PROFITABLE GROWTH FOR ALL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management’s Discussion and Analysis of Financial Condition and Results of Operations<br />

trade payables are based primarily on industry-standard production supplier payment terms generally ranging between<br />

30 to 45 days. As a result, our cash flow tends to improve as wholesale volumes increase, but can deteriorate<br />

significantly when wholesale volumes drop sharply. In addition, these working capital balances generally are subject to<br />

seasonal changes that can impact cash flow. For example, we typically experience cash flow timing differences<br />

associated with inventories and payables due to our annual summer and December shutdown periods, when production,<br />

and therefore inventories and wholesale volumes, are usually at their lowest levels, while payables continue to come due<br />

and be paid. The net impact of this typically results in cash outflows from changes in our working capital balances during<br />

these shutdown periods.<br />

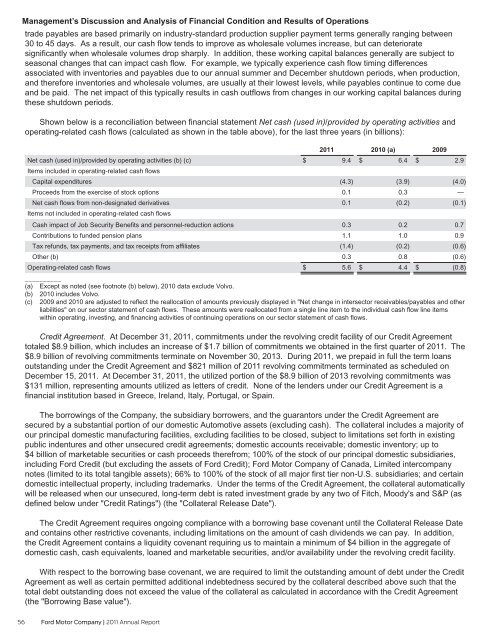

Shown below is a reconciliation between financial statement Net cash (used in)/provided by operating activities and<br />

operating-related cash flows (calculated as shown in the table above), for the last three years (in billions):<br />

2011<br />

2010 (a)<br />

2009<br />

Net cash (used in)/provided by operating activities (b) (c)<br />

Items included in operating-related cash flows<br />

Capital expenditures<br />

Proceeds from the exercise of stock options<br />

Net cash flows from non-designated derivatives<br />

Items not included in operating-related cash flows<br />

Cash impact of Job Security Benefits and personnel-reduction actions<br />

Contributions to funded pension plans<br />

Tax refunds, tax payments, and tax receipts from affiliates<br />

Other (b)<br />

$ 9.4<br />

(4.3)<br />

0.1<br />

0.1<br />

0.3<br />

1.1<br />

(1.4)<br />

0.3<br />

$ 6.4<br />

(3.9)<br />

0.3<br />

(0.2)<br />

0.2<br />

1.0<br />

(0.2)<br />

0.8<br />

$ 2.9<br />

(4.0)<br />

—<br />

(0.1)<br />

0.7<br />

0.9<br />

(0.6)<br />

(0.6)<br />

Operating-related cash flows<br />

$ 5.6 $ 4.4 $ (0.8)<br />

__________<br />

(a) Except as noted (see footnote (b) below), 2010 data exclude Volvo.<br />

(b) 2010 includes Volvo.<br />

(c) 2009 and 2010 are adjusted to reflect the reallocation of amounts previously displayed in "Net change in intersector receivables/payables and other<br />

liabilities" on our sector statement of cash flows. These amounts were reallocated from a single line item to the individual cash flow line items<br />

within operating, investing, and financing activities of continuing operations on our sector statement of cash flows.<br />

Credit Agreement. At December 31, 2011, commitments under the revolving credit facility of our Credit Agreement<br />

totaled $8.9 billion, which includes an increase of $1.7 billion of commitments we obtained in the first quarter of 2011. The<br />

$8.9 billion of revolving commitments terminate on November 30, 2013. During 2011, we prepaid in full the term loans<br />

outstanding under the Credit Agreement and $821 million of 2011 revolving commitments terminated as scheduled on<br />

December 15, 2011. At December 31, 2011, the utilized portion of the $8.9 billion of 2013 revolving commitments was<br />

$131 million, representing amounts utilized as letters of credit. None of the lenders under our Credit Agreement is a<br />

financial institution based in Greece, Ireland, Italy, Portugal, or Spain.<br />

The borrowings of the Company, the subsidiary borrowers, and the guarantors under the Credit Agreement are<br />

secured by a substantial portion of our domestic Automotive assets (excluding cash). The collateral includes a majority of<br />

our principal domestic manufacturing facilities, excluding facilities to be closed, subject to limitations set forth in existing<br />

public indentures and other unsecured credit agreements; domestic accounts receivable; domestic inventory; up to<br />

$4 billion of marketable securities or cash proceeds therefrom; 100% of the stock of our principal domestic subsidiaries,<br />

including Ford Credit (but excluding the assets of Ford Credit); Ford Motor Company of Canada, Limited intercompany<br />

notes (limited to its total tangible assets); 66% to 100% of the stock of all major first tier non-U.S. subsidiaries; and certain<br />

domestic intellectual property, including trademarks. Under the terms of the Credit Agreement, the collateral automatically<br />

will be released when our unsecured, long-term debt is rated investment grade by any two of Fitch, Moody's and S&P (as<br />

defined below under "Credit Ratings") (the "Collateral Release Date").<br />

The Credit Agreement requires ongoing compliance with a borrowing base covenant until the Collateral Release Date<br />

and contains other restrictive covenants, including limitations on the amount of cash dividends we can pay. In addition,<br />

the Credit Agreement contains a liquidity covenant requiring us to maintain a minimum of $4 billion in the aggregate of<br />

domestic cash, cash equivalents, loaned and marketable securities, and/or availability under the revolving credit facility.<br />

With respect to the borrowing base covenant, we are required to limit the outstanding amount of debt under the Credit<br />

Agreement as well as certain permitted additional indebtedness secured by the collateral described above such that the<br />

total debt outstanding does not exceed the value of the collateral as calculated in accordance with the Credit Agreement<br />

(the "Borrowing Base value").<br />

56 Ford Motor Company | 2011 Annual Report