Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

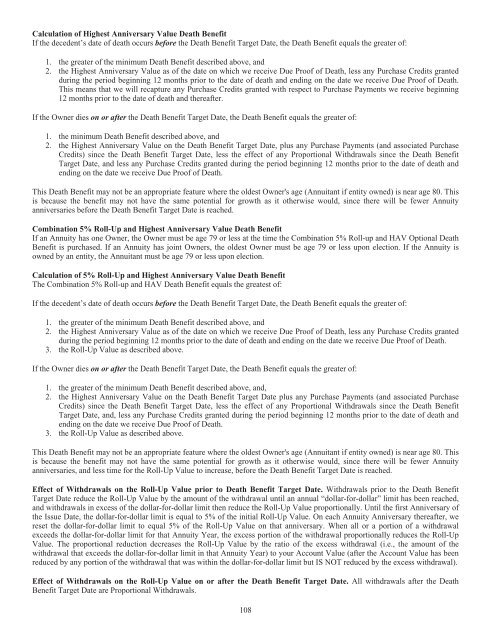

Calculation of Highest Anniversary Value Death Benefit<br />

If the decedent’s date of death occurs before the Death Benefit Target Date, the Death Benefit equals the greater of:<br />

1. the greater of the minimum Death Benefit described above, and<br />

2. the Highest Anniversary Value as of the date on which we receive Due Proof of Death, less any Purchase Credits granted<br />

during the period beginning 12 months prior to the date of death and ending on the date we receive Due Proof of Death.<br />

This means that we will recapture any Purchase Credits granted with respect to Purchase Payments we receive beginning<br />

12 months prior to the date of death and thereafter.<br />

If the Owner dies on or after the Death Benefit Target Date, the Death Benefit equals the greater of:<br />

1. the minimum Death Benefit described above, and<br />

2. the Highest Anniversary Value on the Death Benefit Target Date, plus any Purchase Payments (and associated Purchase<br />

Credits) since the Death Benefit Target Date, less the effect of any Proportional Withdrawals since the Death Benefit<br />

Target Date, and less any Purchase Credits granted during the period beginning 12 months prior to the date of death and<br />

ending on the date we receive Due Proof of Death.<br />

This Death Benefit may not be an appropriate feature where the oldest Owner's age (Annuitant if entity owned) is near age 80. This<br />

is because the benefit may not have the same potential for growth as it otherwise would, since there will be fewer Annuity<br />

anniversaries before the Death Benefit Target Date is reached.<br />

Combination 5% Roll-Up and Highest Anniversary Value Death Benefit<br />

If an Annuity has one Owner, the Owner must be age 79 or less at the time the Combination 5% Roll-up and HAV Optional Death<br />

Benefit is purchased. If an Annuity has joint Owners, the oldest Owner must be age 79 or less upon election. If the Annuity is<br />

owned by an entity, the Annuitant must be age 79 or less upon election.<br />

Calculation of 5% Roll-Up and Highest Anniversary Value Death Benefit<br />

The Combination 5% Roll-up and HAV Death Benefit equals the greatest of:<br />

If the decedent’s date of death occurs before the Death Benefit Target Date, the Death Benefit equals the greater of:<br />

1. the greater of the minimum Death Benefit described above, and<br />

2. the Highest Anniversary Value as of the date on which we receive Due Proof of Death, less any Purchase Credits granted<br />

during the period beginning 12 months prior to the date of death and ending on the date we receive Due Proof of Death.<br />

3. the Roll-Up Value as described above.<br />

If the Owner dies on or after the Death Benefit Target Date, the Death Benefit equals the greater of:<br />

1. the greater of the minimum Death Benefit described above, and,<br />

2. the Highest Anniversary Value on the Death Benefit Target Date plus any Purchase Payments (and associated Purchase<br />

Credits) since the Death Benefit Target Date, less the effect of any Proportional Withdrawals since the Death Benefit<br />

Target Date, and, less any Purchase Credits granted during the period beginning 12 months prior to the date of death and<br />

ending on the date we receive Due Proof of Death.<br />

3. the Roll-Up Value as described above.<br />

This Death Benefit may not be an appropriate feature where the oldest Owner's age (Annuitant if entity owned) is near age 80. This<br />

is because the benefit may not have the same potential for growth as it otherwise would, since there will be fewer Annuity<br />

anniversaries, and less time for the Roll-Up Value to increase, before the Death Benefit Target Date is reached.<br />

Effect of Withdrawals on the Roll-Up Value prior to Death Benefit Target Date. Withdrawals prior to the Death Benefit<br />

Target Date reduce the Roll-Up Value by the amount of the withdrawal until an annual “dollar-for-dollar” limit has been reached,<br />

and withdrawals in excess of the dollar-for-dollar limit then reduce the Roll-Up Value proportionally. Until the first Anniversary of<br />

the Issue Date, the dollar-for-dollar limit is equal to 5% of the initial Roll-Up Value. On each Annuity Anniversary thereafter, we<br />

reset the dollar-for-dollar limit to equal 5% of the Roll-Up Value on that anniversary. When all or a portion of a withdrawal<br />

exceeds the dollar-for-dollar limit for that Annuity Year, the excess portion of the withdrawal proportionally reduces the Roll-Up<br />

Value. The proportional reduction decreases the Roll-Up Value by the ratio of the excess withdrawal (i.e., the amount of the<br />

withdrawal that exceeds the dollar-for-dollar limit in that Annuity Year) to your Account Value (after the Account Value has been<br />

reduced by any portion of the withdrawal that was within the dollar-for-dollar limit but IS NOT reduced by the excess withdrawal).<br />

Effect of Withdrawals on the Roll-Up Value on or after the Death Benefit Target Date. All withdrawals after the Death<br />

Benefit Target Date are Proportional Withdrawals.<br />

108