Presentation (correction slide 18) - Dexia.com

Presentation (correction slide 18) - Dexia.com

Presentation (correction slide 18) - Dexia.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

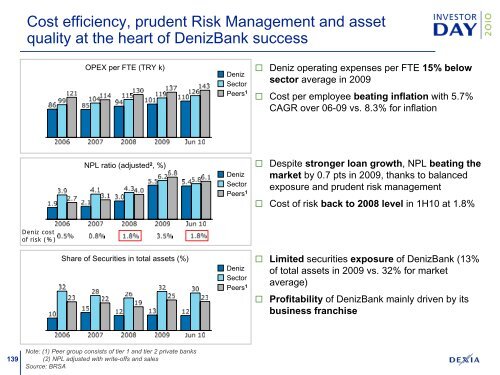

Cost efficiency, prudent Risk Management and asset<br />

quality at the heart of DenizBank success<br />

OPEX per FTE (TRY k)<br />

Deniz<br />

Sector<br />

Peers 1<br />

Deniz operating expenses per FTE 15% below<br />

sector average in 2009<br />

Cost per employee beating inflation with 5.7%<br />

CAGR over 06-09 vs. 8.3% for inflation<br />

NPL ratio (adjusted 2 , %)<br />

Deniz<br />

Sector<br />

Despite stronger loan growth, NPL beating the<br />

market by 0.7 pts in 2009, thanks to balanced<br />

exposure and prudent risk management<br />

Cost of risk back to 2008 level in 1H10 at 1.8%<br />

Peers 1 Limited securities exposure of DenizBank (13%<br />

Deniz cost<br />

of risk (%)<br />

Share of Securities in total assets (%)<br />

Sector<br />

Deniz<br />

Peers 1<br />

of total assets in 2009 vs. 32% for market<br />

average)<br />

Profitability of DenizBank mainly driven by its<br />

business franchise<br />

139<br />

Note: (1) Peer group consists of tier 1 and tier 2 private banks<br />

(2) NPL adjusted with write-offs and sales<br />

Source: BRSA