Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

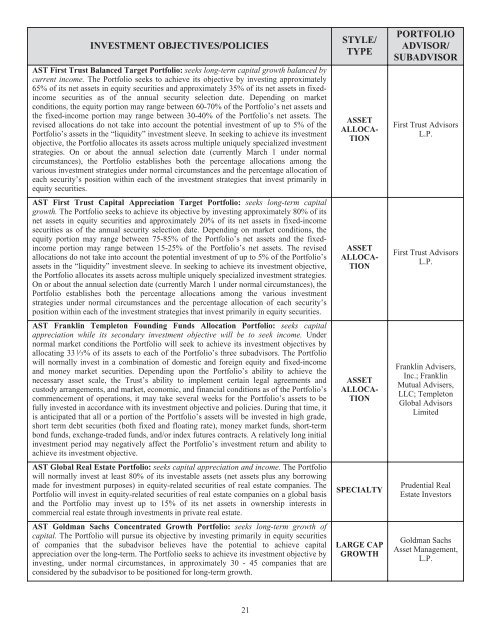

INVESTMENT OBJECTIVES/POLICIES<br />

AST First Trust Balanced Target Portfolio: seeks long-term capital growth balanced by<br />

current income. The Portfolio seeks to achieve its objective by investing approximately<br />

65% of its net assets in equity securities and approximately 35% of its net assets in fixedincome<br />

securities as of the annual security selection date. Depending on market<br />

conditions, the equity portion may range between 60-70% of the Portfolio’s net assets and<br />

the fixed-income portion may range between 30-40% of the Portfolio’s net assets. The<br />

revised allocations do not take into account the potential investment of up to 5% of the<br />

Portfolio’s assets in the “liquidity” investment sleeve. In seeking to achieve its investment<br />

objective, the Portfolio allocates its assets across multiple uniquely specialized investment<br />

strategies. On or about the annual selection date (currently March 1 under normal<br />

circumstances), the Portfolio establishes both the percentage allocations among the<br />

various investment strategies under normal circumstances and the percentage allocation of<br />

each security’s position within each of the investment strategies that invest primarily in<br />

equity securities.<br />

AST First Trust Capital Appreciation Target Portfolio: seeks long-term capital<br />

growth. The Portfolio seeks to achieve its objective by investing approximately 80% of its<br />

net assets in equity securities and approximately 20% of its net assets in fixed-income<br />

securities as of the annual security selection date. Depending on market conditions, the<br />

equity portion may range between 75-85% of the Portfolio’s net assets and the fixedincome<br />

portion may range between 15-25% of the Portfolio’s net assets. The revised<br />

allocations do not take into account the potential investment of up to 5% of the Portfolio’s<br />

assets in the “liquidity” investment sleeve. In seeking to achieve its investment objective,<br />

the Portfolio allocates its assets across multiple uniquely specialized investment strategies.<br />

On or about the annual selection date (currently March 1 under normal circumstances), the<br />

Portfolio establishes both the percentage allocations among the various investment<br />

strategies under normal circumstances and the percentage allocation of each security’s<br />

position within each of the investment strategies that invest primarily in equity securities.<br />

AST Franklin Templeton Founding Funds Allocation Portfolio: seeks capital<br />

appreciation while its secondary investment objective will be to seek income. Under<br />

normal market conditions the Portfolio will seek to achieve its investment objectives by<br />

allocating 33 1 ⁄3% of its assets to each of the Portfolio’s three subadvisors. The Portfolio<br />

will normally invest in a combination of domestic and foreign equity and fixed-income<br />

and money market securities. Depending upon the Portfolio’s ability to achieve the<br />

necessary asset scale, the Trust’s ability to implement certain legal agreements and<br />

custody arrangements, and market, economic, and financial conditions as of the Portfolio’s<br />

commencement of operations, it may take several weeks for the Portfolio’s assets to be<br />

fully invested in accordance with its investment objective and policies. During that time, it<br />

is anticipated that all or a portion of the Portfolio’s assets will be invested in high grade,<br />

short term debt securities (both fixed and floating rate), money market funds, short-term<br />

bond funds, exchange-traded funds, and/or index futures contracts. A relatively long initial<br />

investment period may negatively affect the Portfolio’s investment return and ability to<br />

achieve its investment objective.<br />

AST Global Real Estate Portfolio: seeks capital appreciation and income. The Portfolio<br />

will normally invest at least 80% of its investable assets (net assets plus any borrowing<br />

made for investment purposes) in equity-related securities of real estate companies. The<br />

Portfolio will invest in equity-related securities of real estate companies on a global basis<br />

and the Portfolio may invest up to 15% of its net assets in ownership interests in<br />

commercial real estate through investments in private real estate.<br />

AST Goldman Sachs Concentrated Growth Portfolio: seeks long-term growth of<br />

capital. The Portfolio will pursue its objective by investing primarily in equity securities<br />

of companies that the subadvisor believes have the potential to achieve capital<br />

appreciation over the long-term. The Portfolio seeks to achieve its investment objective by<br />

investing, under normal circumstances, in approximately 30 - 45 companies that are<br />

considered by the subadvisor to be positioned for long-term growth.<br />

21<br />

STYLE/<br />

TYPE<br />

ASSET<br />

ALLOCA-<br />

TION<br />

ASSET<br />

ALLOCA-<br />

TION<br />

ASSET<br />

ALLOCA-<br />

TION<br />

SPECIALTY<br />

LARGE CAP<br />

GROWTH<br />

PORTFOLIO<br />

ADVISOR/<br />

SUBADVISOR<br />

First Trust Advisors<br />

L.P.<br />

First Trust Advisors<br />

L.P.<br />

Franklin Advisers,<br />

Inc.; Franklin<br />

Mutual Advisers,<br />

LLC; Templeton<br />

Global Advisors<br />

Limited<br />

<strong>Prudential</strong> Real<br />

Estate Investors<br />

Goldman Sachs<br />

Asset Management,<br />

L.P.