Presentation (correction slide 18) - Dexia.com

Presentation (correction slide 18) - Dexia.com

Presentation (correction slide 18) - Dexia.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

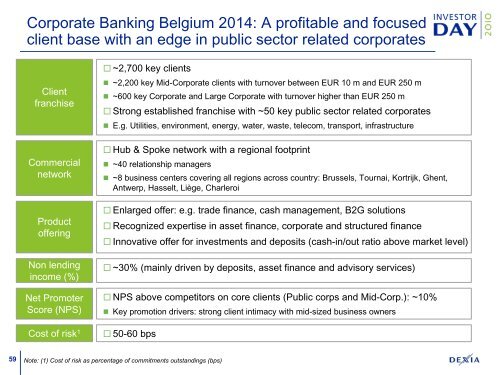

Corporate Banking Belgium 2014: A profitable and focused<br />

client base with an edge in public sector related corporates<br />

Client<br />

franchise<br />

Commercial<br />

network<br />

Product<br />

offering<br />

Non lending<br />

in<strong>com</strong>e (%)<br />

Net Promoter<br />

Score (NPS)<br />

Cost of risk 1<br />

~2,700 key clients<br />

• ~2,200 key Mid-Corporate clients with turnover between EUR 10 m and EUR 250 m<br />

• ~600 key Corporate and Large Corporate with turnover higher than EUR 250 m<br />

Strong established franchise with ~50 key public sector related corporates<br />

• E.g. Utilities, environment, energy, water, waste, tele<strong>com</strong>, transport, infrastructure<br />

Hub & Spoke network with a regional footprint<br />

• ~40 relationship managers<br />

• ~8 business centers covering all regions across country: Brussels, Tournai, Kortrijk, Ghent,<br />

Antwerp, Hasselt, Liège, Charleroi<br />

Enlarged offer: e.g. trade finance, cash management, B2G solutions<br />

Recognized expertise in asset finance, corporate and structured finance<br />

Innovative offer for investments and deposits (cash-in/out ratio above market level)<br />

~30% (mainly driven by deposits, asset finance and advisory services)<br />

NPS above <strong>com</strong>petitors on core clients (Public corps and Mid-Corp.): ~10%<br />

• Key promotion drivers: strong client intimacy with mid-sized business owners<br />

50-60 bps<br />

59<br />

Note: (1) Cost of risk as percentage of <strong>com</strong>mitments outstandings (bps)