Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

Prudential Premier Retirement Variable Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

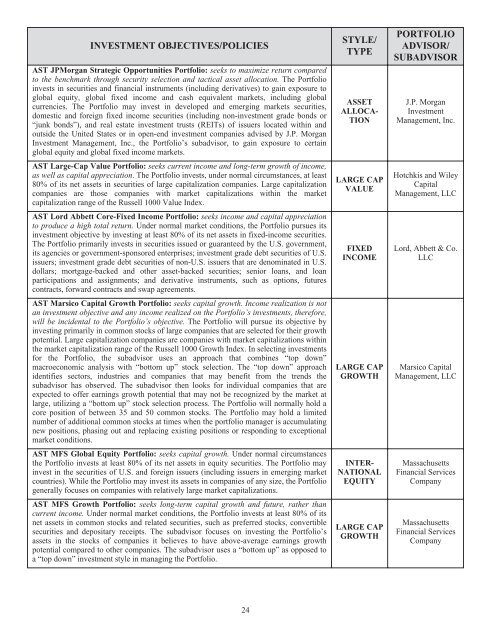

INVESTMENT OBJECTIVES/POLICIES<br />

AST JPMorgan Strategic Opportunities Portfolio: seeks to maximize return compared<br />

to the benchmark through security selection and tactical asset allocation. The Portfolio<br />

invests in securities and financial instruments (including derivatives) to gain exposure to<br />

global equity, global fixed income and cash equivalent markets, including global<br />

currencies. The Portfolio may invest in developed and emerging markets securities,<br />

domestic and foreign fixed income securities (including non-investment grade bonds or<br />

“junk bonds”), and real estate investment trusts (REITs) of issuers located within and<br />

outside the United States or in open-end investment companies advised by J.P. Morgan<br />

Investment Management, Inc., the Portfolio’s subadvisor, to gain exposure to certain<br />

global equity and global fixed income markets.<br />

AST Large-Cap Value Portfolio: seeks current income and long-term growth of income,<br />

as well as capital appreciation. The Portfolio invests, under normal circumstances, at least<br />

80% of its net assets in securities of large capitalization companies. Large capitalization<br />

companies are those companies with market capitalizations within the market<br />

capitalization range of the Russell 1000 Value Index.<br />

AST Lord Abbett Core-Fixed Income Portfolio: seeks income and capital appreciation<br />

to produce a high total return. Under normal market conditions, the Portfolio pursues its<br />

investment objective by investing at least 80% of its net assets in fixed-income securities.<br />

The Portfolio primarily invests in securities issued or guaranteed by the U.S. government,<br />

its agencies or government-sponsored enterprises; investment grade debt securities of U.S.<br />

issuers; investment grade debt securities of non-U.S. issuers that are denominated in U.S.<br />

dollars; mortgage-backed and other asset-backed securities; senior loans, and loan<br />

participations and assignments; and derivative instruments, such as options, futures<br />

contracts, forward contracts and swap agreements.<br />

AST Marsico Capital Growth Portfolio: seeks capital growth. Income realization is not<br />

an investment objective and any income realized on the Portfolio’s investments, therefore,<br />

will be incidental to the Portfolio’s objective. The Portfolio will pursue its objective by<br />

investing primarily in common stocks of large companies that are selected for their growth<br />

potential. Large capitalization companies are companies with market capitalizations within<br />

the market capitalization range of the Russell 1000 Growth Index. In selecting investments<br />

for the Portfolio, the subadvisor uses an approach that combines “top down”<br />

macroeconomic analysis with “bottom up” stock selection. The “top down” approach<br />

identifies sectors, industries and companies that may benefit from the trends the<br />

subadvisor has observed. The subadvisor then looks for individual companies that are<br />

expected to offer earnings growth potential that may not be recognized by the market at<br />

large, utilizing a “bottom up” stock selection process. The Portfolio will normally hold a<br />

core position of between 35 and 50 common stocks. The Portfolio may hold a limited<br />

number of additional common stocks at times when the portfolio manager is accumulating<br />

new positions, phasing out and replacing existing positions or responding to exceptional<br />

market conditions.<br />

AST MFS Global Equity Portfolio: seeks capital growth. Under normal circumstances<br />

the Portfolio invests at least 80% of its net assets in equity securities. The Portfolio may<br />

invest in the securities of U.S. and foreign issuers (including issuers in emerging market<br />

countries). While the Portfolio may invest its assets in companies of any size, the Portfolio<br />

generally focuses on companies with relatively large market capitalizations.<br />

AST MFS Growth Portfolio: seeks long-term capital growth and future, rather than<br />

current income. Under normal market conditions, the Portfolio invests at least 80% of its<br />

net assets in common stocks and related securities, such as preferred stocks, convertible<br />

securities and depositary receipts. The subadvisor focuses on investing the Portfolio’s<br />

assets in the stocks of companies it believes to have above-average earnings growth<br />

potential compared to other companies. The subadvisor uses a “bottom up” as opposed to<br />

a “top down” investment style in managing the Portfolio.<br />

24<br />

STYLE/<br />

TYPE<br />

ASSET<br />

ALLOCA-<br />

TION<br />

LARGE CAP<br />

VALUE<br />

FIXED<br />

INCOME<br />

LARGE CAP<br />

GROWTH<br />

INTER-<br />

NATIONAL<br />

EQUITY<br />

LARGE CAP<br />

GROWTH<br />

PORTFOLIO<br />

ADVISOR/<br />

SUBADVISOR<br />

J.P. Morgan<br />

Investment<br />

Management, Inc.<br />

Hotchkis and Wiley<br />

Capital<br />

Management, LLC<br />

Lord, Abbett & Co.<br />

LLC<br />

Marsico Capital<br />

Management, LLC<br />

Massachusetts<br />

Financial Services<br />

Company<br />

Massachusetts<br />

Financial Services<br />

Company