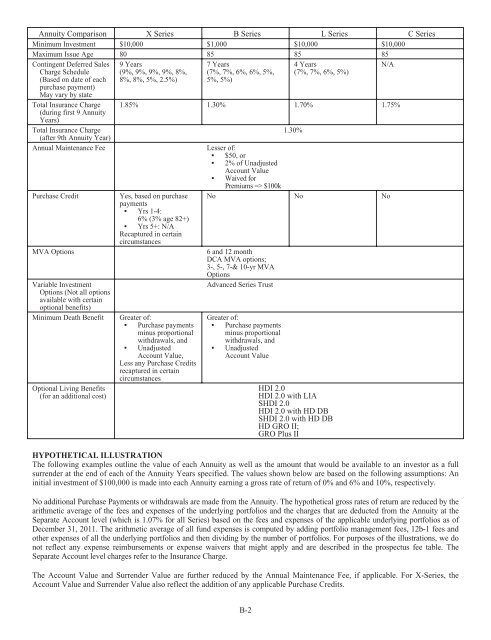

Annuity Comparison X Series B Series L Series C Series Minimum Investment $10,000 $1,000 $10,000 $10,000 Maximum Issue Age 80 85 85 85 Contingent Deferred Sales Charge Schedule (Based on date of each purchase payment) May vary by state Total Insurance Charge (during first 9 Annuity Years) Total Insurance Charge (after 9th Annuity Year) 9 Years (9%, 9%, 9%, 9%, 8%, 8%, 8%, 5%, 2.5%) 7 Years (7%, 7%, 6%, 6%, 5%, 5%, 5%) 4 Years (7%, 7%, 6%, 5%) 1.85% 1.30% 1.70% 1.75% 1.30% Annual Maintenance Fee Lesser of: ▪ $50, or ▪ 2% of Unadjusted Account Value ▪ Waived for Premiums => $100k Purchase Credit Yes, based on purchase payments No No No ▪ Yrs 1-4: 6% (3% age 82+) ▪ Yrs 5+: N/A Recaptured in certain circumstances MVA Options 6 and 12 month DCA MVA options; 3-, 5-, 7-& 10-yr MVA Options <strong>Variable</strong> Investment Options (Not all options available with certain optional benefits) Advanced Series Trust Minimum Death Benefit Greater of: ▪ Purchase payments minus proportional withdrawals, and ▪ Unadjusted Account Value, Less any Purchase Credits recaptured in certain circumstances Optional Living Benefits (for an additional cost) Greater of: ▪ Purchase payments minus proportional withdrawals, and ▪ Unadjusted Account Value HDI 2.0 HDI 2.0 with LIA SHDI 2.0 HDI 2.0 with HD DB SHDI 2.0 with HD DB HD GRO II; GRO Plus II HYPOTHETICAL ILLUSTRATION The following examples outline the value of each Annuity as well as the amount that would be available to an investor as a full surrender at the end of each of the Annuity Years specified. The values shown below are based on the following assumptions: An initial investment of $100,000 is made into each Annuity earning a gross rate of return of 0% and 6% and 10%, respectively. No additional Purchase Payments or withdrawals are made from the Annuity. The hypothetical gross rates of return are reduced by the arithmetic average of the fees and expenses of the underlying portfolios and the charges that are deducted from the Annuity at the Separate Account level (which is 1.07% for all Series) based on the fees and expenses of the applicable underlying portfolios as of December 31, 2011. The arithmetic average of all fund expenses is computed by adding portfolio management fees, 12b-1 fees and other expenses of all the underlying portfolios and then dividing by the number of portfolios. For purposes of the illustrations, we do not reflect any expense reimbursements or expense waivers that might apply and are described in the prospectus fee table. The Separate Account level charges refer to the Insurance Charge. The Account Value and Surrender Value are further reduced by the Annual Maintenance Fee, if applicable. For X-Series, the Account Value and Surrender Value also reflect the addition of any applicable Purchase Credits. B-2 N/A

