Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

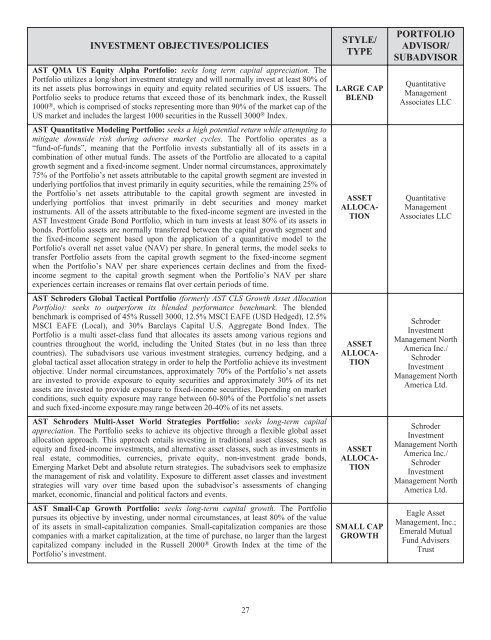

INVESTMENT OBJECTIVES/POLICIES<br />

AST QMA US Equity Alpha Portfolio: seeks long term capital appreciation. The<br />

Portfolio utilizes a long/short investment strategy and will normally invest at least 80% of<br />

its net assets plus borrowings in equity and equity related securities of US issuers. The<br />

Portfolio seeks to produce returns that exceed those of its benchmark index, the Russell<br />

1000 ® , which is comprised of stocks representing more than 90% of the market cap of the<br />

US market and includes the largest 1000 securities in the Russell 3000 ® Index.<br />

AST Quantitative Modeling Portfolio: seeks a high potential return while attempting to<br />

mitigate downside risk during adverse market cycles. The Portfolio operates as a<br />

“fund-of-funds”, meaning that the Portfolio invests substantially all of its assets in a<br />

combination of other mutual funds. The assets of the Portfolio are allocated to a capital<br />

growth segment and a fixed-income segment. Under normal circumstances, approximately<br />

75% of the Portfolio’s net assets attributable to the capital growth segment are invested in<br />

underlying portfolios that invest primarily in equity securities, while the remaining 25% of<br />

the Portfolio’s net assets attributable to the capital growth segment are invested in<br />

underlying portfolios that invest primarily in debt securities and money market<br />

instruments. All of the assets attributable to the fixed-income segment are invested in the<br />

AST Investment Grade Bond Portfolio, which in turn invests at least 80% of its assets in<br />

bonds. Portfolio assets are normally transferred between the capital growth segment and<br />

the fixed-income segment based upon the application of a quantitative model to the<br />

Portfolio's overall net asset value (NAV) per share. In general terms, the model seeks to<br />

transfer Portfolio assets from the capital growth segment to the fixed-income segment<br />

when the Portfolio’s NAV per share experiences certain declines and from the fixedincome<br />

segment to the capital growth segment when the Portfolio’s NAV per share<br />

experiences certain increases or remains flat over certain periods of time.<br />

AST Schroders Global Tactical Portfolio (formerly AST CLS Growth Asset Allocation<br />

Portfolio): seeks to outperform its blended performance benchmark. The blended<br />

benchmark is comprised of 45% Russell 3000, 12.5% MSCI EAFE (USD Hedged), 12.5%<br />

MSCI EAFE (Local), and 30% Barclays Capital U.S. Aggregate Bond Index. The<br />

Portfolio is a multi asset-class fund that allocates its assets among various regions and<br />

countries throughout the world, including the United States (but in no less than three<br />

countries). The subadvisors use various investment strategies, currency hedging, and a<br />

global tactical asset allocation strategy in order to help the Portfolio achieve its investment<br />

objective. Under normal circumstances, approximately 70% of the Portfolio’s net assets<br />

are invested to provide exposure to equity securities and approximately 30% of its net<br />

assets are invested to provide exposure to fixed-income securities. Depending on market<br />

conditions, such equity exposure may range between 60-80% of the Portfolio’s net assets<br />

and such fixed-income exposure may range between 20-40% of its net assets.<br />

AST Schroders Multi-Asset World Strategies Portfolio: seeks long-term capital<br />

appreciation. The Portfolio seeks to achieve its objective through a flexible global asset<br />

allocation approach. This approach entails investing in traditional asset classes, such as<br />

equity and fixed-income investments, and alternative asset classes, such as investments in<br />

real estate, commodities, currencies, private equity, non-investment grade bonds,<br />

Emerging Market Debt and absolute return strategies. The subadvisors seek to emphasize<br />

the management of risk and volatility. Exposure to different asset classes and investment<br />

strategies will vary over time based upon the subadvisor’s assessments of changing<br />

market, economic, financial and political factors and events.<br />

AST Small-Cap Growth Portfolio: seeks long-term capital growth. The Portfolio<br />

pursues its objective by investing, under normal circumstances, at least 80% of the value<br />

of its assets in small-capitalization companies. Small-capitalization companies are those<br />

companies with a market capitalization, at the time of purchase, no larger than the largest<br />

capitalized company included in the Russell 2000 ® Growth Index at the time of the<br />

Portfolio’s investment.<br />

27<br />

STYLE/<br />

TYPE<br />

LARGE CAP<br />

BLEND<br />

ASSET<br />

ALLOCA-<br />

TION<br />

ASSET<br />

ALLOCA-<br />

TION<br />

ASSET<br />

ALLOCA-<br />

TION<br />

SMALL CAP<br />

GROWTH<br />

PORTFOLIO<br />

ADVISOR/<br />

SUBADVISOR<br />

Quantitative<br />

Management<br />

Associates LLC<br />

Quantitative<br />

Management<br />

Associates LLC<br />

Schroder<br />

Investment<br />

Management North<br />

America Inc./<br />

Schroder<br />

Investment<br />

Management North<br />

America Ltd.<br />

Schroder<br />

Investment<br />

Management North<br />

America Inc./<br />

Schroder<br />

Investment<br />

Management North<br />

America Ltd.<br />

Eagle Asset<br />

Management, Inc.;<br />

Emerald Mutual<br />

Fund Advisers<br />

Trust