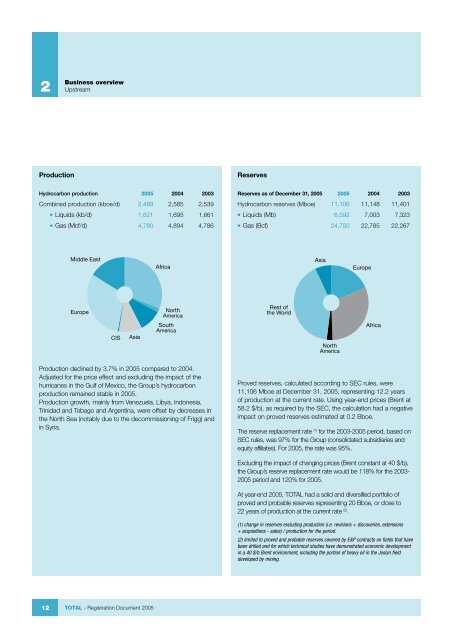

2 Production Business overview Upstream Hydrocarbon production <strong>2005</strong> 2004 2003 Combined production (kboe/d) 2,489 2,585 2,539 • Liquids (kb/d) 1,621 1,695 1,661 • Gas (Mcf/d) 4,780 4,894 4,786 Middle East Europe CIS Asia 12 TOTAL - <strong>Registration</strong> <strong>Document</strong> <strong>2005</strong> Africa North America South America Production declined by 3.7% in <strong>2005</strong> <strong>com</strong>pared to 2004. Adjusted for the price effect and excluding the impact of the hurricanes in the Gulf of Mexico, the Group’s hydrocarbon production remained stable in <strong>2005</strong>. Production growth, mainly from Venezuela, Libya, Indonesia, Trinidad and Tobago and Argentina, were offset by decreases in the North Sea (notably due to the de<strong>com</strong>missioning of Frigg) and in Syria. Reserves Reserves as of December 31, <strong>2005</strong> <strong>2005</strong> 2004 2003 Hydrocarbon reserves (Mboe) 11,106 11,148 11,401 • Liquids (Mb) 6,592 7,003 7,323 • Gas (Bcf) 24,750 22,785 22,267 Rest of the World Asia North America Europe Africa Proved reserves, calculated according to SEC rules, were 11,106 Mboe at December 31, <strong>2005</strong>, representing 12.2 years of production at the current rate. Using year-end prices (Brent at 58.2 $/b), as required by the SEC, the calculation had a negative impact on proved reserves estimated at 0.2 Bboe. The reserve replacement rate (1) for the 2003-<strong>2005</strong> period, based on SEC rules, was 97% for the Group (consolidated subsidiaries and equity affiliates). For <strong>2005</strong>, the rate was 95%. Excluding the impact of changing prices (Brent constant at 40 $/b), the Group’s reserve replacement rate would be 118% for the 2003- <strong>2005</strong> period and 120% for <strong>2005</strong>. At year-end <strong>2005</strong>, TOTAL had a solid and diversified portfolio of proved and probable reserves representing 20 Bboe, or close to 22 years of production at the current rate (2) . (1) change in reserves excluding production (i.e. revisions + discoveries, extensions + acquisitions - sales) / production for the period. (2) limited to proved and probable reserves covered by E&P contracts on fields that have been drilled and for which technical studies have demonstrated economic development in a 40 $/b Brent environment, including the portion of heavy oil in the Joslyn field developed by mining.

