PROFITABLE GROWTH FOR ALL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management’s Discussion and Analysis of Financial Condition and Results of Operations<br />

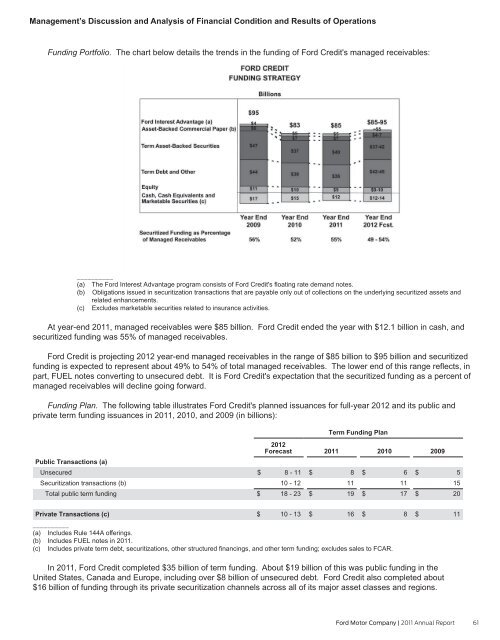

Funding Portfolio. The chart below details the trends in the funding of Ford Credit's managed receivables:<br />

__________<br />

(a) The Ford Interest Advantage program consists of Ford Credit's floating rate demand notes.<br />

(b) Obligations issued in securitization transactions that are payable only out of collections on the underlying securitized assets and<br />

related enhancements.<br />

(c) Excludes marketable securities related to insurance activities.<br />

At year-end 2011, managed receivables were $85 billion. Ford Credit ended the year with $12.1 billion in cash, and<br />

securitized funding was 55% of managed receivables.<br />

Ford Credit is projecting 2012 year-end managed receivables in the range of $85 billion to $95 billion and securitized<br />

funding is expected to represent about 49% to 54% of total managed receivables. The lower end of this range reflects, in<br />

part, FUEL notes converting to unsecured debt. It is Ford Credit's expectation that the securitized funding as a percent of<br />

managed receivables will decline going forward.<br />

Funding Plan. The following table illustrates Ford Credit's planned issuances for full-year 2012 and its public and<br />

private term funding issuances in 2011, 2010, and 2009 (in billions):<br />

Term Funding Plan<br />

Public Transactions (a)<br />

Unsecured<br />

Securitization transactions (b)<br />

Total public term funding<br />

2012<br />

Forecast<br />

$ 8 - 11<br />

10 - 12<br />

$ 18 - 23<br />

2011<br />

$ 8<br />

11<br />

$ 19<br />

2010<br />

$ 6<br />

11<br />

$ 17<br />

2009<br />

$ 5<br />

15<br />

$ 20<br />

Private Transactions (c)<br />

$ 10 - 13 $ 16 $ 8<br />

__________<br />

(a) Includes Rule 144A offerings.<br />

(b) Includes FUEL notes in 2011.<br />

(c) Includes private term debt, securitizations, other structured financings, and other term funding; excludes sales to FCAR.<br />

$ 11<br />

In 2011, Ford Credit completed $35 billion of term funding. About $19 billion of this was public funding in the<br />

United States, Canada and Europe, including over $8 billion of unsecured debt. Ford Credit also completed about<br />

$16 billion of funding through its private securitization channels across all of its major asset classes and regions.<br />

Ford Motor Company | 2011 Annual Report 61