Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

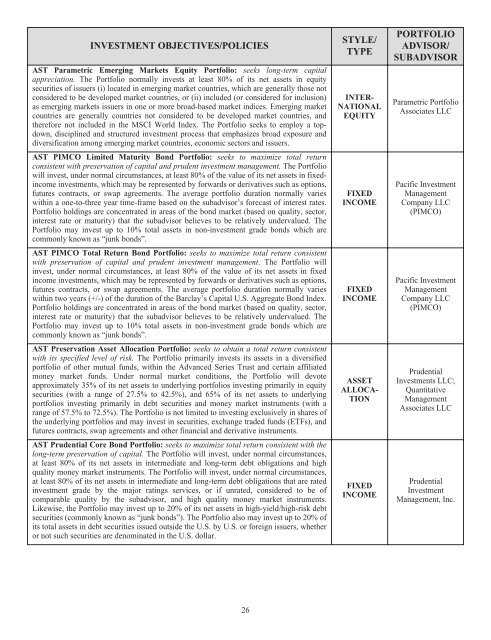

INVESTMENT OBJECTIVES/POLICIES<br />

AST Parametric Emerging Markets Equity Portfolio: seeks long-term capital<br />

appreciation. The Portfolio normally invests at least 80% of its net assets in equity<br />

securities of issuers (i) located in emerging market countries, which are generally those not<br />

considered to be developed market countries, or (ii) included (or considered for inclusion)<br />

as emerging markets issuers in one or more broad-based market indices. Emerging market<br />

countries are generally countries not considered to be developed market countries, and<br />

therefore not included in the MSCI World Index. The Portfolio seeks to employ a topdown,<br />

disciplined and structured investment process that emphasizes broad exposure and<br />

diversification among emerging market countries, economic sectors and issuers.<br />

AST PIMCO Limited Maturity Bond Portfolio: seeks to maximize total return<br />

consistent with preservation of capital and prudent investment management. The Portfolio<br />

will invest, under normal circumstances, at least 80% of the value of its net assets in fixedincome<br />

investments, which may be represented by forwards or derivatives such as options,<br />

futures contracts, or swap agreements. The average portfolio duration normally varies<br />

within a one-to-three year time-frame based on the subadvisor’s forecast of interest rates.<br />

Portfolio holdings are concentrated in areas of the bond market (based on quality, sector,<br />

interest rate or maturity) that the subadvisor believes to be relatively undervalued. The<br />

Portfolio may invest up to 10% total assets in non-investment grade bonds which are<br />

commonly known as “junk bonds”.<br />

AST PIMCO Total Return Bond Portfolio: seeks to maximize total return consistent<br />

with preservation of capital and prudent investment management. The Portfolio will<br />

invest, under normal circumstances, at least 80% of the value of its net assets in fixed<br />

income investments, which may be represented by forwards or derivatives such as options,<br />

futures contracts, or swap agreements. The average portfolio duration normally varies<br />

within two years (+/-) of the duration of the Barclay’s Capital U.S. Aggregate Bond Index.<br />

Portfolio holdings are concentrated in areas of the bond market (based on quality, sector,<br />

interest rate or maturity) that the subadvisor believes to be relatively undervalued. The<br />

Portfolio may invest up to 10% total assets in non-investment grade bonds which are<br />

commonly known as “junk bonds”.<br />

AST Preservation Asset Allocation Portfolio: seeks to obtain a total return consistent<br />

with its specified level of risk. The Portfolio primarily invests its assets in a diversified<br />

portfolio of other mutual funds, within the Advanced Series Trust and certain affiliated<br />

money market funds. Under normal market conditions, the Portfolio will devote<br />

approximately 35% of its net assets to underlying portfolios investing primarily in equity<br />

securities (with a range of 27.5% to 42.5%), and 65% of its net assets to underlying<br />

portfolios investing primarily in debt securities and money market instruments (with a<br />

range of 57.5% to 72.5%). The Portfolio is not limited to investing exclusively in shares of<br />

the underlying portfolios and may invest in securities, exchange traded funds (ETFs), and<br />

futures contracts, swap agreements and other financial and derivative instruments.<br />

AST <strong>Prudential</strong> Core Bond Portfolio: seeks to maximize total return consistent with the<br />

long-term preservation of capital. The Portfolio will invest, under normal circumstances,<br />

at least 80% of its net assets in intermediate and long-term debt obligations and high<br />

quality money market instruments. The Portfolio will invest, under normal circumstances,<br />

at least 80% of its net assets in intermediate and long-term debt obligations that are rated<br />

investment grade by the major ratings services, or if unrated, considered to be of<br />

comparable quality by the subadvisor, and high quality money market instruments.<br />

Likewise, the Portfolio may invest up to 20% of its net assets in high-yield/high-risk debt<br />

securities (commonly known as “junk bonds”). The Portfolio also may invest up to 20% of<br />

its total assets in debt securities issued outside the U.S. by U.S. or foreign issuers, whether<br />

or not such securities are denominated in the U.S. dollar.<br />

26<br />

STYLE/<br />

TYPE<br />

INTER-<br />

NATIONAL<br />

EQUITY<br />

FIXED<br />

INCOME<br />

FIXED<br />

INCOME<br />

ASSET<br />

ALLOCA-<br />

TION<br />

FIXED<br />

INCOME<br />

PORTFOLIO<br />

ADVISOR/<br />

SUBADVISOR<br />

Parametric Portfolio<br />

Associates LLC<br />

Pacific Investment<br />

Management<br />

Company LLC<br />

(PIMCO)<br />

Pacific Investment<br />

Management<br />

Company LLC<br />

(PIMCO)<br />

<strong>Prudential</strong><br />

Investments LLC;<br />

Quantitative<br />

Management<br />

Associates LLC<br />

<strong>Prudential</strong><br />

Investment<br />

Management, Inc.