PROFITABLE GROWTH FOR ALL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

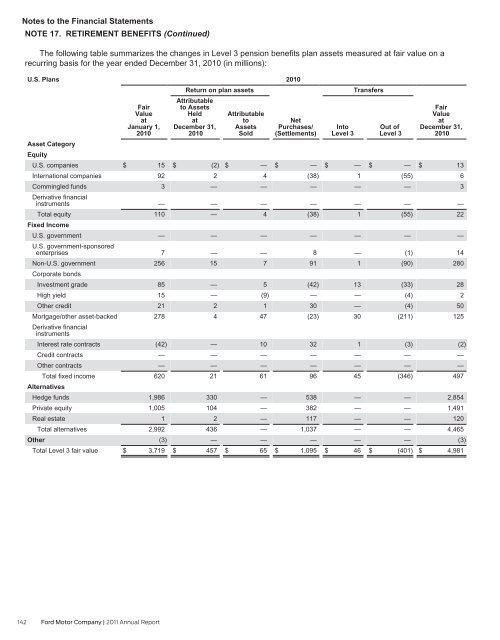

Notes to the Financial Statements<br />

NOTE 17. RETIREMENT BENEFITS (Continued)<br />

The following table summarizes the changes in Level 3 pension benefits plan assets measured at fair value on a<br />

recurring basis for the year ended December 31, 2010 (in millions):<br />

U.S. Plans<br />

Asset Category<br />

Equity<br />

U.S. companies<br />

International companies<br />

Commingled funds<br />

Derivative financial<br />

instruments<br />

Total equity<br />

Fixed Income<br />

U.S. government<br />

U.S. government-sponsored<br />

enterprises<br />

Non-U.S. government<br />

Corporate bonds<br />

Investment grade<br />

High yield<br />

Other credit<br />

Mortgage/other asset-backed<br />

Derivative financial<br />

instruments<br />

Interest rate contracts<br />

Credit contracts<br />

Other contracts<br />

Total fixed income<br />

Alternatives<br />

Hedge funds<br />

Private equity<br />

Real estate<br />

Total alternatives<br />

Other<br />

Total Level 3 fair value<br />

Fair<br />

Value<br />

at<br />

January 1,<br />

2010<br />

$ 15<br />

92<br />

3<br />

—<br />

110<br />

—<br />

7<br />

256<br />

85<br />

15<br />

21<br />

278<br />

(42)<br />

—<br />

—<br />

620<br />

1,986<br />

1,005<br />

1<br />

2,992<br />

(3)<br />

$ 3,719<br />

Return on plan assets<br />

Attributable<br />

to Assets<br />

Held<br />

at<br />

December 31,<br />

2010<br />

$ (2)<br />

2<br />

—<br />

—<br />

—<br />

—<br />

—<br />

15<br />

—<br />

—<br />

2<br />

4<br />

—<br />

—<br />

—<br />

21<br />

330<br />

104<br />

2<br />

436<br />

—<br />

$ 457<br />

Attributable<br />

to<br />

Assets<br />

Sold<br />

$ —<br />

4<br />

—<br />

—<br />

4<br />

—<br />

—<br />

7<br />

5<br />

(9)<br />

1<br />

47<br />

10<br />

—<br />

—<br />

61<br />

—<br />

—<br />

—<br />

—<br />

—<br />

$ 65<br />

2010<br />

Net<br />

Purchases/<br />

(Settlements)<br />

$ —<br />

(38)<br />

—<br />

—<br />

(38)<br />

—<br />

8<br />

91<br />

(42)<br />

—<br />

30<br />

(23)<br />

32<br />

—<br />

—<br />

96<br />

538<br />

382<br />

117<br />

1,037<br />

—<br />

$ 1,095<br />

Into<br />

Level 3<br />

$ —<br />

1<br />

—<br />

Transfers<br />

—<br />

1<br />

—<br />

—<br />

1<br />

13<br />

—<br />

—<br />

30<br />

1<br />

—<br />

—<br />

45<br />

—<br />

—<br />

—<br />

—<br />

—<br />

$ 46<br />

Out of<br />

Level 3<br />

$ —<br />

(55)<br />

—<br />

—<br />

(55)<br />

—<br />

(1)<br />

(90)<br />

(33)<br />

(4)<br />

(4)<br />

(211)<br />

(3)<br />

—<br />

—<br />

(346)<br />

—<br />

—<br />

—<br />

—<br />

—<br />

$ (401)<br />

Fair<br />

Value<br />

at<br />

December 31,<br />

2010<br />

$ 13<br />

6<br />

3<br />

—<br />

22<br />

—<br />

14<br />

280<br />

28<br />

2<br />

50<br />

125<br />

(2)<br />

—<br />

—<br />

497<br />

2,854<br />

1,491<br />

120<br />

4,465<br />

(3)<br />

$ 4,981<br />

142 Ford Motor Company | 2011 Annual Report