PROFITABLE GROWTH FOR ALL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

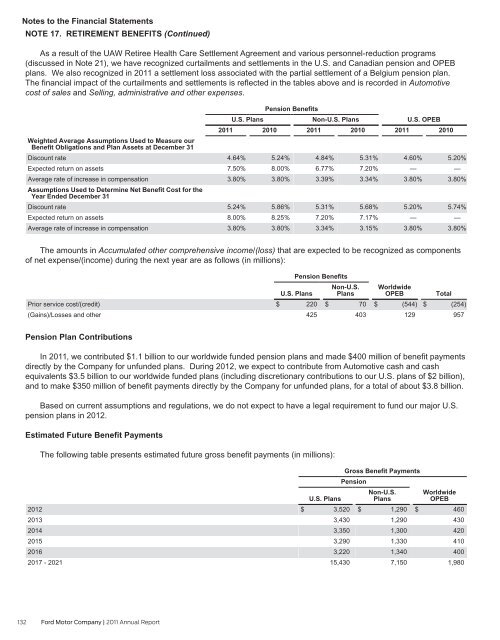

Notes to the Financial Statements<br />

NOTE 17. RETIREMENT BENEFITS (Continued)<br />

As a result of the UAW Retiree Health Care Settlement Agreement and various personnel-reduction programs<br />

(discussed in Note 21), we have recognized curtailments and settlements in the U.S. and Canadian pension and OPEB<br />

plans. We also recognized in 2011 a settlement loss associated with the partial settlement of a Belgium pension plan.<br />

The financial impact of the curtailments and settlements is reflected in the tables above and is recorded in Automotive<br />

cost of sales and Selling, administrative and other expenses.<br />

Weighted Average Assumptions Used to Measure our<br />

Benefit Obligations and Plan Assets at December 31<br />

Discount rate<br />

Expected return on assets<br />

Average rate of increase in compensation<br />

Assumptions Used to Determine Net Benefit Cost for the<br />

Year Ended December 31<br />

Discount rate<br />

Expected return on assets<br />

Average rate of increase in compensation<br />

Pension Benefits<br />

U.S. Plans<br />

Non-U.S. Plans<br />

2011<br />

4.64%<br />

7.50%<br />

3.80%<br />

5.24%<br />

8.00%<br />

3.80%<br />

2010<br />

5.24%<br />

8.00%<br />

3.80%<br />

5.86%<br />

8.25%<br />

3.80%<br />

2011<br />

4.84%<br />

6.77%<br />

3.39%<br />

5.31%<br />

7.20%<br />

3.34%<br />

2010<br />

5.31%<br />

7.20%<br />

3.34%<br />

5.68%<br />

7.17%<br />

3.15%<br />

U.S. OPEB<br />

2011 2010<br />

4.60% 5.20%<br />

—<br />

—<br />

3.80% 3.80%<br />

5.20% 5.74%<br />

—<br />

—<br />

3.80% 3.80%<br />

The amounts in Accumulated other comprehensive income/(loss) that are expected to be recognized as components<br />

of net expense/(income) during the next year are as follows (in millions):<br />

Pension Benefits<br />

Prior service cost/(credit)<br />

(Gains)/Losses and other<br />

U.S. Plans<br />

$ 220<br />

425<br />

Non-U.S.<br />

Plans<br />

$ 70<br />

403<br />

Worldwide<br />

OPEB<br />

$ (544)<br />

129<br />

Total<br />

$ (254)<br />

957<br />

Pension Plan Contributions<br />

In 2011, we contributed $1.1 billion to our worldwide funded pension plans and made $400 million of benefit payments<br />

directly by the Company for unfunded plans. During 2012, we expect to contribute from Automotive cash and cash<br />

equivalents $3.5 billion to our worldwide funded plans (including discretionary contributions to our U.S. plans of $2 billion),<br />

and to make $350 million of benefit payments directly by the Company for unfunded plans, for a total of about $3.8 billion.<br />

Based on current assumptions and regulations, we do not expect to have a legal requirement to fund our major U.S.<br />

pension plans in 2012.<br />

Estimated Future Benefit Payments<br />

The following table presents estimated future gross benefit payments (in millions):<br />

2012<br />

2013<br />

2014<br />

2015<br />

2016<br />

2017 - 2021<br />

U.S. Plans<br />

$ 3,520<br />

3,430<br />

3,350<br />

3,290<br />

3,220<br />

15,430<br />

Gross Benefit Payments<br />

Pension<br />

Non-U.S.<br />

Plans<br />

$ 1,290<br />

1,290<br />

1,300<br />

1,330<br />

1,340<br />

7,150<br />

Worldwide<br />

OPEB<br />

$ 460<br />

430<br />

420<br />

410<br />

400<br />

1,980<br />

132 Ford Motor Company | 2011 Annual Report