Registration Document 2005 - Total.com

Registration Document 2005 - Total.com

Registration Document 2005 - Total.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

9<br />

Appendix 1 – Consolidated financial statements<br />

Notes to the consolidated financial statements<br />

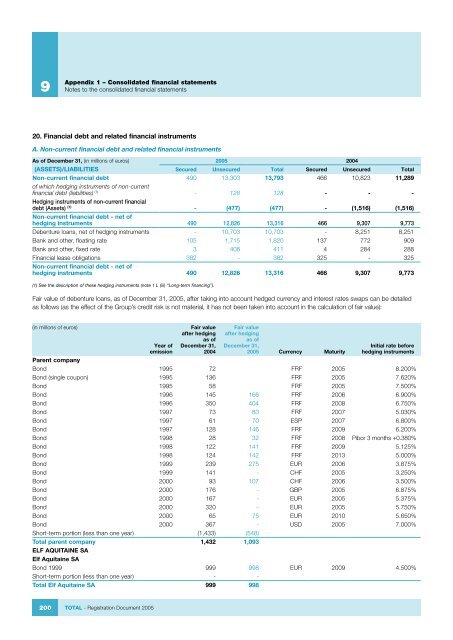

20. Financial debt and related financial instruments<br />

A. Non-current financial debt and related financial instruments<br />

As of December 31, (in millions of euros) <strong>2005</strong> 2004<br />

(ASSETS)/LIABILITIES Secured Unsecured <strong>Total</strong> Secured Unsecured <strong>Total</strong><br />

Non-current financial debt 490 13,303 13,793 466 10,823 11,289<br />

of which hedging instruments of non-current<br />

financial debt (liabilities) (1) - 128 128 - - -<br />

Hedging instruments of non-current financial<br />

debt (Assets) (1) - (477) (477) - (1,516) (1,516)<br />

Non-current financial debt - net of<br />

hedging instruments 490 12,826 13,316 466 9,307 9,773<br />

Debenture loans, net of hedging instruments - 10,703 10,703 - 8,251 8,251<br />

Bank and other, floating rate 105 1,715 1,820 137 772 909<br />

Bank and other, fixed rate 3 408 411 4 284 288<br />

Financial lease obligations 382 - 382 325 - 325<br />

Non-current financial debt - net of<br />

hedging instruments 490 12,826 13,316 466 9,307 9,773<br />

(1) See the description of these hedging instruments (note 1 L (iii) “Long-term financing”).<br />

Fair value of debenture loans, as of December 31, <strong>2005</strong>, after taking into account hedged currency and interest rates swaps can be detailed<br />

as follows (as the effect of the Group’s credit risk is not material, it has not been taken into account in the calculation of fair value):<br />

(in millions of euros)<br />

200 TOTAL - <strong>Registration</strong> <strong>Document</strong> <strong>2005</strong><br />

Year of<br />

emission<br />

Fair value<br />

after hedging<br />

as of<br />

December 31,<br />

2004<br />

Fair value<br />

after hedging<br />

as of<br />

December 31,<br />

<strong>2005</strong> Currency Maturity<br />

Initial rate before<br />

hedging instruments<br />

Parent <strong>com</strong>pany<br />

Bond 1995 72 FRF <strong>2005</strong> 8.200%<br />

Bond (single coupon) 1995 136 FRF <strong>2005</strong> 7.620%<br />

Bond 1995 58 FRF <strong>2005</strong> 7.500%<br />

Bond 1996 145 166 FRF 2006 6.900%<br />

Bond 1996 350 404 FRF 2008 6.750%<br />

Bond 1997 73 83 FRF 2007 5.030%<br />

Bond 1997 61 70 ESP 2007 6.800%<br />

Bond 1997 128 146 FRF 2009 6.200%<br />

Bond 1998 28 32 FRF 2008 Pibor 3 months +0.380%<br />

Bond 1998 122 141 FRF 2009 5.125%<br />

Bond 1998 124 142 FRF 2013 5.000%<br />

Bond 1999 239 275 EUR 2006 3.875%<br />

Bond 1999 141 - CHF <strong>2005</strong> 3.250%<br />

Bond 2000 93 107 CHF 2006 3.500%<br />

Bond 2000 176 - GBP <strong>2005</strong> 6.875%<br />

Bond 2000 167 - EUR <strong>2005</strong> 5.375%<br />

Bond 2000 320 - EUR <strong>2005</strong> 5.750%<br />

Bond 2000 65 75 EUR 2010 5.650%<br />

Bond 2000 367 - USD <strong>2005</strong> 7.000%<br />

Short-term portion (less than one year) (1,433) (548)<br />

<strong>Total</strong> parent <strong>com</strong>pany 1,432 1,093<br />

ELF AQUITAINE SA<br />

Elf Aquitaine SA<br />

Bond 1999 999 998 EUR 2009 4.500%<br />

Short-term portion (less than one year) - -<br />

<strong>Total</strong> Elf Aquitaine SA 999 998