Included in CFR Manual Only - New York State Office of Mental Health

Included in CFR Manual Only - New York State Office of Mental Health

Included in CFR Manual Only - New York State Office of Mental Health

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

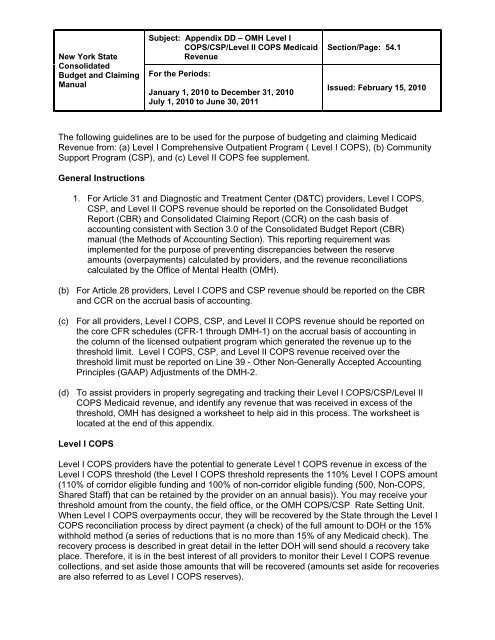

<strong>New</strong> <strong>York</strong> <strong>State</strong><br />

Consolidated<br />

Budget and Claim<strong>in</strong>g<br />

<strong>Manual</strong><br />

Subject: Appendix DD – OMH Level I<br />

COPS/CSP/Level II COPS Medicaid<br />

Revenue<br />

For the Periods:<br />

January 1, 2010 to December 31, 2010<br />

July 1, 2010 to June 30, 2011<br />

Section/Page: 54.1<br />

Issued: February 15, 2010<br />

The follow<strong>in</strong>g guidel<strong>in</strong>es are to be used for the purpose <strong>of</strong> budget<strong>in</strong>g and claim<strong>in</strong>g Medicaid<br />

Revenue from: (a) Level I Comprehensive Outpatient Program ( Level I COPS), (b) Community<br />

Support Program (CSP), and (c) Level II COPS fee supplement.<br />

General Instructions<br />

1. For Article 31 and Diagnostic and Treatment Center (D&TC) providers, Level I COPS,<br />

CSP, and Level II COPS revenue should be reported on the Consolidated Budget<br />

Report (CBR) and Consolidated Claim<strong>in</strong>g Report (CCR) on the cash basis <strong>of</strong><br />

account<strong>in</strong>g consistent with Section 3.0 <strong>of</strong> the Consolidated Budget Report (CBR)<br />

manual (the Methods <strong>of</strong> Account<strong>in</strong>g Section). This report<strong>in</strong>g requirement was<br />

implemented for the purpose <strong>of</strong> prevent<strong>in</strong>g discrepancies between the reserve<br />

amounts (overpayments) calculated by providers, and the revenue reconciliations<br />

calculated by the <strong>Office</strong> <strong>of</strong> <strong>Mental</strong> <strong>Health</strong> (OMH).<br />

(b) For Article 28 providers, Level I COPS and CSP revenue should be reported on the CBR<br />

and CCR on the accrual basis <strong>of</strong> account<strong>in</strong>g.<br />

(c) For all providers, Level I COPS, CSP, and Level II COPS revenue should be reported on<br />

the core <strong>CFR</strong> schedules (<strong>CFR</strong>-1 through DMH-1) on the accrual basis <strong>of</strong> account<strong>in</strong>g <strong>in</strong><br />

the column <strong>of</strong> the licensed outpatient program which generated the revenue up to the<br />

threshold limit. Level I COPS, CSP, and Level II COPS revenue received over the<br />

threshold limit must be reported on L<strong>in</strong>e 39 - Other Non-Generally Accepted Account<strong>in</strong>g<br />

Pr<strong>in</strong>ciples (GAAP) Adjustments <strong>of</strong> the DMH-2.<br />

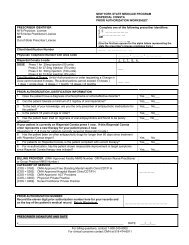

(d) To assist providers <strong>in</strong> properly segregat<strong>in</strong>g and track<strong>in</strong>g their Level I COPS/CSP/Level II<br />

COPS Medicaid revenue, and identify any revenue that was received <strong>in</strong> excess <strong>of</strong> the<br />

threshold, OMH has designed a worksheet to help aid <strong>in</strong> this process. The worksheet is<br />

located at the end <strong>of</strong> this appendix.<br />

Level I COPS<br />

Level I COPS providers have the potential to generate Level ! COPS revenue <strong>in</strong> excess <strong>of</strong> the<br />

Level I COPS threshold (the Level I COPS threshold represents the 110% Level I COPS amount<br />

(110% <strong>of</strong> corridor eligible fund<strong>in</strong>g and 100% <strong>of</strong> non-corridor eligible fund<strong>in</strong>g (500, Non-COPS,<br />

Shared Staff) that can be reta<strong>in</strong>ed by the provider on an annual basis)). You may receive your<br />

threshold amount from the county, the field <strong>of</strong>fice, or the OMH COPS/CSP Rate Sett<strong>in</strong>g Unit.<br />

When Level I COPS overpayments occur, they will be recovered by the <strong>State</strong> through the Level I<br />

COPS reconciliation process by direct payment (a check) <strong>of</strong> the full amount to DOH or the 15%<br />

withhold method (a series <strong>of</strong> reductions that is no more than 15% <strong>of</strong> any Medicaid check). The<br />

recovery process is described <strong>in</strong> great detail <strong>in</strong> the letter DOH will send should a recovery take<br />

place. Therefore, it is <strong>in</strong> the best <strong>in</strong>terest <strong>of</strong> all providers to monitor their Level I COPS revenue<br />

collections, and set aside those amounts that will be recovered (amounts set aside for recoveries<br />

are also referred to as Level I COPS reserves).