Exploration & Production Exploration and development TOTAL’s Upstream segment intends to continue to <strong>com</strong>bine longterm growth and profitability at the level of the best in the industry. TOTAL evaluates exploration opportunities based on a variety of geological, technical, political and economic factors (including taxes and concession terms), as well as on projected oil and gas prices. Discoveries and extensions of existing discoveries accounted for approximately 73% of the 2,607 Mboe added to the Upstream segment’s proved reserves during the three-year period ended December 31, <strong>2005</strong> (before deducting production and sales of reserves in place and adding any acquisitions of reserves in place during this period). The remaining 27% <strong>com</strong>es from revisions. TOTAL continued to follow an active exploration program in <strong>2005</strong>, with exploration expenditures of consolidated subsidiaries amounting to 644 M€ (including unproved property acquisition costs). The principal exploration expenditures were made in Nigeria, Angola, the United Kingdom, Norway, Congo, the United States, Libya, Algeria, Argentina, Kazakhstan, Colombia, Indonesia and the Netherlands. In 2004, the Group’s exploration expenditures amounted to 651 M€, principally in the United States, Nigeria, Angola, the United Kingdom, Libya, Algeria, Congo, Kazakhstan, Norway, Bolivia, the Netherlands, Colombia and Indonesia. In 2003, exploration expenditures amounted to 630 M€ principally in Nigeria, Kazakhstan, the United States, Libya, Angola, the United Kingdom, the Netherlands, Norway, Bolivia, Algeria, Congo, Brunei, Brazil and Venezuela. The development expenditures of the Group’s consolidated Exploration & Production subsidiaries amounted to 5.2 B€ in <strong>2005</strong>, primarily in Norway, Angola, Nigeria, Kazakhstan, Indonesia, the United Kingdom, Qatar, Congo, Azerbaijan, Gabon, Canada and Yemen. 2004 development expenditures amounted to 4.1 B€. The principal development investments for 2004 were carried out in Norway, Angola, Nigeria, Indonesia, Kazakhstan, the United Kingdom, Qatar, Azerbaijan, the United States, Gabon, Congo, Libya, Trinidad & Tobago, Venezuela and Iran. In 2003, development expenditures amounted to 3.8 B€ and were made principally in Norway, Angola, Nigeria, Indonesia, the United States, Iran, the United Kingdom, Gabon, Azerbaijan, Qatar, Congo and Venezuela. Reserves Business overview Exploration & Production - Upstream TOTAL - <strong>Registration</strong> <strong>Document</strong> <strong>2005</strong> 2 The definitions used for proved, proved developed and proved undeveloped oil and gas reserves are in accordance with the applicable U.S. Securities & Exchange Commission regulation, Rule 4-10 of Regulation S-X. Proved reserves are estimated using geological and engineering data to determine with reasonable certainty whether the crude oil or natural gas in known reservoirs is recoverable under existing economic and operating conditions. This process involves making subjective judgments. Consequently, measures of reserves are not precise and are subject to revision. The estimation of proved reserves is controlled by the Group through established validation guidelines. Reserves evaluations are established annually by senior level geoscience and engineering professionals (assisted by a central reserves group with significant technical experience) including reviews with and validation by senior management. Significant features of the reserves estimation process include: • internal peer reviews of technical evaluations also to ensure that the SEC definitions and guidance are followed, and • a requirement that management make significant funding <strong>com</strong>mitments toward the development of the reserves prior to booking. TOTAL’s oil and gas reserves are reviewed annually to take into account, among other things, production levels, field reassessments, the addition of new reserves from discoveries and acquisitions, disposals of reserves and other economic factors. Unless otherwise indicated, references to TOTAL’s proved reserves, proved developed reserves, proved undeveloped reserves and production reflect the entire Group’s share of such reserves or production. TOTAL’s worldwide proved reserves include the proved reserves of its consolidated subsidiaries as well as its proportionate share of the proved reserves of equity affiliates and of two <strong>com</strong>panies accounted for by the cost method. For further information concerning changes in TOTAL’s proved reserves at December 31, <strong>2005</strong>, 2004 and 2003, see “Supplemental Oil and Gas Information (Unaudited)”, included on page 231 and after. Rule 4-10 of Regulation S-X requires the use of the year-end price, as well as existing operating conditions, to determine reserve quantities. Reserves at year-end <strong>2005</strong> have been determined based on the Brent price on December 31, <strong>2005</strong> ($58.21/b). 13

