Targets IMage Energy Regional (TIMER) Model, Technical ...

Targets IMage Energy Regional (TIMER) Model, Technical ...

Targets IMage Energy Regional (TIMER) Model, Technical ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

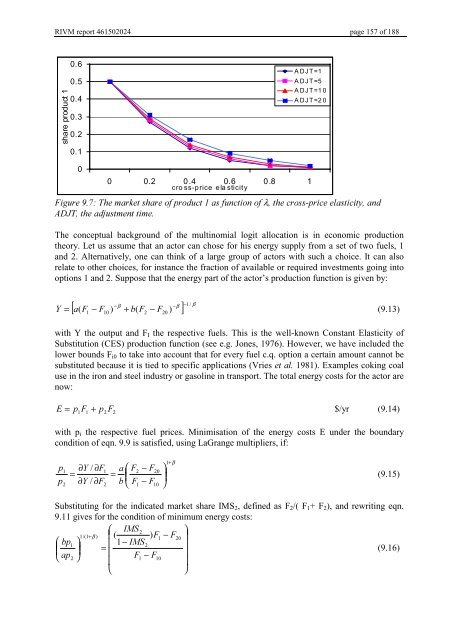

RIVM report 461502024 page 157 of 188<br />

share product 1<br />

0.6<br />

0.5<br />

0.4<br />

0.3<br />

0.2<br />

0.1<br />

ADJT=1<br />

ADJT=5<br />

ADJT=10<br />

ADJT=20<br />

0<br />

0 0.2 0.4 0.6 0.8 1<br />

cross-price elasticity<br />

)LJXUH7KHPDUNHWVKDUHRISURGXFWDVIXQFWLRQRIλWKHFURVVSULFHHODVWLFLW\DQG<br />

$'-7WKHDGMXVWPHQWWLPH<br />

The conceptual background of the multinomial logit allocation is in economic production<br />

theory. Let us assume that an actor can chose for his energy supply from a set of two fuels, 1<br />

and 2. Alternatively, one can think of a large group of actors with such a choice. It can also<br />

relate to other choices, for instance the fraction of available or required investments going into<br />

options 1 and 2. Suppose that the energy part of the actor’s production function is given by:<br />

−<br />

β β<br />

[ ] β − −1<br />

D(<br />

) − ) ) + E(<br />

) −<br />

/<br />

< = )<br />

(9.13)<br />

1 10<br />

2 20<br />

)<br />

with Y the output and F I the respective fuels. This is the well-known Constant Elasticity of<br />

Substitution (CES) production function (see e.g. Jones, 1976). However, we have included the<br />

lower bounds F i0 to take into account that for every fuel c.q. option a certain amount cannot be<br />

substituted because it is tied to specific applications (Vries HWDO 1981). Examples coking coal<br />

use in the iron and steel industry or gasoline in transport. The total energy costs for the actor are<br />

now:<br />

( = S +<br />

$/yr (9.14)<br />

1<br />

)<br />

1<br />

S2)<br />

2<br />

with p i the respective fuel prices. Minimisation of the energy costs E under the boundary<br />

condition of eqn. 9.9 is satisfied, using LaGrange multipliers, if:<br />

S<br />

S<br />

1<br />

2<br />

∂<<br />

/ ∂)<br />

=<br />

∂<<br />

/ ∂)<br />

1<br />

2<br />

=<br />

D ⎛ )<br />

2<br />

− )<br />

⎜<br />

E ⎝ )<br />

1<br />

− )<br />

20<br />

10<br />

⎞<br />

⎟<br />

⎠<br />

1+β<br />

(9.15)<br />

Substituting for the indicated market share IMS 2 , defined as F 2 /( F 1 + F 2 ), and rewriting eqn.<br />

9.11 gives for the condition of minimum energy costs:<br />

⎛ ,062<br />

⎞<br />

1/(1+<br />

β ) ⎜ ( ))<br />

1<br />

− )<br />

20 ⎟<br />

⎛ ES1<br />

⎞ ⎜ 1−<br />

,062<br />

=<br />

⎟<br />

⎜<br />

⎟<br />

(9.16)<br />

⎜<br />

⎝ DS<br />

− ⎟<br />

2 ⎠<br />

)<br />

1<br />

)<br />

10<br />

⎜<br />

⎟<br />

⎝<br />

⎠