Regulation of Fuels and Fuel Additives: Renewable Fuel Standard ...

Regulation of Fuels and Fuel Additives: Renewable Fuel Standard ...

Regulation of Fuels and Fuel Additives: Renewable Fuel Standard ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

presence <strong>of</strong> the denaturant. For instance, under Internal Revenue Service (IRS)<br />

regulations the denaturant can be counted as ethanol by parties filing claims to the IRS<br />

for the federal excise tax credit. Also, EIA reporting requirements for ethanol producers<br />

allow them to include the denaturant in their reported volumes.<br />

Since we are proposing that denatured ethanol be assigned an Equivalence Value<br />

<strong>of</strong> 1.0, this must be reflected in the values <strong>of</strong> REth <strong>and</strong> ECEth. We have calculated these<br />

values to be 93.1 percent <strong>and</strong> 77,550 Btu/gal, respectively. Details <strong>of</strong> these calculations<br />

can be found in the aforementioned technical memor<strong>and</strong>um to the docket.<br />

The calculation <strong>of</strong> the Equivalence Value for a particular renewable fuel can lead<br />

to values that deviate only slightly from 1.0, <strong>and</strong>/or can have varying degrees <strong>of</strong> precision<br />

depending on the uncertainty in the value <strong>of</strong> R or ECRF. We are therefore proposing three<br />

simplifications to streamline the application <strong>of</strong> Equivalence Values in the context <strong>of</strong> the<br />

RFS program. First, consistent with our approach to the R value for ethanol, we are<br />

proposing that all Equivalence Values calculated to be in the range <strong>of</strong> 0.9 - 1.2 be treated<br />

as if they were exactly 1.0. This approach would eliminate many <strong>of</strong> the complexities<br />

described in Section III.D.2 that are associated with using renewable fuels for RFS<br />

compliance purposes that have an Equivalence Value other than 1.0. Second, we propose<br />

that several bins be created for renewable fuels with Equivalence Values above 1.0.<br />

These bins would replace the calculated Equivalence Values with st<strong>and</strong>ardized ones to<br />

account for uncertainty in the calculations as well as to simplify their application. We<br />

propose that the bins be 1.0, 1.3, 1.5, <strong>and</strong> 1.7. Each renewable fuel would be assigned to<br />

the bin that is closest to its calculated Equivalence Value. Finally, we propose that all<br />

Equivalence Values, if any, which are calculated to be less than 0.9 be rounded to the<br />

first decimal place.<br />

Using the methodology described above, we calculated the Equivalence Values<br />

for a number <strong>of</strong> different renewable fuels expected to be in use over the next few years,<br />

<strong>and</strong> modified them according to our proposed rounding protocols. These are shown in<br />

the table below.<br />

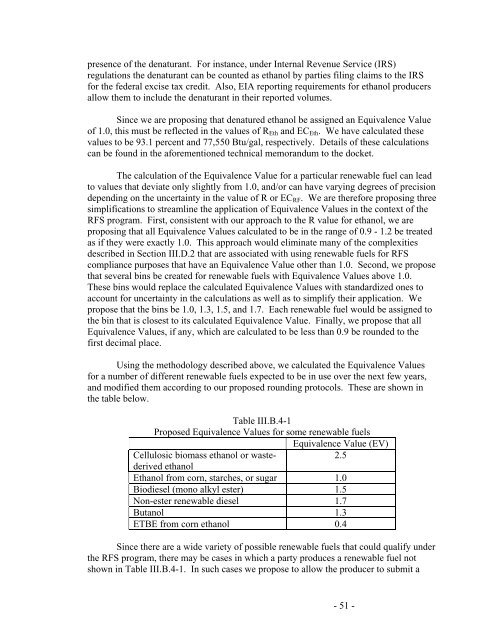

Table III.B.4-1<br />

Proposed Equivalence Values for some renewable fuels<br />

Equivalence Value (EV)<br />

Cellulosic biomass ethanol or waste-<br />

2.5<br />

derived ethanol<br />

Ethanol from corn, starches, or sugar 1.0<br />

Biodiesel (mono alkyl ester) 1.5<br />

Non-ester renewable diesel 1.7<br />

Butanol 1.3<br />

ETBE from corn ethanol 0.4<br />

Since there are a wide variety <strong>of</strong> possible renewable fuels that could qualify under<br />

the RFS program, there may be cases in which a party produces a renewable fuel not<br />

shown in Table III.B.4-1. In such cases we propose to allow the producer to submit a<br />

- 51 -