Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

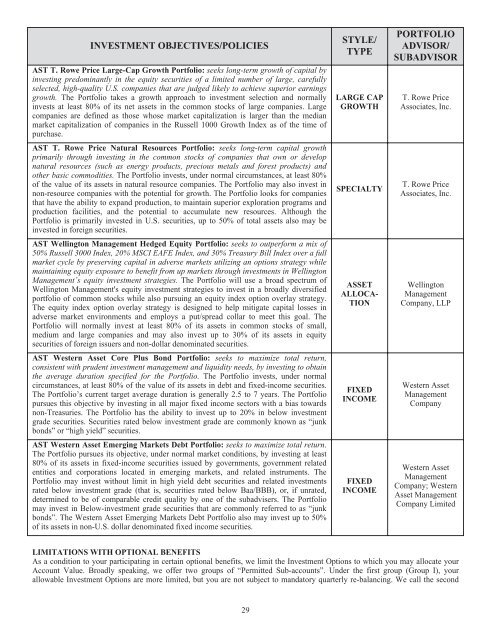

INVESTMENT OBJECTIVES/POLICIES<br />

AST T. Rowe Price Large-Cap Growth Portfolio: seeks long-term growth of capital by<br />

investing predominantly in the equity securities of a limited number of large, carefully<br />

selected, high-quality U.S. companies that are judged likely to achieve superior earnings<br />

growth. The Portfolio takes a growth approach to investment selection and normally<br />

invests at least 80% of its net assets in the common stocks of large companies. Large<br />

companies are defined as those whose market capitalization is larger than the median<br />

market capitalization of companies in the Russell 1000 Growth Index as of the time of<br />

purchase.<br />

AST T. Rowe Price Natural Resources Portfolio: seeks long-term capital growth<br />

primarily through investing in the common stocks of companies that own or develop<br />

natural resources (such as energy products, precious metals and forest products) and<br />

other basic commodities. The Portfolio invests, under normal circumstances, at least 80%<br />

of the value of its assets in natural resource companies. The Portfolio may also invest in<br />

non-resource companies with the potential for growth. The Portfolio looks for companies<br />

that have the ability to expand production, to maintain superior exploration programs and<br />

production facilities, and the potential to accumulate new resources. Although the<br />

Portfolio is primarily invested in U.S. securities, up to 50% of total assets also may be<br />

invested in foreign securities.<br />

AST Wellington Management Hedged Equity Portfolio: seeks to outperform a mix of<br />

50% Russell 3000 Index, 20% MSCI EAFE Index, and 30% Treasury Bill Index over a full<br />

market cycle by preserving capital in adverse markets utilizing an options strategy while<br />

maintaining equity exposure to benefit from up markets through investments in Wellington<br />

Management’s equity investment strategies. The Portfolio will use a broad spectrum of<br />

Wellington Management's equity investment strategies to invest in a broadly diversified<br />

portfolio of common stocks while also pursuing an equity index option overlay strategy.<br />

The equity index option overlay strategy is designed to help mitigate capital losses in<br />

adverse market environments and employs a put/spread collar to meet this goal. The<br />

Portfolio will normally invest at least 80% of its assets in common stocks of small,<br />

medium and large companies and may also invest up to 30% of its assets in equity<br />

securities of foreign issuers and non-dollar denominated securities.<br />

AST Western Asset Core Plus Bond Portfolio: seeks to maximize total return,<br />

consistent with prudent investment management and liquidity needs, by investing to obtain<br />

the average duration specified for the Portfolio. The Portfolio invests, under normal<br />

circumstances, at least 80% of the value of its assets in debt and fixed-income securities.<br />

The Portfolio’s current target average duration is generally 2.5 to 7 years. The Portfolio<br />

pursues this objective by investing in all major fixed income sectors with a bias towards<br />

non-Treasuries. The Portfolio has the ability to invest up to 20% in below investment<br />

grade securities. Securities rated below investment grade are commonly known as “junk<br />

bonds” or “high yield” securities.<br />

AST Western Asset Emerging Markets Debt Portfolio: seeks to maximize total return.<br />

The Portfolio pursues its objective, under normal market conditions, by investing at least<br />

80% of its assets in fixed-income securities issued by governments, government related<br />

entities and corporations located in emerging markets, and related instruments. The<br />

Portfolio may invest without limit in high yield debt securities and related investments<br />

rated below investment grade (that is, securities rated below Baa/BBB), or, if unrated,<br />

determined to be of comparable credit quality by one of the subadvisers. The Portfolio<br />

may invest in Below-investment grade securities that are commonly referred to as “junk<br />

bonds”. The Western Asset Emerging Markets Debt Portfolio also may invest up to 50%<br />

of its assets in non-U.S. dollar denominated fixed income securities.<br />

STYLE/<br />

TYPE<br />

LARGE CAP<br />

GROWTH<br />

SPECIALTY<br />

ASSET<br />

ALLOCA-<br />

TION<br />

FIXED<br />

INCOME<br />

FIXED<br />

INCOME<br />

PORTFOLIO<br />

ADVISOR/<br />

SUBADVISOR<br />

T. Rowe Price<br />

Associates, Inc.<br />

T. Rowe Price<br />

Associates, Inc.<br />

Wellington<br />

Management<br />

Company, LLP<br />

Western Asset<br />

Management<br />

Company<br />

Western Asset<br />

Management<br />

Company; Western<br />

Asset Management<br />

Company Limited<br />

LIMITATIONS WITH OPTIONAL BENEFITS<br />

As a condition to your participating in certain optional benefits, we limit the Investment Options to which you may allocate your<br />

Account Value. Broadly speaking, we offer two groups of “Permitted Sub-accounts”. Under the first group (Group I), your<br />

allowable Investment Options are more limited, but you are not subject to mandatory quarterly re-balancing. We call the second<br />

29