- Page 1 and 2: Registration Document 2005

- Page 3 and 4: Registration Document 2005 This is

- Page 5 and 6: Key figures Selected financial info

- Page 7 and 8: 104,652 2003 French GAAP Sales (M

- Page 9 and 10: DOWNSTREAM Refined product sales (k

- Page 11 and 12: Business overview History and strat

- Page 13: Upstream TOTAL’s Upstream segment

- Page 17 and 18: Production TOTAL’s average daily

- Page 19 and 20: Presentation of production activiti

- Page 21 and 22: Europe Year of entry into the count

- Page 23 and 24: Africa TOTAL has been present in Af

- Page 25 and 26: Libya The Group’s share of produc

- Page 27 and 28: North America The Group’s presenc

- Page 29 and 30: On the Yucal Placer field, the init

- Page 31 and 32: Commonwealth of Independent States

- Page 33 and 34: The Netherlands TOTAL is the second

- Page 35 and 36: Kuwait Since 1997, the Group has pr

- Page 37 and 38: Gas & Power The Gas & Power sector

- Page 39 and 40: Middle East In Qatar, negotiations

- Page 41 and 42: TOTAL is pursuing decentralized rur

- Page 43 and 44: Refining & Marketing On December 31

- Page 45 and 46: Marketing The Group is one of the l

- Page 47 and 48: the provinces of Shanghai, Jiangsu

- Page 49 and 50: All of TOTAL’s trading activities

- Page 51 and 52: Base Chemicals TOTAL’s Base Chemi

- Page 53 and 54: Specialties TOTAL’s Specialties s

- Page 55 and 56: trademarks. It is present on three

- Page 57 and 58: Other activities E-Commerce In 2005

- Page 59 and 60: Organizational structure Position o

- Page 61 and 62: Executive Committee Trading & Shipp

- Page 63 and 64: Management Report of the Board of D

- Page 65 and 66:

Market environment Management Repor

- Page 67 and 68:

Upstream results (in millions of eu

- Page 69 and 70:

Downstream results (in millions of

- Page 71 and 72:

Adoption of IFRS rules The principa

- Page 73 and 74:

Liquidity and capital resources Lon

- Page 75 and 76:

Research and development Research a

- Page 77 and 78:

Risk factors Market risks p. 76 •

- Page 79 and 80:

Financial markets related risks Wit

- Page 81 and 82:

The non-current debt in dollars des

- Page 83 and 84:

Grande Paroisse An explosion occurr

- Page 85 and 86:

Myanmar Under the Belgian “univer

- Page 87 and 88:

Risk management Risk evaluations le

- Page 89 and 90:

ILSA - Other US regulations In 2001

- Page 91 and 92:

Insurance and risk management Organ

- Page 93 and 94:

Corporate governance Board of Direc

- Page 95 and 96:

Anne Lauvergeon 46 years old. Indep

- Page 97 and 98:

Additional information required und

- Page 99 and 100:

Additional information required und

- Page 101 and 102:

Additional information required und

- Page 103 and 104:

Statutory auditors Statutory audito

- Page 105 and 106:

Executive Officers’ Compensation

- Page 107 and 108:

Report of the Chairman of the Board

- Page 109 and 110:

july 19: • estimated earnings for

- Page 111 and 112:

Nominating & Compensation Committee

- Page 113 and 114:

The hydrocarbon reserves are review

- Page 115 and 116:

Headcount, Employee shareholdings,

- Page 117 and 118:

Allocation of TOTAL share subscript

- Page 119 and 120:

TOTAL share subscription and purcha

- Page 121 and 122:

Allocation of TOTAL restricted shar

- Page 123 and 124:

Elf Aquitaine share subscription op

- Page 125 and 126:

TOTAL and its shareholders TOTAL sh

- Page 127 and 128:

Four-for-one stock split A proposal

- Page 129 and 130:

TOTAL share over the last 18 months

- Page 131 and 132:

Dividend payment on Stock Certifica

- Page 133 and 134:

• were repurchased under the auth

- Page 135 and 136:

These transactions may be carried o

- Page 137 and 138:

