PROFITABLE GROWTH FOR ALL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements<br />

NOTE 23. HELD-<strong>FOR</strong>-SALE OPERATIONS, DISPOSITIONS, AND ACQUISITIONS (Continued)<br />

On October 1, 2011, we contributed our wholly-owned operations in Russia, consisting primarily of a manufacturing<br />

plant near St. Petersburg and access to our Russian dealership network to the joint venture. Additionally, we entered into<br />

an agreement with FordSollers for the granting of an exclusive right to manufacture, assemble, and distribute certain<br />

Ford-brand vehicles in Russia through the licensing of certain trademarks and intellectual property rights. Sollers<br />

contributed two production facilities. The joint venture will be engaged in the manufacturing and distribution of a range of<br />

Ford passenger cars and light commercial vehicles in Russia. As part of our ongoing relationship with FordSollers, we will<br />

supply parts and other vehicle components to the joint venture and receive a royalty of five percent of the joint venture's<br />

net sales revenue.<br />

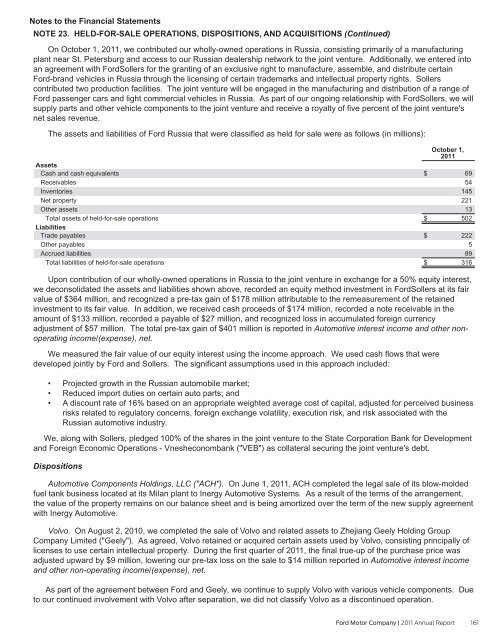

The assets and liabilities of Ford Russia that were classified as held for sale were as follows (in millions):<br />

Assets<br />

Cash and cash equivalents<br />

Receivables<br />

Inventories<br />

Net property<br />

Other assets<br />

Total assets of held-for-sale operations<br />

Liabilities<br />

Trade payables<br />

Other payables<br />

Accrued liabilities<br />

Total liabilities of held-for-sale operations<br />

October 1,<br />

2011<br />

$ 69<br />

54<br />

145<br />

221<br />

13<br />

$ 502<br />

$ 222<br />

5<br />

89<br />

$ 316<br />

Upon contribution of our wholly-owned operations in Russia to the joint venture in exchange for a 50% equity interest,<br />

we deconsolidated the assets and liabilities shown above, recorded an equity method investment in FordSollers at its fair<br />

value of $364 million, and recognized a pre-tax gain of $178 million attributable to the remeasurement of the retained<br />

investment to its fair value. In addition, we received cash proceeds of $174 million, recorded a note receivable in the<br />

amount of $133 million, recorded a payable of $27 million, and recognized loss in accumulated foreign currency<br />

adjustment of $57 million. The total pre-tax gain of $401 million is reported in Automotive interest income and other nonoperating<br />

income/(expense), net.<br />

We measured the fair value of our equity interest using the income approach. We used cash flows that were<br />

developed jointly by Ford and Sollers. The significant assumptions used in this approach included:<br />

• Projected growth in the Russian automobile market;<br />

• Reduced import duties on certain auto parts; and<br />

• A discount rate of 16% based on an appropriate weighted average cost of capital, adjusted for perceived business<br />

risks related to regulatory concerns, foreign exchange volatility, execution risk, and risk associated with the<br />

Russian automotive industry.<br />

We, along with Sollers, pledged 100% of the shares in the joint venture to the State Corporation Bank for Development<br />

and Foreign Economic Operations - Vnesheconombank ("VEB") as collateral securing the joint venture's debt.<br />

Dispositions<br />

Automotive Components Holdings, LLC ("ACH"). On June 1, 2011, ACH completed the legal sale of its blow-molded<br />

fuel tank business located at its Milan plant to Inergy Automotive Systems. As a result of the terms of the arrangement,<br />

the value of the property remains on our balance sheet and is being amortized over the term of the new supply agreement<br />

with Inergy Automotive.<br />

Volvo. On August 2, 2010, we completed the sale of Volvo and related assets to Zhejiang Geely Holding Group<br />

Company Limited ("Geely"). As agreed, Volvo retained or acquired certain assets used by Volvo, consisting principally of<br />

licenses to use certain intellectual property. During the first quarter of 2011, the final true-up of the purchase price was<br />

adjusted upward by $9 million, lowering our pre-tax loss on the sale to $14 million reported in Automotive interest income<br />

and other non-operating income/(expense), net.<br />

As part of the agreement between Ford and Geely, we continue to supply Volvo with various vehicle components. Due<br />

to our continued involvement with Volvo after separation, we did not classify Volvo as a discontinued operation.<br />

Ford Motor Company | 2011 Annual Report 161