Keith Vodden Dr. Douglas Smith - Transports Canada

Keith Vodden Dr. Douglas Smith - Transports Canada

Keith Vodden Dr. Douglas Smith - Transports Canada

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

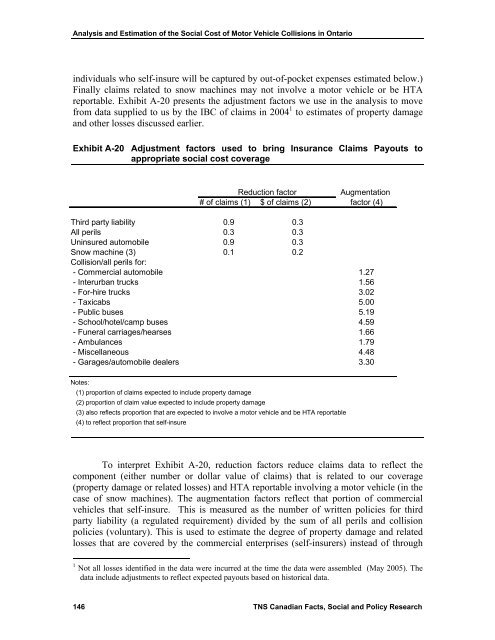

Analysis and Estimation of the Social Cost of Motor Vehicle Collisions in Ontario<br />

individuals who self-insure will be captured by out-of-pocket expenses estimated below.)<br />

Finally claims related to snow machines may not involve a motor vehicle or be HTA<br />

reportable. Exhibit A-20 presents the adjustment factors we use in the analysis to move<br />

from data supplied to us by the IBC of claims in 2004 1 to estimates of property damage<br />

and other losses discussed earlier.<br />

Exhibit A-20 Adjustment factors used to bring Insurance Claims Payouts to<br />

appropriate social cost coverage<br />

Reduction factor<br />

Augmentation<br />

# of claims (1) $ of claims (2) factor (4)<br />

Third party liability 0.9 0.3<br />

All perils 0.3 0.3<br />

Uninsured automobile 0.9 0.3<br />

Snow machine (3) 0.1 0.2<br />

Collision/all perils for:<br />

- Commercial automobile 1.27<br />

- Interurban trucks 1.56<br />

- For-hire trucks 3.02<br />

- Taxicabs 5.00<br />

- Public buses 5.19<br />

- School/hotel/camp buses 4.59<br />

- Funeral carriages/hearses 1.66<br />

- Ambulances 1.79<br />

- Miscellaneous 4.48<br />

- Garages/automobile dealers 3.30<br />

Notes:<br />

(1) proportion of claims expected to include property damage<br />

(2) proportion of claim value expected to include property damage<br />

(3) also reflects proportion that are expected to involve a motor vehicle and be HTA reportable<br />

(4) to reflect proportion that self-insure<br />

To interpret Exhibit A-20, reduction factors reduce claims data to reflect the<br />

component (either number or dollar value of claims) that is related to our coverage<br />

(property damage or related losses) and HTA reportable involving a motor vehicle (in the<br />

case of snow machines). The augmentation factors reflect that portion of commercial<br />

vehicles that self-insure. This is measured as the number of written policies for third<br />

party liability (a regulated requirement) divided by the sum of all perils and collision<br />

policies (voluntary). This is used to estimate the degree of property damage and related<br />

losses that are covered by the commercial enterprises (self-insurers) instead of through<br />

1 Not all losses identified in the data were incurred at the time the data were assembled (May 2005). The<br />

data include adjustments to reflect expected payouts based on historical data.<br />

146 TNS Canadian Facts, Social and Policy Research