The Account Value assumes no surrender, while the Surrender Value assumes a 100% surrender two days prior to the anniversary of the Issue Date of the Annuity (“Annuity Anniversary”), therefore reflecting the CDSC applicable to that Annuity Year. Note that a withdrawal on the Annuity Anniversary, or the day before the Annuity Anniversary, would be subject to the CDSC applicable to the next Annuity Year, which may be lower. The CDSC is calculated based on the date that the Purchase Payment was made and for purposes of these examples, we assume that a single Purchase Payment of $100,000 was made on the Issue Date. The values that you actually experience under an Annuity will be different from what is depicted here if any of the assumptions we make here differ from your circumstances, however the relative values for each Annuity reflected below will remain the same. (We will provide your Financial Professional with a personalized illustration upon request). If, for an additional fee, you elect an optional living benefit that has a Protected Withdrawal Value (PWV), the expenses will be higher and the values will differ from those shown in the charts below. Similar to Account and Surrender Values, the PWV will differ by share class. Typically, the share class with the higher Account Value will translate into a relatively higher PWV, unless the net rate of return is below the roll-up rate, where the PWV of the C, L and B would all grow equally by the guaranteed amount. The X Series, because of the impact of the Purchase Credit applied to the Account Value, will yield the relatively highest PWV in all scenarios. If the minimum guarantee(s) increases the PWV, the PWV of C, L, and B would all be equal at that time. The X Series would yield the highest PWV with the minimum guarantee(s) due to the impact of the Purchase Credit. 0% Gross Rate of Return 0% Gross Rate of Return 0% Gross Rate of Return 0% Gross Rate of Return 0% Gross Rate of Return L Share B Share X Share C Share Net rate of return Net rate of return Net rate of return Net rate of return Yrs 1-10 -2.75% All years -2.36% Yrs 1-10 -2.90% Yrs 1-10 -2.80% Yrs 10+ -2.36% Yrs 10+ -2.36% Yrs 10+ -2.36% Annuity Contract Surrender Contract Surrender Contract Surrender Contract Surrender Year Value Value Value Value Value Value Value Value 1 97,256 90,256 97,650 90,650 102,934 93,934 97,206 97,206 2 94,579 87,579 95,350 88,350 99,949 90,949 94,483 94,483 3 91,977 85,977 93,103 87,103 97,050 88,050 91,837 91,837 4 89,446 84,446 90,909 84,909 94,235 85,235 89,264 89,264 5 86,984 86,984 88,768 83,768 91,502 83,502 86,763 86,763 6 84,591 84,591 86,676 81,676 88,849 80,849 84,333 84,333 7 82,263 82,263 84,634 79,634 86,272 78,272 81,971 81,971 8 79,999 79,999 82,640 82,640 83,770 78,770 79,674 79,674 9 77,798 77,798 80,693 80,693 81,340 78,840 77,442 77,442 10 75,657 75,657 78,792 78,792 78,981 78,981 75,273 75,273 11 73,874 73,874 76,935 76,935 77,119 77,119 73,499 73,499 12 72,133 72,133 75,123 75,123 75,302 75,302 71,767 71,767 13 70,433 70,433 73,353 73,353 73,528 73,528 70,076 70,076 14 68,774 68,774 71,624 71,624 71,796 71,796 68,425 68,425 15 67,154 67,154 69,937 69,937 70,104 70,104 66,813 66,813 16 65,571 65,571 68,289 68,289 68,452 68,452 65,239 65,239 17 64,027 64,027 66,680 66,680 66,840 66,840 63,702 63,702 18 62,518 62,518 65,109 65,109 65,265 65,265 62,201 62,201 19 61,045 61,045 63,575 63,575 63,727 63,727 60,735 60,735 20 59,607 59,607 62,077 62,077 62,226 62,226 59,304 59,304 21 58,202 58,202 60,615 60,615 60,759 60,759 57,907 57,907 22 56,831 56,831 59,186 59,186 59,328 59,328 56,543 56,543 23 55,492 55,492 57,792 57,792 57,930 57,930 55,210 55,210 24 54,185 54,185 56,430 56,430 56,565 56,565 53,910 53,910 25 52,908 52,908 55,101 55,101 55,233 55,233 52,639 52,639 Assumptions: a. $100,000 initial investment b. Fund Expenses = 1.07% c. No optional death benefits or living benefits elected d. Annuity was issued on or after May 1, 2012 e. Surrender value assumes surrender 2 days before Annuity Anniversary B-3

