Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

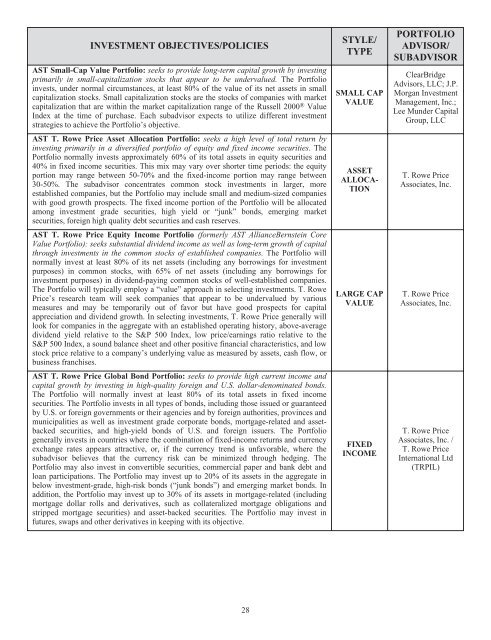

INVESTMENT OBJECTIVES/POLICIES<br />

AST Small-Cap Value Portfolio: seeks to provide long-term capital growth by investing<br />

primarily in small-capitalization stocks that appear to be undervalued. The Portfolio<br />

invests, under normal circumstances, at least 80% of the value of its net assets in small<br />

capitalization stocks. Small capitalization stocks are the stocks of companies with market<br />

capitalization that are within the market capitalization range of the Russell 2000 ® Value<br />

Index at the time of purchase. Each subadvisor expects to utilize different investment<br />

strategies to achieve the Portfolio’s objective.<br />

AST T. Rowe Price Asset Allocation Portfolio: seeks a high level of total return by<br />

investing primarily in a diversified portfolio of equity and fixed income securities. The<br />

Portfolio normally invests approximately 60% of its total assets in equity securities and<br />

40% in fixed income securities. This mix may vary over shorter time periods: the equity<br />

portion may range between 50-70% and the fixed-income portion may range between<br />

30-50%. The subadvisor concentrates common stock investments in larger, more<br />

established companies, but the Portfolio may include small and medium-sized companies<br />

with good growth prospects. The fixed income portion of the Portfolio will be allocated<br />

among investment grade securities, high yield or “junk” bonds, emerging market<br />

securities, foreign high quality debt securities and cash reserves.<br />

AST T. Rowe Price Equity Income Portfolio (formerly AST AllianceBernstein Core<br />

Value Portfolio): seeks substantial dividend income as well as long-term growth of capital<br />

through investments in the common stocks of established companies. The Portfolio will<br />

normally invest at least 80% of its net assets (including any borrowings for investment<br />

purposes) in common stocks, with 65% of net assets (including any borrowings for<br />

investment purposes) in dividend-paying common stocks of well-established companies.<br />

The Portfolio will typically employ a “value” approach in selecting investments. T. Rowe<br />

Price’s research team will seek companies that appear to be undervalued by various<br />

measures and may be temporarily out of favor but have good prospects for capital<br />

appreciation and dividend growth. In selecting investments, T. Rowe Price generally will<br />

look for companies in the aggregate with an established operating history, above-average<br />

dividend yield relative to the S&P 500 Index, low price/earnings ratio relative to the<br />

S&P 500 Index, a sound balance sheet and other positive financial characteristics, and low<br />

stock price relative to a company’s underlying value as measured by assets, cash flow, or<br />

business franchises.<br />

AST T. Rowe Price Global Bond Portfolio: seeks to provide high current income and<br />

capital growth by investing in high-quality foreign and U.S. dollar-denominated bonds.<br />

The Portfolio will normally invest at least 80% of its total assets in fixed income<br />

securities. The Portfolio invests in all types of bonds, including those issued or guaranteed<br />

by U.S. or foreign governments or their agencies and by foreign authorities, provinces and<br />

municipalities as well as investment grade corporate bonds, mortgage-related and assetbacked<br />

securities, and high-yield bonds of U.S. and foreign issuers. The Portfolio<br />

generally invests in countries where the combination of fixed-income returns and currency<br />

exchange rates appears attractive, or, if the currency trend is unfavorable, where the<br />

subadvisor believes that the currency risk can be minimized through hedging. The<br />

Portfolio may also invest in convertible securities, commercial paper and bank debt and<br />

loan participations. The Portfolio may invest up to 20% of its assets in the aggregate in<br />

below investment-grade, high-risk bonds (“junk bonds”) and emerging market bonds. In<br />

addition, the Portfolio may invest up to 30% of its assets in mortgage-related (including<br />

mortgage dollar rolls and derivatives, such as collateralized mortgage obligations and<br />

stripped mortgage securities) and asset-backed securities. The Portfolio may invest in<br />

futures, swaps and other derivatives in keeping with its objective.<br />

28<br />

STYLE/<br />

TYPE<br />

SMALL CAP<br />

VALUE<br />

ASSET<br />

ALLOCA-<br />

TION<br />

LARGE CAP<br />

VALUE<br />

FIXED<br />

INCOME<br />

PORTFOLIO<br />

ADVISOR/<br />

SUBADVISOR<br />

ClearBridge<br />

Advisors, LLC; J.P.<br />

Morgan Investment<br />

Management, Inc.;<br />

Lee Munder Capital<br />

Group, LLC<br />

T. Rowe Price<br />

Associates, Inc.<br />

T. Rowe Price<br />

Associates, Inc.<br />

T. Rowe Price<br />

Associates, Inc. /<br />

T. Rowe Price<br />

International Ltd<br />

(TRPIL)