Registration Document 2005 - Total.com

Registration Document 2005 - Total.com

Registration Document 2005 - Total.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management of short-term interest rate exposure and cash<br />

Cash balances, which are primarily <strong>com</strong>posed of euros and dollars,<br />

are managed with three main objectives set out by management<br />

(to maintain maximum liquidity, to optimize revenue from<br />

investments considering existing interest rate yield curves, and<br />

to minimize the cost of borrowing), over a horizon of less than<br />

twelve months and on the basis of a daily interest rate benchmark,<br />

primarily through short-term interest rate swaps and short-term<br />

currency swaps, without modification of the currency exposure.<br />

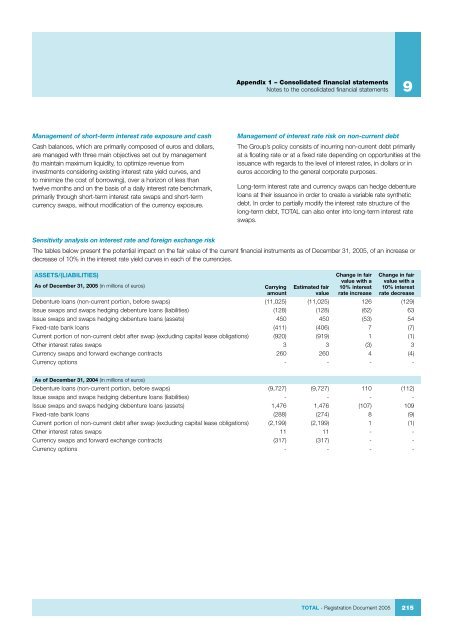

Sensitivity analysis on interest rate and foreign exchange risk<br />

Appendix 1 – Consolidated financial statements<br />

Notes to the consolidated financial statements 9<br />

The tables below present the potential impact on the fair value of the current financial instruments as of December 31, <strong>2005</strong>, of an increase or<br />

decrease of 10% in the interest rate yield curves in each of the currencies.<br />

ASSETS/(LIABILITIES)<br />

As of December 31, <strong>2005</strong> (in millions of euros) Carrying<br />

amount<br />

Management of interest rate risk on non-current debt<br />

The Group’s policy consists of incurring non-current debt primarily<br />

at a floating rate or at a fixed rate depending on opportunities at the<br />

issuance with regards to the level of interest rates, in dollars or in<br />

euros according to the general corporate purposes.<br />

Long-term interest rate and currency swaps can hedge debenture<br />

loans at their issuance in order to create a variable rate synthetic<br />

debt. In order to partially modify the interest rate structure of the<br />

long-term debt, TOTAL can also enter into long-term interest rate<br />

swaps.<br />

Estimated fair<br />

value<br />

Change in fair<br />

value with a<br />

10% interest<br />

rate increase<br />

TOTAL - <strong>Registration</strong> <strong>Document</strong> <strong>2005</strong><br />

Change in fair<br />

value with a<br />

10% interest<br />

rate decrease<br />

Debenture loans (non-current portion, before swaps) (11,025) (11,025) 126 (129)<br />

Issue swaps and swaps hedging debenture loans (liabilities) (128) (128) (62) 63<br />

Issue swaps and swaps hedging debenture loans (assets) 450 450 (53) 54<br />

Fixed-rate bank loans (411) (406) 7 (7)<br />

Current portion of non-current debt after swap (excluding capital lease obligations) (920) (919) 1 (1)<br />

Other interest rates swaps 3 3 (3) 3<br />

Currency swaps and forward exchange contracts 260 260 4 (4)<br />

Currency options - - - -<br />

As of December 31, 2004 (in millions of euros)<br />

Debenture loans (non-current portion, before swaps) (9,727) (9,727) 110 (112)<br />

Issue swaps and swaps hedging debenture loans (liabilities) - - - -<br />

Issue swaps and swaps hedging debenture loans (assets) 1,476 1,476 (107) 109<br />

Fixed-rate bank loans (288) (274) 8 (9)<br />

Current portion of non-current debt after swap (excluding capital lease obligations) (2,199) (2,199) 1 (1)<br />

Other interest rates swaps 11 11 - -<br />

Currency swaps and forward exchange contracts (317) (317) - -<br />

Currency options - - - -<br />

215