Presentation (correction slide 18) - Dexia.com

Presentation (correction slide 18) - Dexia.com

Presentation (correction slide 18) - Dexia.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

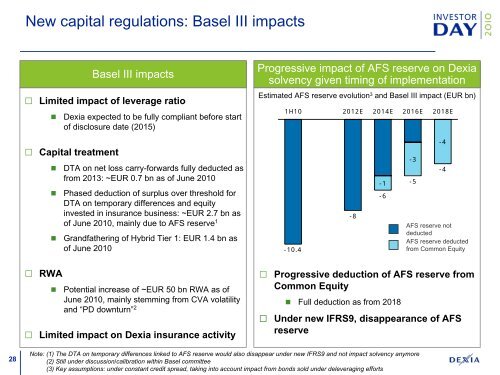

New capital regulations: Basel III impacts<br />

Basel III impacts<br />

Limited impact of leverage ratio<br />

• <strong>Dexia</strong> expected to be fully <strong>com</strong>pliant before start<br />

of disclosure date (2015)<br />

Progressive impact of AFS reserve on <strong>Dexia</strong><br />

solvency given timing of implementation<br />

Estimated AFS reserve evolution 3 and Basel III impact (EUR bn)<br />

1H10 2012E 2014E 2016E 20<strong>18</strong>E<br />

Capital treatment<br />

• DTA on net loss carry-forwards fully deducted as<br />

from 2013: ~EUR 0.7 bn as of June 2010<br />

• Phased deduction of surplus over threshold for<br />

DTA on temporary differences and equity<br />

invested in insurance business: ~EUR 2.7 bn as<br />

of June 2010, mainly due to AFS reserve 1<br />

• Grandfathering of Hybrid Tier 1: EUR 1.4 bn as<br />

of June 2010<br />

-10.4<br />

-8<br />

-1<br />

-6<br />

-3<br />

-5<br />

-4<br />

-4<br />

AFS reserve not<br />

deducted<br />

AFS reserve deducted<br />

from Common Equity<br />

RWA<br />

• Potential increase of ~EUR 50 bn RWA as of<br />

June 2010, mainly stemming from CVA volatility<br />

and “PD downturn” 2<br />

Limited impact on <strong>Dexia</strong> insurance activity<br />

Progressive deduction of AFS reserve from<br />

Common Equity<br />

• Full deduction as from 20<strong>18</strong><br />

Under new IFRS9, disappearance of AFS<br />

reserve<br />

28<br />

Note: (1) The DTA on temporary differences linked to AFS reserve would also disappear under new IFRS9 and not impact solvency anymore<br />

(2) Still under discussion/calibration within Basel <strong>com</strong>mittee<br />

(3) Key assumptions: under constant credit spread, taking into account impact from bonds sold under deleveraging efforts