PROFITABLE GROWTH FOR ALL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management’s Discussion and Analysis of Financial Condition and Results of Operations<br />

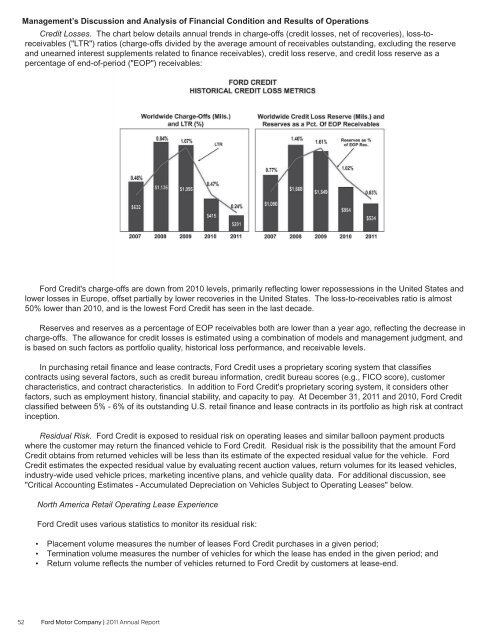

Credit Losses. The chart below details annual trends in charge-offs (credit losses, net of recoveries), loss-toreceivables<br />

("LTR") ratios (charge-offs divided by the average amount of receivables outstanding, excluding the reserve<br />

and unearned interest supplements related to finance receivables), credit loss reserve, and credit loss reserve as a<br />

percentage of end-of-period ("EOP") receivables:<br />

Ford Credit's charge-offs are down from 2010 levels, primarily reflecting lower repossessions in the United States and<br />

lower losses in Europe, offset partially by lower recoveries in the United States. The loss-to-receivables ratio is almost<br />

50% lower than 2010, and is the lowest Ford Credit has seen in the last decade.<br />

Reserves and reserves as a percentage of EOP receivables both are lower than a year ago, reflecting the decrease in<br />

charge-offs. The allowance for credit losses is estimated using a combination of models and management judgment, and<br />

is based on such factors as portfolio quality, historical loss performance, and receivable levels.<br />

In purchasing retail finance and lease contracts, Ford Credit uses a proprietary scoring system that classifies<br />

contracts using several factors, such as credit bureau information, credit bureau scores (e.g., FICO score), customer<br />

characteristics, and contract characteristics. In addition to Ford Credit's proprietary scoring system, it considers other<br />

factors, such as employment history, financial stability, and capacity to pay. At December 31, 2011 and 2010, Ford Credit<br />

classified between 5% - 6% of its outstanding U.S. retail finance and lease contracts in its portfolio as high risk at contract<br />

inception.<br />

Residual Risk. Ford Credit is exposed to residual risk on operating leases and similar balloon payment products<br />

where the customer may return the financed vehicle to Ford Credit. Residual risk is the possibility that the amount Ford<br />

Credit obtains from returned vehicles will be less than its estimate of the expected residual value for the vehicle. Ford<br />

Credit estimates the expected residual value by evaluating recent auction values, return volumes for its leased vehicles,<br />

industry-wide used vehicle prices, marketing incentive plans, and vehicle quality data. For additional discussion, see<br />

"Critical Accounting Estimates - Accumulated Depreciation on Vehicles Subject to Operating Leases" below.<br />

North America Retail Operating Lease Experience<br />

Ford Credit uses various statistics to monitor its residual risk:<br />

• Placement volume measures the number of leases Ford Credit purchases in a given period;<br />

• Termination volume measures the number of vehicles for which the lease has ended in the given period; and<br />

• Return volume reflects the number of vehicles returned to Ford Credit by customers at lease-end.<br />

52 Ford Motor Company | 2011 Annual Report