PROFITABLE GROWTH FOR ALL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management’s Discussion and Analysis of Financial Condition and Results of Operations<br />

Total costs and expenses for our Automotive sector for 2011 and 2010 was $122.4 billion and $113.5 billion,<br />

respectively, a difference of $8.9 billion. An explanation of the change as reconciled to our income statement is shown<br />

below (in billions):<br />

2011<br />

Better/(Worse)<br />

2010<br />

Explanation of change:<br />

Volume and mix, exchange, and other<br />

Contribution costs (a)<br />

Commodity costs (incl. hedging)<br />

Material costs excluding commodity costs<br />

Warranty/Freight<br />

Other costs (a)<br />

Structural costs<br />

Other<br />

Special items (b)<br />

$ (11.4)<br />

(2.3)<br />

(1.2)<br />

(0.7)<br />

(1.4)<br />

0.1<br />

8.0<br />

Total<br />

$ (8.9)<br />

_________<br />

(a) Our key cost change elements are measured primarily at present-year exchange; in addition, costs that vary directly with volume, such as material,<br />

freight and warranty costs, are measured at present-year volume and mix. Excludes special items.<br />

(b) Special items primarily reflect the non-recurrence of Volvo costs and expenses in 2011.<br />

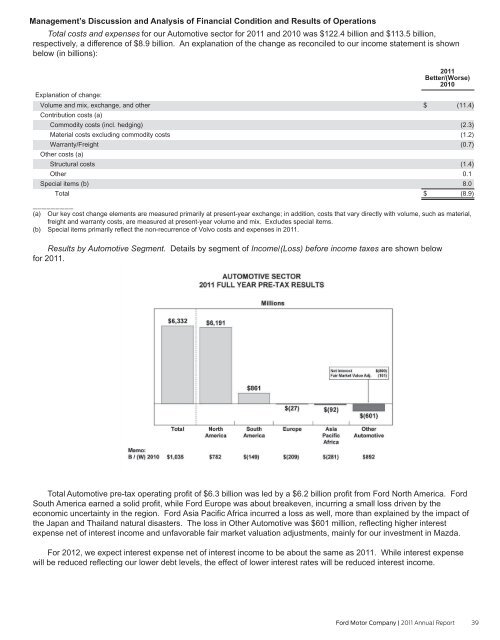

Results by Automotive Segment. Details by segment of Income/(Loss) before income taxes are shown below<br />

for 2011.<br />

Total Automotive pre-tax operating profit of $6.3 billion was led by a $6.2 billion profit from Ford North America. Ford<br />

South America earned a solid profit, while Ford Europe was about breakeven, incurring a small loss driven by the<br />

economic uncertainty in the region. Ford Asia Pacific Africa incurred a loss as well, more than explained by the impact of<br />

the Japan and Thailand natural disasters. The loss in Other Automotive was $601 million, reflecting higher interest<br />

expense net of interest income and unfavorable fair market valuation adjustments, mainly for our investment in Mazda.<br />

For 2012, we expect interest expense net of interest income to be about the same as 2011. While interest expense<br />

will be reduced reflecting our lower debt levels, the effect of lower interest rates will be reduced interest income.<br />

Ford Motor Company | 2011 Annual Report 39