Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

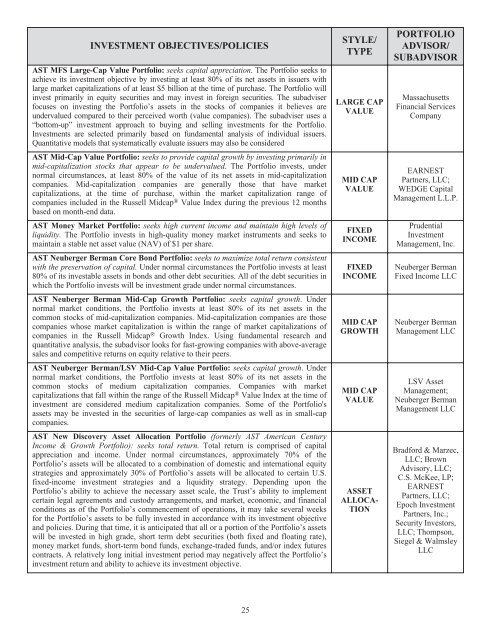

INVESTMENT OBJECTIVES/POLICIES<br />

AST MFS Large-Cap Value Portfolio: seeks capital appreciation. The Portfolio seeks to<br />

achieve its investment objective by investing at least 80% of its net assets in issuers with<br />

large market capitalizations of at least $5 billion at the time of purchase. The Portfolio will<br />

invest primarily in equity securities and may invest in foreign securities. The subadviser<br />

focuses on investing the Portfolio’s assets in the stocks of companies it believes are<br />

undervalued compared to their perceived worth (value companies). The subadviser uses a<br />

“bottom-up” investment approach to buying and selling investments for the Portfolio.<br />

Investments are selected primarily based on fundamental analysis of individual issuers.<br />

Quantitative models that systematically evaluate issuers may also be considered<br />

AST Mid-Cap Value Portfolio: seeks to provide capital growth by investing primarily in<br />

mid-capitalization stocks that appear to be undervalued. The Portfolio invests, under<br />

normal circumstances, at least 80% of the value of its net assets in mid-capitalization<br />

companies. Mid-capitalization companies are generally those that have market<br />

capitalizations, at the time of purchase, within the market capitalization range of<br />

companies included in the Russell Midcap ® Value Index during the previous 12 months<br />

based on month-end data.<br />

AST Money Market Portfolio: seeks high current income and maintain high levels of<br />

liquidity. The Portfolio invests in high-quality money market instruments and seeks to<br />

maintain a stable net asset value (NAV) of $1 per share.<br />

AST Neuberger Berman Core Bond Portfolio: seeks to maximize total return consistent<br />

with the preservation of capital. Under normal circumstances the Portfolio invests at least<br />

80% of its investable assets in bonds and other debt securities. All of the debt securities in<br />

which the Portfolio invests will be investment grade under normal circumstances.<br />

AST Neuberger Berman Mid-Cap Growth Portfolio: seeks capital growth. Under<br />

normal market conditions, the Portfolio invests at least 80% of its net assets in the<br />

common stocks of mid-capitalization companies. Mid-capitalization companies are those<br />

companies whose market capitalization is within the range of market capitalizations of<br />

companies in the Russell Midcap ® Growth Index. Using fundamental research and<br />

quantitative analysis, the subadvisor looks for fast-growing companies with above-average<br />

sales and competitive returns on equity relative to their peers.<br />

AST Neuberger Berman/LSV Mid-Cap Value Portfolio: seeks capital growth. Under<br />

normal market conditions, the Portfolio invests at least 80% of its net assets in the<br />

common stocks of medium capitalization companies. Companies with market<br />

capitalizations that fall within the range of the Russell Midcap ® Value Index at the time of<br />

investment are considered medium capitalization companies. Some of the Portfolio's<br />

assets may be invested in the securities of large-cap companies as well as in small-cap<br />

companies.<br />

AST New Discovery Asset Allocation Portfolio (formerly AST American Century<br />

Income & Growth Portfolio): seeks total return. Total return is comprised of capital<br />

appreciation and income. Under normal circumstances, approximately 70% of the<br />

Portfolio’s assets will be allocated to a combination of domestic and international equity<br />

strategies and approximately 30% of Portfolio’s assets will be allocated to certain U.S.<br />

fixed-income investment strategies and a liquidity strategy. Depending upon the<br />

Portfolio’s ability to achieve the necessary asset scale, the Trust’s ability to implement<br />

certain legal agreements and custody arrangements, and market, economic, and financial<br />

conditions as of the Portfolio’s commencement of operations, it may take several weeks<br />

for the Portfolio’s assets to be fully invested in accordance with its investment objective<br />

and policies. During that time, it is anticipated that all or a portion of the Portfolio’s assets<br />

will be invested in high grade, short term debt securities (both fixed and floating rate),<br />

money market funds, short-term bond funds, exchange-traded funds, and/or index futures<br />

contracts. A relatively long initial investment period may negatively affect the Portfolio’s<br />

investment return and ability to achieve its investment objective.<br />

25<br />

STYLE/<br />

TYPE<br />

LARGE CAP<br />

VALUE<br />

MID CAP<br />

VALUE<br />

FIXED<br />

INCOME<br />

FIXED<br />

INCOME<br />

MID CAP<br />

GROWTH<br />

MID CAP<br />

VALUE<br />

ASSET<br />

ALLOCA-<br />

TION<br />

PORTFOLIO<br />

ADVISOR/<br />

SUBADVISOR<br />

Massachusetts<br />

Financial Services<br />

Company<br />

EARNEST<br />

Partners, LLC;<br />

WEDGE Capital<br />

Management L.L.P.<br />

<strong>Prudential</strong><br />

Investment<br />

Management, Inc.<br />

Neuberger Berman<br />

Fixed Income LLC<br />

Neuberger Berman<br />

Management LLC<br />

LSV Asset<br />

Management;<br />

Neuberger Berman<br />

Management LLC<br />

Bradford & Marzec,<br />

LLC; Brown<br />

Advisory, LLC;<br />

C.S. McKee, LP;<br />

EARNEST<br />

Partners, LLC;<br />

Epoch Investment<br />

Partners, Inc.;<br />

Security Investors,<br />

LLC; Thompson,<br />

Siegel & Walmsley<br />

LLC