Presentation (correction slide 18) - Dexia.com

Presentation (correction slide 18) - Dexia.com

Presentation (correction slide 18) - Dexia.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial Products portfolio<br />

Financial Products portfolio<br />

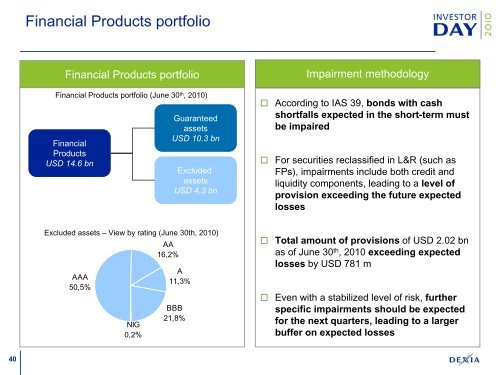

Financial Products portfolio (June 30 th , 2010)<br />

Financial<br />

Products<br />

USD 14.6 bn<br />

Guaranteed<br />

assets<br />

USD 10.3 bn<br />

Excluded<br />

assets<br />

USD 4.3 bn<br />

Impairment methodology<br />

According to IAS 39, bonds with cash<br />

shortfalls expected in the short-term must<br />

be impaired<br />

For securities reclassified in L&R (such as<br />

FPs), impairments include both credit and<br />

liquidity <strong>com</strong>ponents, leading to a level of<br />

provision exceeding the future expected<br />

losses<br />

Excluded assets – View by rating (June 30th, 2010)<br />

AA<br />

16,2%<br />

AAA<br />

50,5%<br />

NIG<br />

0,2%<br />

A<br />

11,3%<br />

BBB<br />

21,8%<br />

Total amount of provisions of USD 2.02 bn<br />

as of June 30 th , 2010 exceeding expected<br />

losses by USD 781 m<br />

Even with a stabilized level of risk, further<br />

specific impairments should be expected<br />

for the next quarters, leading to a larger<br />

buffer on expected losses<br />

40