- Page 1 and 2:

PRUCO LIFE INSURANCE COMPANY PRUCO

- Page 3 and 4:

UNDERLYING PORTFOLIO UNDERLYING MUT

- Page 5 and 6:

UNDERLYING PORTFOLIO UNDERLYING MUT

- Page 7 and 8:

ii. To the list of available variab

- Page 9 and 10:

II. NEW OPTIONAL BENEFITS This supp

- Page 11 and 12:

that may periodically transfer your

- Page 13 and 14:

Anniversary, we identify the Unadju

- Page 15 and 16:

Non-Lifetime Withdrawal Feature You

- Page 17 and 18:

▪ If annuity payments are to begi

- Page 19 and 20:

(iv) our receipt of Due Proof of De

- Page 21 and 22:

Example (assume the income basis is

- Page 23 and 24:

taken first from your own Account V

- Page 25 and 26:

While Spousal Highest Daily Lifetim

- Page 27 and 28:

** In this example, the first daily

- Page 29 and 30:

▪ Any Lifetime Withdrawal that yo

- Page 31 and 32:

to the death claim and the payment

- Page 33 and 34:

ages 59 1 ⁄2 to 64; 4.5% for ages

- Page 35 and 36:

Example of proportional reductions

- Page 37 and 38:

In general, withdrawals made from t

- Page 39 and 40:

certain in order to comply with the

- Page 41 and 42:

Upon termination of Highest Daily L

- Page 43 and 44:

Key Feature - Annual Income Amount

- Page 45 and 46:

Example of dollar-for-dollar reduct

- Page 47 and 48:

Highest Daily Death Benefit A Death

- Page 49 and 50:

newly-elected benefit will commence

- Page 51 and 52:

How Spousal Highest Daily Lifetime

- Page 53 and 54:

[THIS PAGE INTENTIONALLY LEFT BLANK

- Page 55 and 56:

[THIS PAGE INTENTIONALLY LEFT BLANK

- Page 57 and 58:

[THIS PAGE INTENTIONALLY LEFT BLANK

- Page 60 and 61:

The Prudential Insurance Company of

- Page 62 and 63:

COMBOSUP2 ADVANCED SERIES TRUST Sup

- Page 64 and 65:

Subadvisers Investment Categories a

- Page 66 and 67:

STYLE/ TYPE Asset Allocation COMBOS

- Page 68 and 69:

GENPROD2 PRUCO LIFE INSURANCE COMPA

- Page 70 and 71:

PRUCO LIFE INSURANCE COMPANY PRUCO

- Page 72 and 73:

In the section titled “Investment

- Page 74 and 75:

PRUCO LIFE INSURANCE COMPANY PRUCO

- Page 76 and 77:

Advanced Series Trust AST Academic

- Page 78 and 79:

DEATH BENEFITS ....................

- Page 80 and 81:

Guarantee Period: The period of tim

- Page 82 and 83:

C SERIES There is no CDSC or other

- Page 84 and 85:

OPTIONAL BENEFIT ANNUALIZED OPTIONA

- Page 86 and 87:

OPTIONAL BENEFIT ANNUALIZED OPTIONA

- Page 88 and 89:

UNDERLYING PORTFOLIO UNDERLYING MUT

- Page 90 and 91:

EXPENSE EXAMPLES These examples are

- Page 92 and 93:

Please see “Investment Options,

- Page 94 and 95:

INVESTMENT OPTIONS The Investment O

- Page 96 and 97:

INVESTMENT OBJECTIVES/POLICIES ADVA

- Page 98 and 99:

INVESTMENT OBJECTIVES/POLICIES AST

- Page 100 and 101:

