />

parameters established to support certain living benefits for variable annuities that mature<br />

on December 31, 2017. Please note that you may not make purchase payments to this<br />

Portfolio, and that this Portfolio is available only with certain living benefits.<br />

AST Bond Portfolio 2018: seeks the highest total return for a specific period of time,<br />

consistent with the preservation of capital and liquidity needs. Total return is comprised of<br />

current income and capital appreciation. Under normal market conditions, the Portfolio<br />

invests at least 80% of its investable assets in bonds. The Portfolio is designed to meet the<br />

parameters established to support certain living benefits for variable annuities that mature<br />

on December 31, 2018. Please note that you may not make purchase payments to this<br />

Portfolio, and that this Portfolio is available only with certain living benefits.<br />

AST Bond Portfolio 2019: seeks the highest total return for a specific period of time,<br />

consistent with the preservation of capital and liquidity needs. Total return is comprised of<br />

current income and capital appreciation. Under normal market conditions, the Portfolio<br />

invests at least 80% of its investable assets in bonds. The Portfolio is designed to meet the<br />

parameters established to support certain living benefits for variable annuities that mature<br />

on December 31, 2019. Please note that you may not make purchase payments to this<br />

Portfolio, and that this Portfolio is available only with certain living benefits.<br />

AST Bond Portfolio 2020: seeks the highest total return for a specific period of time,<br />

consistent with the preservation of capital and liquidity needs. Total return is comprised of<br />

current income and capital appreciation. Under normal market conditions, the Portfolio<br />

invests at least 80% of its investable assets in bonds. The Portfolio is designed to meet the<br />

parameters established to support certain living benefits for variable annuities that mature<br />

on December 31, 2020. Please note that you may not make purchase payments to this<br />

Portfolio, and that this Portfolio is available only with certain living benefits.<br />

AST Bond Portfolio 2021: seeks the highest total return for a specific period of time,<br />

consistent with the preservation of capital and liquidity needs. Total return is comprised of<br />

current income and capital appreciation. Under normal market conditions, the Portfolio<br />

invests at least 80% of its investable assets in bonds. The Portfolio is designed to meet the<br />

parameters established to support certain living benefits for variable annuities that mature<br />

on December 31, 2021. Please note that you may not make purchase payments to this<br />

Portfolio, and that this Portfolio is available only with certain living benefits.<br />

AST Bond Portfolio 2022: seeks the highest total return for a specific period of time,<br />

consistent with the preservation of capital and liquidity needs. Total return is comprised of<br />

current income and capital appreciation. Under normal market conditions, the Portfolio<br />

invests at least 80% of its investable assets in bonds. The Portfolio is designed to meet the<br />

parameters established to support certain living benefits for variable annuities that mature<br />

on December 31, 2022. Please note that you may not make purchase payments to this<br />

Portfolio, and that this Portfolio is available only with certain living benefits.<br />

19<br />

STYLE/<br />

TYPE<br />

LARGE CAP<br />

VALUE<br />

FIXED<br />

INCOME<br />

FIXED<br />

INCOME<br />

FIXED<br />

INCOME<br />

FIXED<br />

INCOME<br />

FIXED<br />

INCOME<br />

FIXED<br />

INCOME<br />

PORTFOLIO<br />

ADVISOR/<br />

SUBADVISOR<br />

BlackRock<br />

Investment<br />

Management, LLC<br />

<strong>Prudential</strong><br />

Investment<br />

Management, Inc.<br />

<strong>Prudential</strong><br />

Investment<br />

Management, Inc.<br />

<strong>Prudential</strong><br />

Investment<br />

Management, Inc.<br />

<strong>Prudential</strong><br />

Investment<br />

Management, Inc.<br />

<strong>Prudential</strong><br />

Investment<br />

Management, Inc.<br />

<strong>Prudential</strong><br />

Investment<br />

Management, Inc.