Full Report - Subregional Office for East and North-East Asia - escap

Full Report - Subregional Office for East and North-East Asia - escap

Full Report - Subregional Office for East and North-East Asia - escap

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE STATE OF INCLUSIVE AND SUSTAINABLE DEVELOPMENT IN UNCERTAIN TIMES CHAPTER 1<br />

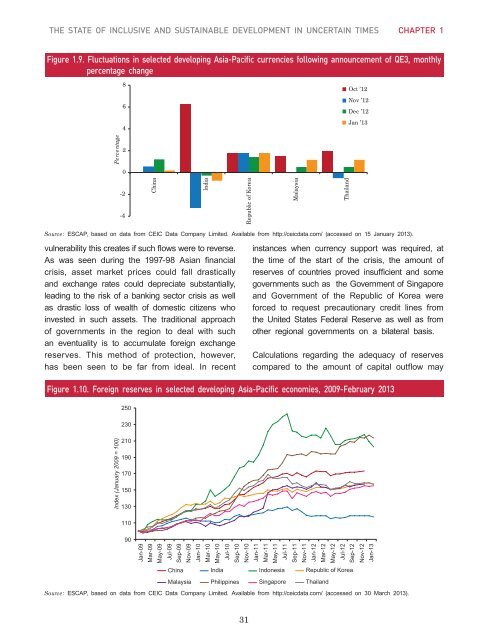

Figure 1.9. Fluctuations in selected developing <strong>Asia</strong>-Pacific currencies following announcement of QE3, monthly<br />

percentage change<br />

8<br />

6<br />

4<br />

Oct ’12<br />

Nov ’12<br />

Dec ’12<br />

Jan ’13<br />

Percentage<br />

2<br />

0<br />

-2<br />

-4<br />

China<br />

India<br />

Republic of Korea<br />

Malaysia<br />

Thail<strong>and</strong><br />

Source: ESCAP, based on data from CEIC Data Company Limited. Available from http://ceicdata.com/ (accessed on 15 January 2013).<br />

vulnerability this creates if such flows were to reverse.<br />

As was seen during the 1997-98 <strong>Asia</strong>n financial<br />

crisis, asset market prices could fall drastically<br />

<strong>and</strong> exchange rates could depreciate substantially,<br />

leading to the risk of a banking sector crisis as well<br />

as drastic loss of wealth of domestic citizens who<br />

invested in such assets. The traditional approach<br />

of governments in the region to deal with such<br />

an eventuality is to accumulate <strong>for</strong>eign exchange<br />

reserves. This method of protection, however,<br />

has been seen to be far from ideal. In recent<br />

instances when currency support was required, at<br />

the time of the start of the crisis, the amount of<br />

reserves of countries proved insufficient <strong>and</strong> some<br />

governments such as the Government of Singapore<br />

<strong>and</strong> Government of the Republic of Korea were<br />

<strong>for</strong>ced to request precautionary credit lines from<br />

the United States Federal Reserve as well as from<br />

other regional governments on a bilateral basis.<br />

Calculations regarding the adequacy of reserves<br />

compared to the amount of capital outflow may<br />

Figure 1.10. Foreign reserves in selected developing <strong>Asia</strong>-Pacific economies, 2009-February 2013<br />

250<br />

230<br />

Index (January 2009 = 100)<br />

210<br />

190<br />

170<br />

150<br />

130<br />

110<br />

90<br />

Jan-09<br />

Mar-09<br />

May-09<br />

Jul-09<br />

Sep-09<br />

Nov-09<br />

Jan-10<br />

Mar-10<br />

May-10<br />

Jul-10<br />

Sep-10<br />

Nov-10<br />

Jan-11<br />

Mar-11<br />

May-11<br />

Jul-11<br />

Sep-11<br />

Nov-11<br />

Jan-12<br />

Mar-12<br />

May-12<br />

Jul-12<br />

Sep-12<br />

Nov-12<br />

Jan-13<br />

China India Indonesia Republic of Korea<br />

Malaysia Philippines Singapore Thail<strong>and</strong><br />

Source: ESCAP, based on data from CEIC Data Company Limited. Available from http://ceicdata.com/ (accessed on 30 March 2013).<br />

31