Presentation (correction slide 18) - Dexia.com

Presentation (correction slide 18) - Dexia.com

Presentation (correction slide 18) - Dexia.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

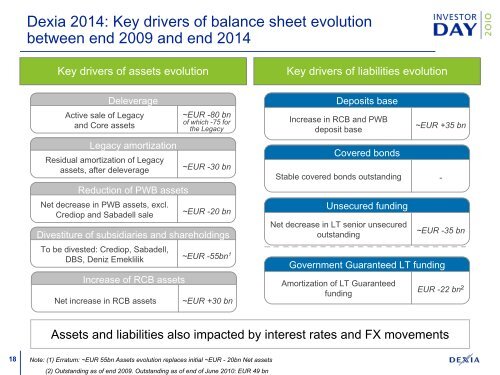

<strong>Dexia</strong> 2014: Key drivers of balance sheet evolution<br />

between end 2009 and end 2014<br />

Key drivers of assets evolution<br />

Key drivers of liabilities evolution<br />

Deleverage<br />

Active sale of Legacy<br />

and Core assets<br />

Legacy amortization<br />

Residual amortization of Legacy<br />

assets, after deleverage<br />

Reduction of PWB assets<br />

Net decrease in PWB assets, excl.<br />

Crediop and Sabadell sale<br />

~EUR -80 bn<br />

of which -75 for<br />

the Legacy<br />

~EUR -30 bn<br />

~EUR -20 bn<br />

Divestiture of subsidiaries and shareholdings<br />

To be divested: Crediop, Sabadell,<br />

DBS, Deniz Emeklilik<br />

Increase of RCB assets<br />

Net increase in RCB assets<br />

~EUR -55bn 1<br />

~EUR +30 bn<br />

Deposits base<br />

Increase in RCB and PWB<br />

deposit base<br />

Covered bonds<br />

Stable covered bonds outstanding<br />

Unsecured funding<br />

Net decrease in LT senior unsecured<br />

outstanding<br />

Government Guaranteed LT funding<br />

Amortization of LT Guaranteed<br />

funding<br />

~EUR +35 bn<br />

-<br />

~EUR -35 bn<br />

EUR -22 bn 2<br />

Assets and liabilities also impacted by interest rates and FX movements<br />

<strong>18</strong><br />

Note: (1) Erratum: ~EUR 55bn Assets evolution replaces initial ~EUR - 20bn Net assets<br />

(2) Outstanding as of end 2009. Outstanding as of end of June 2010: EUR 49 bn