Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

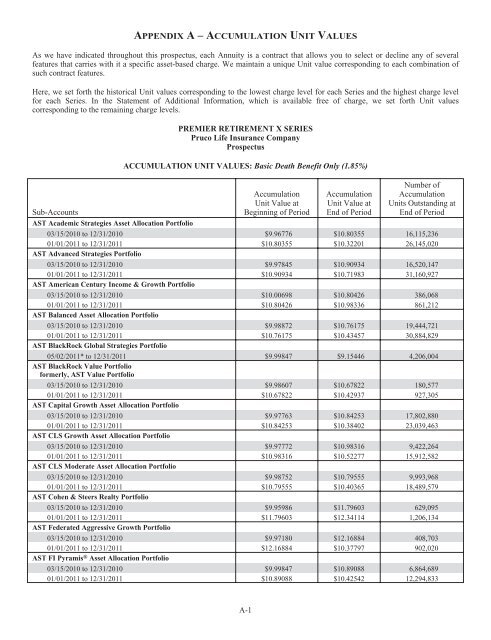

APPENDIX A–ACCUMULATION UNIT VALUES<br />

As we have indicated throughout this prospectus, each Annuity is a contract that allows you to select or decline any of several<br />

features that carries with it a specific asset-based charge. We maintain a unique Unit value corresponding to each combination of<br />

such contract features.<br />

Here, we set forth the historical Unit values corresponding to the lowest charge level for each Series and the highest charge level<br />

for each Series. In the Statement of Additional Information, which is available free of charge, we set forth Unit values<br />

corresponding to the remaining charge levels.<br />

Sub-Accounts<br />

PREMIER RETIREMENT X SERIES<br />

Pruco Life Insurance Company<br />

Prospectus<br />

ACCUMULATION UNIT VALUES: Basic Death Benefit Only (1.85%)<br />

Accumulation<br />

Unit Value at<br />

Beginning of Period<br />

Accumulation<br />

Unit Value at<br />

End of Period<br />

Number of<br />

Accumulation<br />

Units Outstanding at<br />

End of Period<br />

AST Academic Strategies Asset Allocation Portfolio<br />

03/15/2010 to 12/31/2010 $9.96776 $10.80355 16,115,236<br />

01/01/2011 to 12/31/2011 $10.80355 $10.32201 26,145,020<br />

AST Advanced Strategies Portfolio<br />

03/15/2010 to 12/31/2010 $9.97845 $10.90934 16,520,147<br />

01/01/2011 to 12/31/2011 $10.90934 $10.71983 31,160,927<br />

AST American Century Income & Growth Portfolio<br />

03/15/2010 to 12/31/2010 $10.00698 $10.80426 386,068<br />

01/01/2011 to 12/31/2011 $10.80426 $10.98336 861,212<br />

AST Balanced Asset Allocation Portfolio<br />

03/15/2010 to 12/31/2010 $9.98872 $10.76175 19,444,721<br />

01/01/2011 to 12/31/2011 $10.76175 $10.43457 30,884,829<br />

AST BlackRock Global Strategies Portfolio<br />

05/02/2011* to 12/31/2011 $9.99847 $9.15446 4,206,004<br />

AST BlackRock Value Portfolio<br />

formerly, AST Value Portfolio<br />

03/15/2010 to 12/31/2010 $9.98607 $10.67822 180,577<br />

01/01/2011 to 12/31/2011 $10.67822 $10.42937 927,305<br />

AST Capital Growth Asset Allocation Portfolio<br />

03/15/2010 to 12/31/2010 $9.97763 $10.84253 17,802,880<br />

01/01/2011 to 12/31/2011 $10.84253 $10.38402 23,039,463<br />

AST CLS Growth Asset Allocation Portfolio<br />

03/15/2010 to 12/31/2010 $9.97772 $10.98316 9,422,264<br />

01/01/2011 to 12/31/2011 $10.98316 $10.52277 15,912,582<br />

AST CLS Moderate Asset Allocation Portfolio<br />

03/15/2010 to 12/31/2010 $9.98752 $10.79555 9,993,968<br />

01/01/2011 to 12/31/2011 $10.79555 $10.40365 18,489,579<br />

AST Cohen & Steers Realty Portfolio<br />

03/15/2010 to 12/31/2010 $9.95986 $11.79603 629,095<br />

01/01/2011 to 12/31/2011 $11.79603 $12.34114 1,206,134<br />

AST Federated Aggressive Growth Portfolio<br />

03/15/2010 to 12/31/2010 $9.97180 $12.16884 408,703<br />

01/01/2011 to 12/31/2011 $12.16884 $10.37797 902,020<br />

AST FI Pyramis ® Asset Allocation Portfolio<br />

03/15/2010 to 12/31/2010 $9.99847 $10.89088 6,864,689<br />

01/01/2011 to 12/31/2011 $10.89088 $10.42542 12,294,833<br />

A-1