INVESTMENT OBJECTIVES/POLICIES AST

- Page 102 and 103:

INVESTMENT OBJECTIVES/POLICIES AST

- Page 104 and 105:

INVESTMENT OBJECTIVES/POLICIES AST

- Page 106 and 107:

INVESTMENT OBJECTIVES/POLICIES AST

- Page 108 and 109:

group (Group II) our “Custom Port

- Page 110 and 111:

For the Long-Term MVA Option, a Gua

- Page 112 and 113:

FEES, CHARGES AND DEDUCTIONS In thi

- Page 114 and 115:

Settlement Service Charge: If your

- Page 116 and 117:

additional Purchase Payments, unles

- Page 118 and 119:

Please note the following additiona

- Page 120 and 121:

MANAGING YOUR ACCOUNT VALUE There a

- Page 122 and 123:

Please Note: Contracts managed by y

- Page 124 and 125:

ACCESS TO ACCOUNT VALUE TYPES OF DI

- Page 126 and 127:

prior to age 59 1 ⁄2 if you elect

- Page 128 and 129:

ANNUITY OPTIONS Annuitization invol

- Page 130 and 131:

LIVING BENEFITS Pruco Life offers d

- Page 132 and 133:

Income 2.0 may be appropriate if yo

- Page 134 and 135:

subsequent Purchase Payments and wi

- Page 136 and 137:

make will be the first Lifetime Wit

- Page 138 and 139:

certain in order to comply with the

- Page 140 and 141:

transfer all amounts held in the AS

- Page 142 and 143:

Example: Assuming the Target Ratio

- Page 144 and 145:

If you elect Highest Daily Lifetime

- Page 146 and 147:

If the Annuity permits additional P

- Page 148 and 149:

If you have not made a Lifetime Wit

- Page 150 and 151:

▪ Spousal Highest Daily Lifetime

- Page 152 and 153:

Required Minimum Distributions See

- Page 154 and 155:

▪ One Annuity Owner, where the Ow

- Page 156 and 157:

effective date of the benefit, the

- Page 158 and 159:

Highest Daily Lifetime Income 2.0 w

- Page 160 and 161:

▪ The Annuitant was 70 years old

- Page 162 and 163:

▪ Please note that if your Unadju

- Page 164 and 165:

The benefit automatically terminate

- Page 166 and 167:

(c) all Purchase Payments (includin

- Page 168 and 169:

▪ Both designated lives were 70 y

- Page 170 and 171:

Required Minimum Distributions See

- Page 172 and 173:

newly-elected benefit will commence

- Page 174 and 175:

GUARANTEED RETURN OPTION PLUS II (G

- Page 176 and 177:

time. The formula determines the ap

- Page 178 and 179:

Value” above for more details). Y

- Page 180 and 181:

HD GRO II uses a predetermined math

- Page 182 and 183:

Any amounts invested in the AST bon

- Page 184 and 185:

DEATH BENEFITS TRIGGERS FOR PAYMENT

- Page 186 and 187:

Calculation of Highest Anniversary

- Page 188 and 189:

A surviving spouse’s ability to c

- Page 190 and 191:

VALUING YOUR INVESTMENT VALUING THE

- Page 192 and 193:

