PROFITABLE GROWTH FOR ALL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

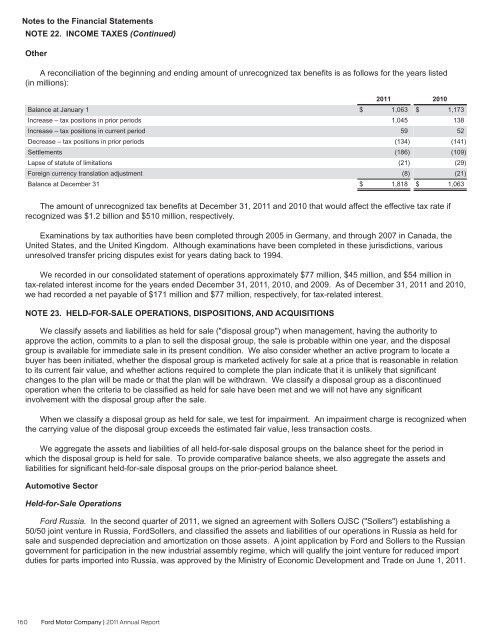

Notes to the Financial Statements<br />

NOTE 22. INCOME TAXES (Continued)<br />

Other<br />

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows for the years listed<br />

(in millions):<br />

Balance at January 1<br />

Increase – tax positions in prior periods<br />

Increase – tax positions in current period<br />

Decrease – tax positions in prior periods<br />

Settlements<br />

Lapse of statute of limitations<br />

Foreign currency translation adjustment<br />

Balance at December 31<br />

2011<br />

$ 1,063<br />

1,045<br />

59<br />

(134)<br />

(186)<br />

(21)<br />

(8)<br />

$ 1,818<br />

2010<br />

$ 1,173<br />

138<br />

52<br />

(141)<br />

(109)<br />

(29)<br />

(21)<br />

$ 1,063<br />

The amount of unrecognized tax benefits at December 31, 2011 and 2010 that would affect the effective tax rate if<br />

recognized was $1.2 billion and $510 million, respectively.<br />

Examinations by tax authorities have been completed through 2005 in Germany, and through 2007 in Canada, the<br />

United States, and the United Kingdom. Although examinations have been completed in these jurisdictions, various<br />

unresolved transfer pricing disputes exist for years dating back to 1994.<br />

We recorded in our consolidated statement of operations approximately $77 million, $45 million, and $54 million in<br />

tax-related interest income for the years ended December 31, 2011, 2010, and 2009. As of December 31, 2011 and 2010,<br />

we had recorded a net payable of $171 million and $77 million, respectively, for tax-related interest.<br />

NOTE 23. HELD-<strong>FOR</strong>-SALE OPERATIONS, DISPOSITIONS, AND ACQUISITIONS<br />

We classify assets and liabilities as held for sale ("disposal group") when management, having the authority to<br />

approve the action, commits to a plan to sell the disposal group, the sale is probable within one year, and the disposal<br />

group is available for immediate sale in its present condition. We also consider whether an active program to locate a<br />

buyer has been initiated, whether the disposal group is marketed actively for sale at a price that is reasonable in relation<br />

to its current fair value, and whether actions required to complete the plan indicate that it is unlikely that significant<br />

changes to the plan will be made or that the plan will be withdrawn. We classify a disposal group as a discontinued<br />

operation when the criteria to be classified as held for sale have been met and we will not have any significant<br />

involvement with the disposal group after the sale.<br />

When we classify a disposal group as held for sale, we test for impairment. An impairment charge is recognized when<br />

the carrying value of the disposal group exceeds the estimated fair value, less transaction costs.<br />

We aggregate the assets and liabilities of all held-for-sale disposal groups on the balance sheet for the period in<br />

which the disposal group is held for sale. To provide comparative balance sheets, we also aggregate the assets and<br />

liabilities for significant held-for-sale disposal groups on the prior-period balance sheet.<br />

Automotive Sector<br />

Held-for-Sale Operations<br />

Ford Russia. In the second quarter of 2011, we signed an agreement with Sollers OJSC ("Sollers") establishing a<br />

50/50 joint venture in Russia, FordSollers, and classified the assets and liabilities of our operations in Russia as held for<br />

sale and suspended depreciation and amortization on those assets. A joint application by Ford and Sollers to the Russian<br />

government for participation in the new industrial assembly regime, which will qualify the joint venture for reduced import<br />

duties for parts imported into Russia, was approved by the Ministry of Economic Development and Trade on June 1, 2011.<br />

160 Ford Motor Company | 2011 Annual Report