PROFITABLE GROWTH FOR ALL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

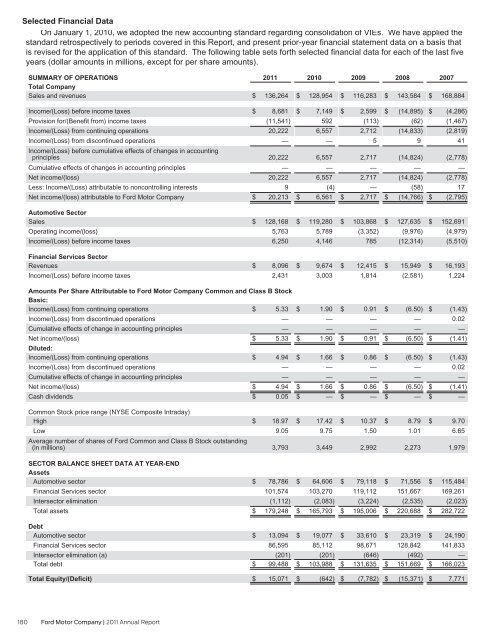

Selected Financial Data<br />

On January 1, 2010, we adopted the new accounting standard regarding consolidation of VIEs. We have applied the<br />

standard retrospectively to periods covered in this Report, and present prior-year financial statement data on a basis that<br />

is revised for the application of this standard. The following table sets forth selected financial data for each of the last five<br />

years (dollar amounts in millions, except for per share amounts).<br />

SUMMARY OF OPERATIONS<br />

Total Company<br />

Sales and revenues<br />

2011<br />

$ 136,264<br />

2010<br />

$ 128,954<br />

2009<br />

$ 116,283<br />

2008<br />

$ 143,584<br />

2007<br />

$ 168,884<br />

Income/(Loss) before income taxes<br />

Provision for/(Benefit from) income taxes<br />

Income/(Loss) from continuing operations<br />

Income/(Loss) from discontinued operations<br />

Income/(Loss) before cumulative effects of changes in accounting<br />

principles<br />

Cumulative effects of changes in accounting principles<br />

Net income/(loss)<br />

Less: Income/(Loss) attributable to noncontrolling interests<br />

Net income/(loss) attributable to Ford Motor Company<br />

$ 8,681<br />

(11,541)<br />

20,222<br />

—<br />

20,222<br />

—<br />

20,222<br />

9<br />

$ 20,213<br />

$ 7,149<br />

592<br />

6,557<br />

—<br />

6,557<br />

—<br />

6,557<br />

(4)<br />

$ 6,561<br />

$ 2,599<br />

(113)<br />

2,712<br />

5<br />

2,717<br />

—<br />

2,717<br />

—<br />

$ 2,717<br />

$ (14,895)<br />

(62)<br />

(14,833)<br />

9<br />

(14,824)<br />

—<br />

(14,824)<br />

(58)<br />

$ (14,766)<br />

$ (4,286)<br />

(1,467)<br />

(2,819)<br />

41<br />

(2,778)<br />

—<br />

(2,778)<br />

17<br />

$ (2,795)<br />

Automotive Sector<br />

Sales<br />

Operating income/(loss)<br />

Income/(Loss) before income taxes<br />

$ 128,168<br />

5,763<br />

6,250<br />

$ 119,280<br />

5,789<br />

4,146<br />

$ 103,868<br />

(3,352)<br />

785<br />

$ 127,635<br />

(9,976)<br />

(12,314)<br />

$ 152,691<br />

(4,979)<br />

(5,510)<br />

Financial Services Sector<br />

Revenues<br />

Income/(Loss) before income taxes<br />

$ 8,096<br />

2,431<br />

$ 9,674<br />

3,003<br />

$ 12,415<br />

1,814<br />

$ 15,949<br />

(2,581)<br />

$ 16,193<br />

1,224<br />

Amounts Per Share Attributable to Ford Motor Company Common and Class B Stock<br />

Basic:<br />

Income/(Loss) from continuing operations<br />

Income/(Loss) from discontinued operations<br />

Cumulative effects of change in accounting principles<br />

Net income/(loss)<br />

Diluted:<br />

Income/(Loss) from continuing operations<br />

Income/(Loss) from discontinued operations<br />

Cumulative effects of change in accounting principles<br />

Net income/(loss)<br />

Cash dividends<br />

$<br />

$<br />

$<br />

$<br />

$<br />

5.33<br />

—<br />

—<br />

5.33<br />

4.94<br />

—<br />

—<br />

4.94<br />

0.05<br />

$ 1.90<br />

—<br />

—<br />

$ 1.90<br />

$ 1.66<br />

—<br />

—<br />

$ 1.66<br />

$ —<br />

$ 0.91<br />

—<br />

—<br />

$ 0.91<br />

$ 0.86<br />

—<br />

—<br />

$ 0.86<br />

$ —<br />

$ (6.50)<br />

—<br />

—<br />

$ (6.50)<br />

$ (6.50)<br />

—<br />

—<br />

$ (6.50)<br />

$ —<br />

$ (1.43)<br />

0.02<br />

—<br />

$ (1.41)<br />

$ (1.43)<br />

0.02<br />

—<br />

$ (1.41)<br />

$ —<br />

Common Stock price range (NYSE Composite Intraday)<br />

High<br />

Low<br />

Average number of shares of Ford Common and Class B Stock outstanding<br />

(in millions)<br />

$ 18.97<br />

9.05<br />

3,793<br />

$ 17.42<br />

9.75<br />

3,449<br />

$ 10.37<br />

1.50<br />

2,992<br />

$ 8.79<br />

1.01<br />

2,273<br />

$ 9.70<br />

6.65<br />

1,979<br />

SECTOR BALANCE SHEET DATA AT YEAR-END<br />

Assets<br />

Automotive sector<br />

Financial Services sector<br />

Intersector elimination<br />

Total assets<br />

$ 78,786<br />

101,574<br />

(1,112)<br />

$ 179,248<br />

$ 64,606<br />

103,270<br />

(2,083)<br />

$ 165,793<br />

$ 79,118<br />

119,112<br />

(3,224)<br />

$ 195,006<br />

$ 71,556<br />

151,667<br />

(2,535)<br />

$ 220,688<br />

$ 115,484<br />

169,261<br />

(2,023)<br />

$ 282,722<br />

Debt<br />

Automotive sector<br />

Financial Services sector<br />

Intersector elimination (a)<br />

Total debt<br />

$ 13,094<br />

86,595<br />

(201)<br />

$ 99,488<br />

$ 19,077<br />

85,112<br />

(201)<br />

$ 103,988<br />

$ 33,610<br />

98,671<br />

(646)<br />

$ 131,635<br />

$ 23,319<br />

128,842<br />

(492)<br />

$ 151,669<br />

$ 24,190<br />

141,833<br />

—<br />

$ 166,023<br />

Total Equity/(Deficit)<br />

$ 15,071<br />

$ (642)<br />

$ (7,782)<br />

$ (15,371)<br />

$ 7,771<br />

180 Ford Motor Company | 2011 Annual Report