TAX CONSIDERATIONS The tax consider

- Page 194 and 195: Taxes Payable by Beneficiaries The

- Page 196 and 197: A Nonqualified annuity may also be

- Page 198 and 199: In any event, you must begin receiv

- Page 200 and 201: ERISA Requirements ERISA (the “Em

- Page 202 and 203: out of any other business we may co

- Page 204 and 205: Cost Averaging, auto rebalancing, a

- Page 206 and 207: Infinex Investments, Inc. ING Finan

- Page 208 and 209: County, Illinois, was served on Pru

- Page 210 and 211: [THIS PAGE INTENTIONALLY LEFT BLANK

- Page 212 and 213: Sub-Accounts Accumulation Unit Valu

- Page 214 and 215: Sub-Accounts Accumulation Unit Valu

- Page 216 and 217: Sub-Accounts Accumulation Unit Valu

- Page 218 and 219: Sub-Accounts Accumulation Unit Valu

- Page 220 and 221: Sub-Accounts Accumulation Unit Valu

- Page 222 and 223: Sub-Accounts Accumulation Unit Valu

- Page 224 and 225: Sub-Accounts Accumulation Unit Valu

- Page 226 and 227: Sub-Accounts Accumulation Unit Valu

- Page 228 and 229: Sub-Accounts Accumulation Unit Valu

- Page 230 and 231: PREMIER RETIREMENT L SERIES Pruco L

- Page 232 and 233: Sub-Accounts Accumulation Unit Valu

- Page 234 and 235: Sub-Accounts PREMIER RETIREMENT C S

- Page 236 and 237: Sub-Accounts Accumulation Unit Valu

- Page 238 and 239: Sub-Accounts Accumulation Unit Valu

- Page 240 and 241: Sub-Accounts Accumulation Unit Valu

- Page 242 and 243: [THIS PAGE INTENTIONALLY LEFT BLANK

- Page 246 and 247: The shaded values indicate the high

- Page 248 and 249: [THIS PAGE INTENTIONALLY LEFT BLANK

- Page 250 and 251: holidays), plus the amount of any P

- Page 252 and 253: Examples of dollar-for-dollar and p

- Page 254 and 255: Required Minimum Distributions Requ

- Page 256 and 257: Unadjusted Account Value and Protec

- Page 258 and 259: equire a transfer to the Bond Sub-a

- Page 260 and 261: to as the “LIA Amount”) if you

- Page 262 and 263: the latter scenario, we determine w

- Page 264 and 265: The “Periodic Value” is initial

- Page 266 and 267: Amount on a dollar-for-dollar basis

- Page 268 and 269: Here is the calculation: Withdrawal

- Page 270 and 271: Election of and Designations under

- Page 272 and 273: [THIS PAGE INTENTIONALLY LEFT BLANK

- Page 274 and 275: holidays), plus the amount of any P

- Page 276 and 277: Examples of dollar-for-dollar and p

- Page 278 and 279: Required Minimum Distributions Requ

- Page 280 and 281: ▪ If you elect this benefit and i

- Page 282 and 283: Generally, the formula, which is ap

- Page 284 and 285: Additional Tax Considerations If yo

- Page 286 and 287: LIA Amount after the first Lifetime

- Page 288 and 289: section above entitled “How Highe

- Page 290 and 291: Highest Daily Auto Step-Up An autom

- Page 292 and 293: Non-Lifetime Withdrawal Feature You

- Page 294 and 295:

apply to current participants in th

- Page 296 and 297:

[THIS PAGE INTENTIONALLY LEFT BLANK

- Page 298 and 299:

If the formula ratio is less than a

- Page 300 and 301:

[THIS PAGE INTENTIONALLY LEFT BLANK

- Page 302 and 303:

We reserve the right to waive the l

- Page 304 and 305:

[THIS PAGE INTENTIONALLY LEFT BLANK

- Page 306 and 307:

If the formula ratio is less than a

- Page 308 and 309:

[THIS PAGE INTENTIONALLY LEFT BLANK

- Page 310 and 311:

▪ T - the amount of a transfer in

- Page 312 and 313:

[THIS PAGE INTENTIONALLY LEFT BLANK

- Page 314 and 315:

You can have a traditional IRA whet

- Page 316 and 317:

2. Rollovers from an employer retir

- Page 318 and 319:

Distributions from traditional IRAs

- Page 320 and 321:

[THIS PAGE INTENTIONALLY LEFT BLANK

- Page 322 and 323:

income, and dividend income), pensi

- Page 324 and 325:

c. Made to a Beneficiary or to your

- Page 326 and 327:

[THIS PAGE INTENTIONALLY LEFT BLANK

- Page 328 and 329:

CONTINGENT DEFERRED SALES CHARGE 1

- Page 330 and 331:

[THIS PAGE INTENTIONALLY LEFT BLANK

- Page 332:

The Prudential Insurance Company of