Targets IMage Energy Regional (TIMER) Model, Technical ...

Targets IMage Energy Regional (TIMER) Model, Technical ...

Targets IMage Energy Regional (TIMER) Model, Technical ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

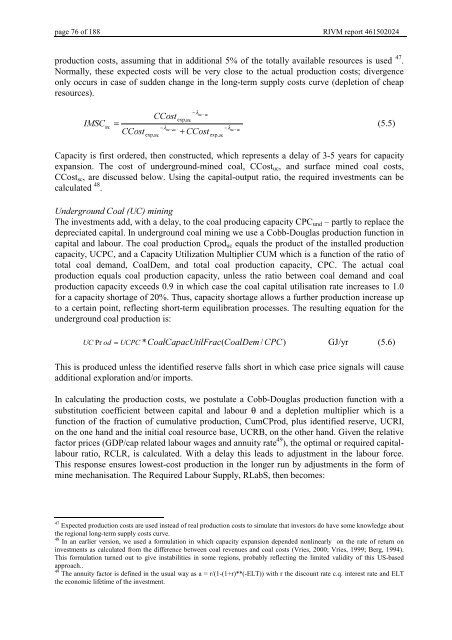

page 76 of 188 RIVM report 461502024<br />

production costs, assuming that in additional 5% of the totally available resources is used 47 .<br />

Normally, these expected costs will be very close to the actual production costs; divergence<br />

only occurs in case of sudden change in the long-term supply costs curve (depletion of cheap<br />

resources).<br />

,06&<br />

XF<br />

= XF<br />

−λXF−<br />

− λ<br />

VF<br />

XF−<br />

VF<br />

&&RVW<br />

exp,<br />

&&RVW<br />

XF<br />

exp,<br />

−λXF−<br />

VF<br />

+ &&RVW<br />

exp,<br />

VF<br />

(5.5)<br />

Capacity is first ordered, then constructed, which represents a delay of 3-5 years for capacity<br />

expansion. The cost of underground-mined coal, CCost uc , and surface mined coal costs,<br />

CCost sc , are discussed below. Using the capital-output ratio, the required investments can be<br />

calculated 48 .<br />

8QGHUJURXQG&RDO8&PLQLQJ<br />

The investments add, with a delay, to the coal producing capacity CPC und – partly to replace the<br />

depreciated capital. In underground coal mining we use a Cobb-Douglas production function in<br />

capital and labour. The coal production Cprod uc equals the product of the installed production<br />

capacity, UCPC, and a Capacity Utilization Multiplier CUM which is a function of the ratio of<br />

total coal demand, CoalDem, and total coal production capacity, CPC. The actual coal<br />

production equals coal production capacity, unless the ratio between coal demand and coal<br />

production capacity exceeds 0.9 in which case the coal capital utilisation rate increases to 1.0<br />

for a capacity shortage of 20%. Thus, capacity shortage allows a further production increase up<br />

to a certain point, reflecting short-term equilibration processes. The resulting equation for the<br />

underground coal production is:<br />

8& Pr RG = 8&3& *&RDO&DSDF8WLO)UDF(&RDO'HP<br />

/ &3&)<br />

GJ/yr (5.6)<br />

This is produced unless the identified reserve falls short in which case price signals will cause<br />

additional exploration and/or imports.<br />

In calculating the production costs, we postulate a Cobb-Douglas production function with a<br />

substitution coefficient between capital and labour θ and a depletion multiplier which is a<br />

function of the fraction of cumulative production, CumCProd, plus identified reserve, UCRI,<br />

on the one hand and the initial coal resource base, UCRB, on the other hand. Given the relative<br />

factor prices (GDP/cap related labour wages and annuity rate 49 ), the optimal or required capitallabour<br />

ratio, RCLR, is calculated. With a delay this leads to adjustment in the labour force.<br />

This response ensures lowest-cost production in the longer run by adjustments in the form of<br />

mine mechanisation. The Required Labour Supply, RLabS, then becomes:<br />

47 Expected production costs are used instead of real production costs to simulate that investors do have some knowledge about<br />

the regional long-term supply costs curve.<br />

48 In an earlier version, we used a formulation in which capacity expansion depended nonlinearly on the rate of return on<br />

investments as calculated from the difference between coal revenues and coal costs (Vries, 2000; Vries, 1999; Berg, 1994).<br />

This formulation turned out to give instabilities in some regions, probably reflecting the limited validity of this US-based<br />

approach..<br />

49 The annuity factor is defined in the usual way as a = r/(1-(1+r)**(-ELT)) with r the discount rate c.q. interest rate and ELT<br />

the economic lifetime of the investment.