PROFITABLE GROWTH FOR ALL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

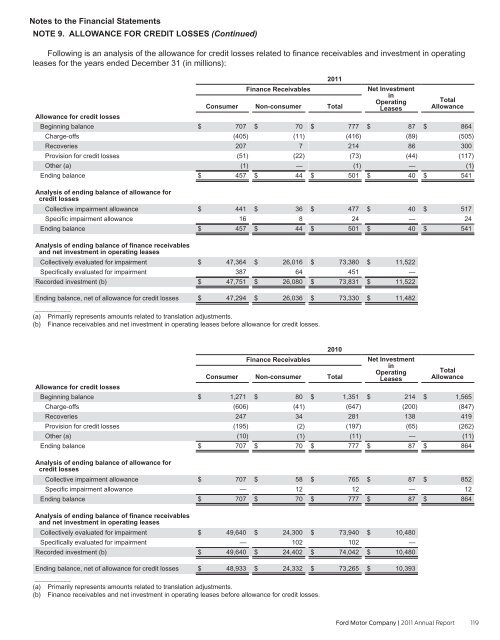

Notes to the Financial Statements<br />

NOTE 9. <strong>ALL</strong>OWANCE <strong>FOR</strong> CREDIT LOSSES (Continued)<br />

Following is an analysis of the allowance for credit losses related to finance receivables and investment in operating<br />

leases for the years ended December 31 (in millions):<br />

2011<br />

Allowance for credit losses<br />

Beginning balance<br />

Charge-offs<br />

Recoveries<br />

Provision for credit losses<br />

Other (a)<br />

Ending balance<br />

Finance Receivables<br />

Consumer Non-consumer Total<br />

$ 707<br />

(405)<br />

207<br />

(51)<br />

(1)<br />

$ 70<br />

(11)<br />

7<br />

(22)<br />

—<br />

$ 777<br />

(416)<br />

214<br />

(73)<br />

(1)<br />

$ 457 $ 44 $ 501<br />

Net Investment<br />

in<br />

Operating<br />

Leases<br />

$ 87<br />

(89)<br />

86<br />

(44)<br />

—<br />

$ 40<br />

Total<br />

Allowance<br />

$ 864<br />

(505)<br />

300<br />

(117)<br />

(1)<br />

$ 541<br />

Analysis of ending balance of allowance for<br />

credit losses<br />

Collective impairment allowance<br />

Specific impairment allowance<br />

Ending balance<br />

$ 441<br />

16<br />

$ 457<br />

$ 36<br />

8<br />

$ 44<br />

$ 477<br />

24<br />

$ 501<br />

$ 40<br />

—<br />

$ 40<br />

$ 517<br />

24<br />

$ 541<br />

Analysis of ending balance of finance receivables<br />

and net investment in operating leases<br />

Collectively evaluated for impairment<br />

Specifically evaluated for impairment<br />

Recorded investment (b)<br />

$ 47,364<br />

387<br />

$ 47,751<br />

$ 26,016<br />

64<br />

$ 26,080<br />

$ 73,380<br />

451<br />

$ 73,831<br />

$ 11,522<br />

—<br />

$ 11,522<br />

Ending balance, net of allowance for credit losses $ 47,294 $ 26,036 $ 73,330<br />

__________<br />

(a) Primarily represents amounts related to translation adjustments.<br />

(b) Finance receivables and net investment in operating leases before allowance for credit losses.<br />

$ 11,482<br />

2010<br />

Allowance for credit losses<br />

Beginning balance<br />

Charge-offs<br />

Recoveries<br />

Provision for credit losses<br />

Other (a)<br />

Ending balance<br />

Finance Receivables<br />

Consumer Non-consumer Total<br />

$ 1,271<br />

(606)<br />

247<br />

(195)<br />

(10)<br />

$ 80<br />

(41)<br />

34<br />

(2)<br />

(1)<br />

$ 1,351<br />

(647)<br />

281<br />

(197)<br />

(11)<br />

$ 707 $ 70 $ 777<br />

Net Investment<br />

in<br />

Operating<br />

Leases<br />

$ 214<br />

(200)<br />

138<br />

(65)<br />

—<br />

$ 87<br />

Total<br />

Allowance<br />

$ 1,565<br />

(847)<br />

419<br />

(262)<br />

(11)<br />

$ 864<br />

Analysis of ending balance of allowance for<br />

credit losses<br />

Collective impairment allowance<br />

Specific impairment allowance<br />

Ending balance<br />

$ 707<br />

—<br />

$ 707<br />

$ 58<br />

12<br />

$ 70<br />

$ 765<br />

12<br />

$ 777<br />

$ 87<br />

—<br />

$ 87<br />

$ 852<br />

12<br />

$ 864<br />

Analysis of ending balance of finance receivables<br />

and net investment in operating leases<br />

Collectively evaluated for impairment<br />

Specifically evaluated for impairment<br />

Recorded investment (b)<br />

$ 49,640<br />

—<br />

$ 49,640<br />

$ 24,300<br />

102<br />

$ 24,402<br />

$ 73,940<br />

102<br />

$ 74,042<br />

$ 10,480<br />

—<br />

$ 10,480<br />

Ending balance, net of allowance for credit losses $ 48,933 $ 24,332 $ 73,265<br />

__________<br />

(a) Primarily represents amounts related to translation adjustments.<br />

(b) Finance receivables and net investment in operating leases before allowance for credit losses.<br />

$ 10,393<br />

Ford Motor Company | 2011 Annual Report 119