PROFITABLE GROWTH FOR ALL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements<br />

NOTE 17. RETIREMENT BENEFITS (Continued)<br />

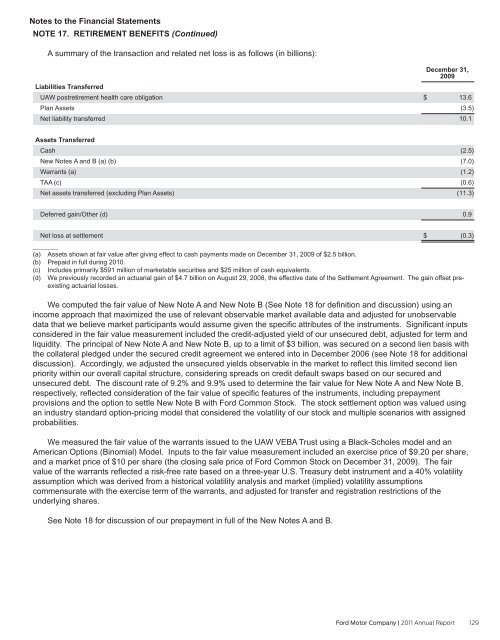

A summary of the transaction and related net loss is as follows (in billions):<br />

Liabilities Transferred<br />

UAW postretirement health care obligation<br />

Plan Assets<br />

Net liability transferred<br />

December 31,<br />

2009<br />

$ 13.6<br />

(3.5)<br />

10.1<br />

Assets Transferred<br />

Cash<br />

New Notes A and B (a) (b)<br />

Warrants (a)<br />

TAA (c)<br />

Net assets transferred (excluding Plan Assets)<br />

(2.5)<br />

(7.0)<br />

(1.2)<br />

(0.6)<br />

(11.3)<br />

Deferred gain/Other (d)<br />

0.9<br />

Net loss at settlement<br />

$ (0.3)<br />

_______<br />

(a) Assets shown at fair value after giving effect to cash payments made on December 31, 2009 of $2.5 billion.<br />

(b) Prepaid in full during 2010.<br />

(c) Includes primarily $591 million of marketable securities and $25 million of cash equivalents.<br />

(d) We previously recorded an actuarial gain of $4.7 billion on August 29, 2008, the effective date of the Settlement Agreement. The gain offset preexisting<br />

actuarial losses.<br />

We computed the fair value of New Note A and New Note B (See Note 18 for definition and discussion) using an<br />

income approach that maximized the use of relevant observable market available data and adjusted for unobservable<br />

data that we believe market participants would assume given the specific attributes of the instruments. Significant inputs<br />

considered in the fair value measurement included the credit-adjusted yield of our unsecured debt, adjusted for term and<br />

liquidity. The principal of New Note A and New Note B, up to a limit of $3 billion, was secured on a second lien basis with<br />

the collateral pledged under the secured credit agreement we entered into in December 2006 (see Note 18 for additional<br />

discussion). Accordingly, we adjusted the unsecured yields observable in the market to reflect this limited second lien<br />

priority within our overall capital structure, considering spreads on credit default swaps based on our secured and<br />

unsecured debt. The discount rate of 9.2% and 9.9% used to determine the fair value for New Note A and New Note B,<br />

respectively, reflected consideration of the fair value of specific features of the instruments, including prepayment<br />

provisions and the option to settle New Note B with Ford Common Stock. The stock settlement option was valued using<br />

an industry standard option-pricing model that considered the volatility of our stock and multiple scenarios with assigned<br />

probabilities.<br />

We measured the fair value of the warrants issued to the UAW VEBA Trust using a Black-Scholes model and an<br />

American Options (Binomial) Model. Inputs to the fair value measurement included an exercise price of $9.20 per share,<br />

and a market price of $10 per share (the closing sale price of Ford Common Stock on December 31, 2009). The fair<br />

value of the warrants reflected a risk-free rate based on a three-year U.S. Treasury debt instrument and a 40% volatility<br />

assumption which was derived from a historical volatility analysis and market (implied) volatility assumptions<br />

commensurate with the exercise term of the warrants, and adjusted for transfer and registration restrictions of the<br />

underlying shares.<br />

See Note 18 for discussion of our prepayment in full of the New Notes A and B.<br />

Ford Motor Company | 2011 Annual Report 129