- Page 2 and 3: Disclaimer This presentation and th

- Page 4 and 5: Dexia 2014: A Retail Group with 10

- Page 6 and 7: Financial restructuring: Scaled dow

- Page 8 and 9: Financial restructuring: Non-commer

- Page 10 and 11: Capturing Retail upside in a fast g

- Page 12 and 13: Dexia teams sharing clear strategic

- Page 14 and 15: Investor Day 2010 - Agenda 11h00 -

- Page 16 and 17: Economic scenario: Slow recovery in

- Page 18 and 19: Dexia 2014: Key drivers of balance

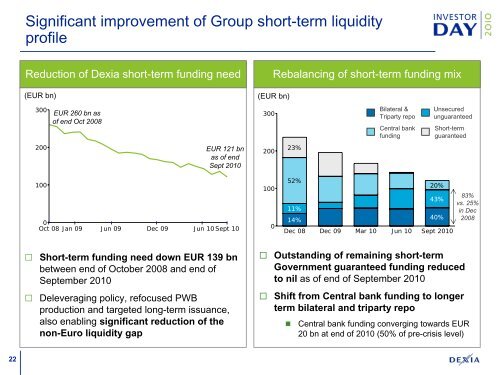

- Page 20 and 21: LT wholesale funding program aligne

- Page 24 and 25: Target 2014: Stringent management o

- Page 26 and 27: Target 2014: Strong rebound of Dexi

- Page 28 and 29: New capital regulations: Basel III

- Page 30 and 31: New liquidity regime: Getting prepa

- Page 32 and 33: Legacy division Deleverage balance

- Page 34 and 35: Sustained pace of asset sales in 20

- Page 36 and 37: Dedicated set up in place to manage

- Page 38 and 39: Bond portfolio in run-off (EUR bn)

- Page 40 and 41: Financial Products portfolio Financ

- Page 42 and 43: After 2014: Ability to hold and man

- Page 44 and 45: Financials: Progressive decrease in

- Page 46 and 47: Public and Wholesale Banking Renew

- Page 48 and 49: PWB 2014: Renew with sustainable sc

- Page 50 and 51: Our ambition: Renew with sustainabl

- Page 52 and 53: Public Banking Belgium 2010: Qualit

- Page 54 and 55: Public Banking Belgium 2010: Contin

- Page 56 and 57: Public Banking France 2010: Quality

- Page 58 and 59: Public Banking France 2010: A recog

- Page 60 and 61: Corporate Banking Belgium 2010: Ree

- Page 62 and 63: Project Finance 2010: A well recogn

- Page 64 and 65: PWB Target 2014: Renew with sustain

- Page 66 and 67: PWB target 2014 Public Banking Bel

- Page 68 and 69: Belgium and Luxembourg: Wealthy and

- Page 70 and 71: Belgium: A concentrated and mature

- Page 72 and 73:

Strong Retail position with full te

- Page 74 and 75:

A resilient and solid franchise thr

- Page 76 and 77:

Our ambition: Unlock growth potenti

- Page 78 and 79:

Commercial targets in network to gr

- Page 80 and 81:

EUR 350 m Capex investment plan lau

- Page 82 and 83:

Roll-out of Open Branch Concept on

- Page 84 and 85:

A new in-branch specialized sales &

- Page 86 and 87:

Branch re-clustering and optimizing

- Page 88 and 89:

Launch of innovative offers to supp

- Page 90 and 91:

Operating efficiency under close sc

- Page 92 and 93:

RCB Luxembourg Consolidate local fr

- Page 94 and 95:

Dexia: A major actor in Luxembourg

- Page 96 and 97:

A domestic and international Privat

- Page 98 and 99:

By 2014: Increase market share in R

- Page 100 and 101:

By 2014: Reinforce Private Banking

- Page 102 and 103:

By 2014: Further improve cost effic

- Page 104 and 105:

RCB Belgium and Luxembourg Enhance

- Page 106 and 107:

Asset Management & Services Manage

- Page 108 and 109:

Asset Management An efficient and r

- Page 110 and 111:

Resilience proven through the crisi

- Page 112 and 113:

A client-centric business model, ad

- Page 114 and 115:

Dexia AM Target 2014: Deliver furth

- Page 116 and 117:

DIS: A key insurance player with a

- Page 118 and 119:

Going forward, Dexia Insurance to d

- Page 120 and 121:

DVV: Investment plan to develop tie

- Page 122 and 123:

Investor Services A well recognized

- Page 124 and 125:

Recent industry trends creating bot

- Page 126 and 127:

RBC Dexia Investor Services is well

- Page 128 and 129:

Investor Services Target 2014: Deli

- Page 130 and 131:

In a nutshell: DenizBank, a sustain

- Page 132 and 133:

Several socio-economic indicators c

- Page 134 and 135:

Current level of banking penetratio

- Page 136 and 137:

DenizBank, the most influential pro

- Page 138 and 139:

DenizBank growth outperformed the m

- Page 140 and 141:

Accelerated branch opening over the

- Page 142 and 143:

Strong Commercial and Corporate seg

- Page 144 and 145:

Deniz 2014: Be the first alternativ

- Page 146 and 147:

Network: DenizBank to open 300+ new

- Page 148 and 149:

SME & Agricultural Banking: DenizBa

- Page 150 and 151:

Overall: Increased weight of Retail

- Page 152 and 153:

Operating model Reach operational e

- Page 154 and 155:

Reaching operational excellence fac

- Page 156 and 157:

Efficiency measures 2008-2011: Capt

- Page 158 and 159:

Industrialisation 2008-2011: Manage

- Page 160 and 161:

Examples of intra-group efficiency

- Page 162 and 163:

Close monitoring system in place St

- Page 164 and 165:

Dexia Group Dexia 2014: A Retail Gr

- Page 166 and 167:

166

- Page 168 and 169:

Philippe Rucheton Philippe Rucheton

- Page 170 and 171:

Stefaan Decraene The first part of

- Page 172:

André Vanden Camp André Vanden Ca