PROFITABLE GROWTH FOR ALL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

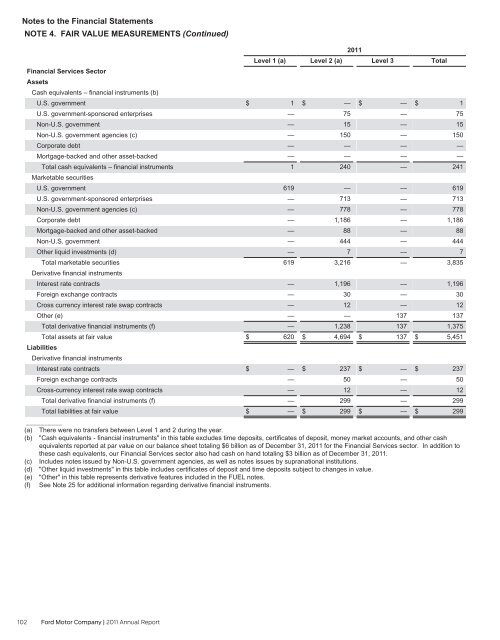

Notes to the Financial Statements<br />

NOTE 4. FAIR VALUE MEASUREMENTS (Continued)<br />

2011<br />

Level 1 (a) Level 2 (a) Level 3<br />

Total<br />

Financial Services Sector<br />

Assets<br />

Cash equivalents – financial instruments (b)<br />

U.S. government<br />

U.S. government-sponsored enterprises<br />

Non-U.S. government<br />

Non-U.S. government agencies (c)<br />

Corporate debt<br />

Mortgage-backed and other asset-backed<br />

Total cash equivalents – financial instruments<br />

Marketable securities<br />

U.S. government<br />

U.S. government-sponsored enterprises<br />

Non-U.S. government agencies (c)<br />

Corporate debt<br />

Mortgage-backed and other asset-backed<br />

Non-U.S. government<br />

Other liquid investments (d)<br />

Total marketable securities<br />

Derivative financial instruments<br />

Interest rate contracts<br />

Foreign exchange contracts<br />

Cross currency interest rate swap contracts<br />

Other (e)<br />

Total derivative financial instruments (f)<br />

$ 1<br />

—<br />

—<br />

—<br />

—<br />

—<br />

1<br />

619<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

619<br />

—<br />

—<br />

—<br />

—<br />

—<br />

$ —<br />

75<br />

15<br />

150<br />

—<br />

—<br />

240<br />

—<br />

713<br />

778<br />

1,186<br />

88<br />

444<br />

7<br />

3,216<br />

1,196<br />

30<br />

12<br />

—<br />

1,238<br />

$ —<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

—<br />

137<br />

137<br />

$ 1<br />

75<br />

15<br />

150<br />

—<br />

—<br />

241<br />

619<br />

713<br />

778<br />

1,186<br />

88<br />

444<br />

7<br />

3,835<br />

1,196<br />

30<br />

12<br />

137<br />

1,375<br />

Total assets at fair value<br />

$ 620 $ 4,694 $ 137 $ 5,451<br />

Liabilities<br />

Derivative financial instruments<br />

Interest rate contracts<br />

Foreign exchange contracts<br />

Cross-currency interest rate swap contracts<br />

Total derivative financial instruments (f)<br />

$ —<br />

—<br />

—<br />

—<br />

$ 237<br />

50<br />

12<br />

299<br />

$ —<br />

—<br />

—<br />

—<br />

$ 237<br />

50<br />

12<br />

299<br />

Total liabilities at fair value<br />

$ — $ 299 $ — $ 299<br />

__________<br />

(a) There were no transfers between Level 1 and 2 during the year.<br />

(b) "Cash equivalents - financial instruments" in this table excludes time deposits, certificates of deposit, money market accounts, and other cash<br />

equivalents reported at par value on our balance sheet totaling $6 billion as of December 31, 2011 for the Financial Services sector. In addition to<br />

these cash equivalents, our Financial Services sector also had cash on hand totaling $3 billion as of December 31, 2011.<br />

(c) Includes notes issued by Non-U.S. government agencies, as well as notes issues by supranational institutions.<br />

(d) "Other liquid investments" in this table includes certificates of deposit and time deposits subject to changes in value.<br />

(e) "Other" in this table represents derivative features included in the FUEL notes.<br />

(f) See Note 25 for additional information regarding derivative financial instruments.<br />

102 Ford Motor Company | 2011 Annual Report