PROFITABLE GROWTH FOR ALL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

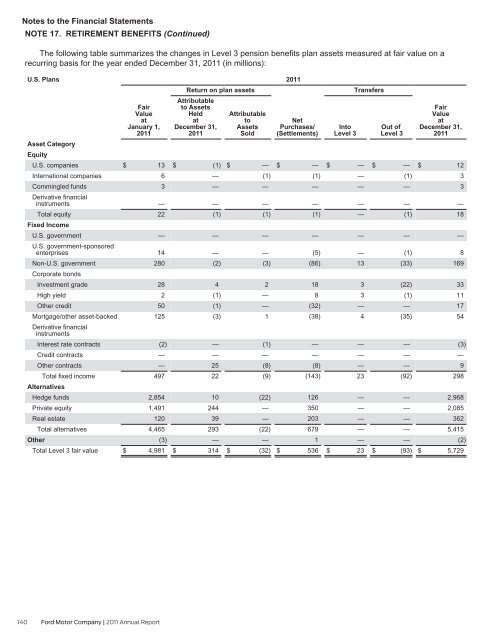

Notes to the Financial Statements<br />

NOTE 17. RETIREMENT BENEFITS (Continued)<br />

The following table summarizes the changes in Level 3 pension benefits plan assets measured at fair value on a<br />

recurring basis for the year ended December 31, 2011 (in millions):<br />

U.S. Plans<br />

Asset Category<br />

Equity<br />

U.S. companies<br />

International companies<br />

Commingled funds<br />

Derivative financial<br />

instruments<br />

Total equity<br />

Fixed Income<br />

U.S. government<br />

U.S. government-sponsored<br />

enterprises<br />

Non-U.S. government<br />

Corporate bonds<br />

Investment grade<br />

High yield<br />

Other credit<br />

Mortgage/other asset-backed<br />

Derivative financial<br />

instruments<br />

Interest rate contracts<br />

Credit contracts<br />

Other contracts<br />

Total fixed income<br />

Alternatives<br />

Hedge funds<br />

Private equity<br />

Real estate<br />

Total alternatives<br />

Other<br />

Total Level 3 fair value<br />

Fair<br />

Value<br />

at<br />

January 1,<br />

2011<br />

$ 13<br />

6<br />

3<br />

—<br />

22<br />

—<br />

14<br />

280<br />

28<br />

2<br />

50<br />

125<br />

(2)<br />

—<br />

—<br />

497<br />

2,854<br />

1,491<br />

120<br />

4,465<br />

(3)<br />

$ 4,981<br />

Return on plan assets<br />

Attributable<br />

to Assets<br />

Held<br />

at<br />

December 31,<br />

2011<br />

$ (1)<br />

—<br />

—<br />

—<br />

(1)<br />

—<br />

—<br />

(2)<br />

4<br />

(1)<br />

(1)<br />

(3)<br />

—<br />

—<br />

25<br />

22<br />

10<br />

244<br />

39<br />

293<br />

—<br />

$ 314<br />

Attributable<br />

to<br />

Assets<br />

Sold<br />

$ —<br />

(1)<br />

—<br />

—<br />

(1)<br />

—<br />

—<br />

(3)<br />

2<br />

—<br />

—<br />

1<br />

(1)<br />

—<br />

(8)<br />

(9)<br />

(22)<br />

—<br />

—<br />

(22)<br />

—<br />

$ (32)<br />

2011<br />

Net<br />

Purchases/<br />

(Settlements)<br />

$ —<br />

(1)<br />

—<br />

—<br />

(1)<br />

—<br />

(5)<br />

(86)<br />

18<br />

8<br />

(32)<br />

(38)<br />

—<br />

—<br />

(8)<br />

(143)<br />

126<br />

350<br />

203<br />

679<br />

1<br />

$ 536<br />

Into<br />

Level 3<br />

$ —<br />

—<br />

—<br />

Transfers<br />

—<br />

—<br />

—<br />

—<br />

13<br />

3<br />

3<br />

—<br />

4<br />

—<br />

—<br />

—<br />

23<br />

—<br />

—<br />

—<br />

—<br />

—<br />

$ 23<br />

Out of<br />

Level 3<br />

$ —<br />

(1)<br />

—<br />

—<br />

(1)<br />

—<br />

(1)<br />

(33)<br />

(22)<br />

(1)<br />

—<br />

(35)<br />

—<br />

—<br />

—<br />

(92)<br />

—<br />

—<br />

—<br />

—<br />

—<br />

$ (93)<br />

Fair<br />

Value<br />

at<br />

December 31,<br />

2011<br />

$ 12<br />

3<br />

3<br />

—<br />

18<br />

—<br />

8<br />

169<br />

33<br />

11<br />

17<br />

54<br />

(3)<br />

—<br />

9<br />

298<br />

2,968<br />

2,085<br />

362<br />

5,415<br />

(2)<br />

$ 5,729<br />

140 Ford Motor Company | 2011 Annual Report