PROFITABLE GROWTH FOR ALL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements<br />

NOTE 1. PRESENTATION (Continued)<br />

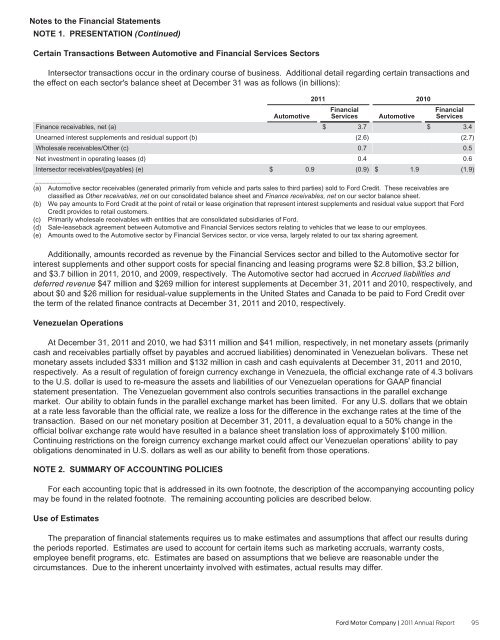

Certain Transactions Between Automotive and Financial Services Sectors<br />

Intersector transactions occur in the ordinary course of business. Additional detail regarding certain transactions and<br />

the effect on each sector's balance sheet at December 31 was as follows (in billions):<br />

Financial<br />

Financial<br />

Automotive Services Automotive Services<br />

Finance receivables, net (a)<br />

Unearned interest supplements and residual support (b)<br />

Wholesale receivables/Other (c)<br />

Net investment in operating leases (d)<br />

$ 3.7<br />

(2.6)<br />

0.7<br />

0.4<br />

$ 3.4<br />

(2.7)<br />

0.5<br />

0.6<br />

Intersector receivables/(payables) (e)<br />

$ 0.9<br />

(0.9) $ 1.9<br />

(1.9)<br />

__________<br />

(a) Automotive sector receivables (generated primarily from vehicle and parts sales to third parties) sold to Ford Credit. These receivables are<br />

classified as Other receivables, net on our consolidated balance sheet and Finance receivables, net on our sector balance sheet.<br />

(b) We pay amounts to Ford Credit at the point of retail or lease origination that represent interest supplements and residual value support that Ford<br />

Credit provides to retail customers.<br />

(c) Primarily wholesale receivables with entities that are consolidated subsidiaries of Ford.<br />

(d) Sale-leaseback agreement between Automotive and Financial Services sectors relating to vehicles that we lease to our employees.<br />

(e) Amounts owed to the Automotive sector by Financial Services sector, or vice versa, largely related to our tax sharing agreement.<br />

Additionally, amounts recorded as revenue by the Financial Services sector and billed to the Automotive sector for<br />

interest supplements and other support costs for special financing and leasing programs were $2.8 billion, $3.2 billion,<br />

and $3.7 billion in 2011, 2010, and 2009, respectively. The Automotive sector had accrued in Accrued liabilities and<br />

deferred revenue $47 million and $269 million for interest supplements at December 31, 2011 and 2010, respectively, and<br />

about $0 and $26 million for residual-value supplements in the United States and Canada to be paid to Ford Credit over<br />

the term of the related finance contracts at December 31, 2011 and 2010, respectively.<br />

Venezuelan Operations<br />

At December 31, 2011 and 2010, we had $311 million and $41 million, respectively, in net monetary assets (primarily<br />

cash and receivables partially offset by payables and accrued liabilities) denominated in Venezuelan bolivars. These net<br />

monetary assets included $331 million and $132 million in cash and cash equivalents at December 31, 2011 and 2010,<br />

respectively. As a result of regulation of foreign currency exchange in Venezuela, the official exchange rate of 4.3 bolivars<br />

to the U.S. dollar is used to re-measure the assets and liabilities of our Venezuelan operations for GAAP financial<br />

statement presentation. The Venezuelan government also controls securities transactions in the parallel exchange<br />

market. Our ability to obtain funds in the parallel exchange market has been limited. For any U.S. dollars that we obtain<br />

at a rate less favorable than the official rate, we realize a loss for the difference in the exchange rates at the time of the<br />

transaction. Based on our net monetary position at December 31, 2011, a devaluation equal to a 50% change in the<br />

official bolivar exchange rate would have resulted in a balance sheet translation loss of approximately $100 million.<br />

Continuing restrictions on the foreign currency exchange market could affect our Venezuelan operations' ability to pay<br />

obligations denominated in U.S. dollars as well as our ability to benefit from those operations.<br />

NOTE 2. SUMMARY OF ACCOUNTING POLICIES<br />

For each accounting topic that is addressed in its own footnote, the description of the accompanying accounting policy<br />

may be found in the related footnote. The remaining accounting policies are described below.<br />

Use of Estimates<br />

The preparation of financial statements requires us to make estimates and assumptions that affect our results during<br />

the periods reported. Estimates are used to account for certain items such as marketing accruals, warranty costs,<br />

employee benefit programs, etc. Estimates are based on assumptions that we believe are reasonable under the<br />

circumstances. Due to the inherent uncertainty involved with estimates, actual results may differ.<br />

2011<br />

2010<br />

Ford Motor Company | 2011 Annual Report 95