Shareholders Relationship between T

- Page 139 and 140:

The holdings of the principal share

- Page 141 and 142:

Shareholders Estimate of capital di

- Page 143 and 144:

The above-mentioned French forms ar

- Page 145 and 146:

• • • • On November 18 and

- Page 147 and 148:

2006 Calendar February 15 Results f

- Page 149 and 150:

Financial information Historical fi

- Page 151 and 152:

Additional information Financial in

- Page 153 and 154:

General information Share capital p

- Page 155 and 156:

• Authority to grant restricted e

- Page 157 and 158:

Potential capital as of December 31

- Page 159 and 160:

General information Articles of inc

- Page 161 and 162:

Shareholders’ Meetings Notices of

- Page 163 and 164:

Documents on display The documents

- Page 165 and 166:

Statutory auditors’ report on the

- Page 167 and 168:

Consolidated statement of income TO

- Page 169 and 170:

Consolidated statement of cash flow

- Page 171 and 172:

Notes to the consolidated financial

- Page 173 and 174:

The cost of employee-reserved capit

- Page 175 and 176:

K. Impairment of long-lived assets

- Page 177 and 178:

Crude oil costs include raw materia

- Page 179 and 180:

Fair value option In June 2005, the

- Page 181 and 182:

A. Information by business segment

- Page 183 and 184:

Appendix 1 - Consolidated financial

- Page 185 and 186:

Appendix 1 - Consolidated financial

- Page 187 and 188:

C. Adjusting items by business segm

- Page 189 and 190:

7. Other income and other expense A

- Page 191 and 192:

RECONCILIATION BETwEEN PROVISION FO

- Page 193 and 194:

12. Equity affiliates: investments

- Page 195 and 196:

14. Other non-current assets Append

- Page 197 and 198:

Capital increase reserved for Group

- Page 199 and 200:

The Group expects to contribute 371

- Page 201 and 202:

19. Other non-current liabilities A

- Page 203 and 204:

(in millions of euros) TOTAL CAPITA

- Page 205 and 206:

Impact on net income Appendix 1 - C

- Page 207 and 208:

23. Commitments and contingencies A

- Page 209 and 210:

B. TOTAL share purchase plan Append

- Page 211 and 212:

25. Payroll and staff Appendix 1 -

- Page 213 and 214:

Appendix 1 - Consolidated financial

- Page 215 and 216:

B. Financial instruments related to

- Page 217 and 218:

Management of short-term interest r

- Page 219 and 220:

Appendix 1 - Consolidated financial

- Page 221 and 222:

31. Other information A. Research a

- Page 223 and 224:

The consolidated balance sheet and

- Page 225 and 226:

Note 32.6: IFRS restatements with a

- Page 227 and 228:

Fixed assets Component Impairment o

- Page 229 and 230:

Fixed assets Component Impairment o

- Page 231 and 232:

53.2% 95.7% Elf Aquitaine 99.5% 100

- Page 233 and 234:

Oil and gas reserves p. 232 • Cha

- Page 235 and 236:

Changes in liquids reserves Appendi

- Page 237 and 238:

Changes in liquids and gas reserves

- Page 239 and 240:

Costs incurred in oil and gas prope

- Page 241 and 242:

Standardized measure of discounted

- Page 243 and 244:

Other information Accounting for ex

- Page 245 and 246:

Appendix 3 - TOTAL S.A. Special aud

- Page 247 and 248:

Statutory auditors’ report on the

- Page 249 and 250:

Summary balance sheet at December 3

- Page 251 and 252:

Other five-year financial data TOTA

- Page 253 and 254:

Employment and environmental inform

- Page 255 and 256:

4) Compensation TOTAL - Registratio

- Page 257 and 258:

Environment Pursuant to French Law

- Page 259 and 260:

Five-year consolidated financial in

- Page 261 and 262:

10. CAPITAL RESOURCES 10.1. Informa

- Page 264:

TOTAL S.A. Registered Offi ce: 2, p