PROFITABLE GROWTH FOR ALL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management’s Discussion and Analysis of Financial Condition and Results of Operations<br />

borrowed, based on the principal amortization schedule for that advance, with interest payable quarterly in arrears. The<br />

principal amount of the loans under the Facility is payable in quarterly installments, commencing on September 15, 2012,<br />

through June 15, 2022. Through December 31, 2011, we have received $4.8 billion in loans under the Facility and the<br />

weighted-average interest rate on such loans is about 2.5% per annum. For additional details regarding the Arrangement<br />

Agreement and the Note Purchase Agreement, refer to Exhibits 10.1 and 10.2 filed with the September 2009 Form 8-K<br />

Report.<br />

European Investment Bank ("EIB") Credit Facility. On July 12, 2010, Ford Motor Company Limited, our operating<br />

subsidiary in the United Kingdom ("Ford of Britain"), entered into a credit facility for an aggregate amount of £450 million<br />

with the EIB. Proceeds of loans drawn under the facility are being used for research and development of fuel-efficient<br />

engines and commercial vehicles with lower emissions, and related upgrades to an engine manufacturing plant. The<br />

facility was fully drawn in the third quarter of 2010, and Ford of Britain had outstanding $698 million of loans at<br />

December 31, 2011. The loans are five-year, non-amortizing loans secured by a guarantee from the U.K. government for<br />

80% of the outstanding principal amount and cash collateral from Ford of Britain equal to 20% of the outstanding principal<br />

amount, and bear interest at a fixed rate of approximately 3.6% per annum (excluding a commitment fee of 0.30% to the<br />

U.K. government). Ford of Britain has pledged substantially all of its fixed assets, receivables, and inventory to the<br />

U.K. government as collateral, and we have guaranteed Ford of Britain's obligations to the U.K. government related to the<br />

government's guarantee.<br />

U.S. Ex-Im Bank and Private Export Funding Corporation ("PEFCO") Secured Revolving Loan. On<br />

December 21, 2010, we entered into a credit agreement with PEFCO and Ex-Im Bank. Under the terms of the credit<br />

agreement, PEFCO provided us with a $250 million revolving credit facility and Ex-Im Bank provided a guarantee to<br />

PEFCO for 100% of the outstanding principal amount of the loan, which is secured by our in-transit vehicle inventory to<br />

Canada and Mexico. The facility is used to finance vehicles exported for sale to Canada and Mexico that were<br />

manufactured in our U.S. assembly plants. The facility was fully drawn in the fourth quarter of 2010 and we had<br />

outstanding a $250 million loan at December 31, 2011. The loan matures on March 20, 2012 and bears interest at<br />

LIBOR, at a time period that most closely parallels the advancement term, plus a margin of 1% (excluding a facility fee of<br />

1.6%), with interest payable monthly.<br />

Other Automotive Credit Facilities. At December 31, 2011, we had $817 million of local credit facilities to non-<br />

U.S. Automotive affiliates, of which $74 million has been utilized. Of the $817 million of committed credit facilities,<br />

$66 million expires in 2012, $165 million expires in 2013, $223 million expires in 2014, and $363 million expires in 2015.<br />

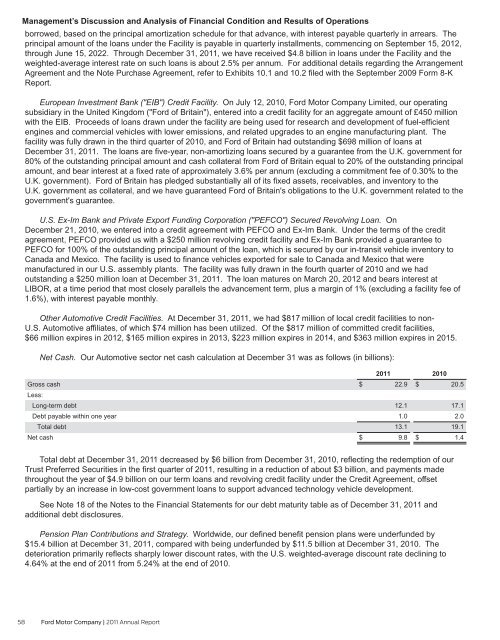

Net Cash. Our Automotive sector net cash calculation at December 31 was as follows (in billions):<br />

Gross cash<br />

Less:<br />

Long-term debt<br />

Debt payable within one year<br />

Total debt<br />

Net cash<br />

2011<br />

$ 22.9<br />

12.1<br />

1.0<br />

13.1<br />

$ 9.8<br />

2010<br />

$ 20.5<br />

17.1<br />

2.0<br />

19.1<br />

$ 1.4<br />

Total debt at December 31, 2011 decreased by $6 billion from December 31, 2010, reflecting the redemption of our<br />

Trust Preferred Securities in the first quarter of 2011, resulting in a reduction of about $3 billion, and payments made<br />

throughout the year of $4.9 billion on our term loans and revolving credit facility under the Credit Agreement, offset<br />

partially by an increase in low-cost government loans to support advanced technology vehicle development.<br />

See Note 18 of the Notes to the Financial Statements for our debt maturity table as of December 31, 2011 and<br />

additional debt disclosures.<br />

Pension Plan Contributions and Strategy. Worldwide, our defined benefit pension plans were underfunded by<br />

$15.4 billion at December 31, 2011, compared with being underfunded by $11.5 billion at December 31, 2010. The<br />

deterioration primarily reflects sharply lower discount rates, with the U.S. weighted-average discount rate declining to<br />

4.64% at the end of 2011 from 5.24% at the end of 2010.<br />

58 Ford Motor Company | 2011 Annual Report